The global financial crisis and the European sovereign debt stimulated an intense debate about what is the role of central banks. Should central banks be responsible for price stability, for the stability of economic activity, or both? For example, while the European Central Bank’s primary objective is to maintain price stability without any explicit responsibility for economic activity, the U.S. Federal Reserve’s main objective is to promote employment in a context of price stability. Is this dual mandate beneficial for the society?

The literature to date suggests that a focus on inflation stabilization is enough to stabilize other macroeconomic variables, and that focusing on economic activity can be even harmful. Yet, in their BSE Working Paper No. 958, “Designing a Simple Loss Function for Central Banks: Does a Dual Mandate Make Sense?” Davide Debortoli, Jinill Kim, Jesper Lindé, and Ricardo Nunes challenge this view. The authors argue that stabilizing measures of economic activity should be one of the primary objectives of central banks, in some cases even more important than stabilizing inflation.

Why a dual mandate rather than multiple mandates?

A central bank should in principle take into account all the economic variables affecting social welfare. Yet, no advanced country asks its central bank to do so. Instead, central banks are mandated to pursue simple objectives that involve only a few variables. Why? Because simple objectives facilitate the communication of policy actions to the public, make monetary policy more transparent, and enhance the accountability of the central bank.

But simplicity comes at a cost. Looking at only few variables is typically inefficient, in the sense that it generates some welfare losses with respect to adopting a more complete, although complex, criterion. A natural question then arises: how to design objectives that are simple, but that generate the smallest possible welfare losses? This is the question addressed by Debortoli, Kim, Lindé and Nunes.

What are the most important variables? Inflation and output

Central bank objectives are typically formulated in terms of two variables: inflation and output. Such a specification captures the main challenge facing central banks. Consider for instance an economy suddenly affected by an exogenous decline in demand. Also, suppose that firms and workers face some costs of adjusting prices or wages, so that prices and wages cannot be adjusted as much as desired. Under these circumstances, if the central bank wishes to stabilize output, it would have to tolerate some price or wage changes, which are costly. Alternatively, if the central bank wishes to keep prices and wages constant, it would have to tolerate a decline in output. The main question is therefore what is the optimal balance between the two conflicting objectives.

What weight should be given to output? Much higher than previously thought

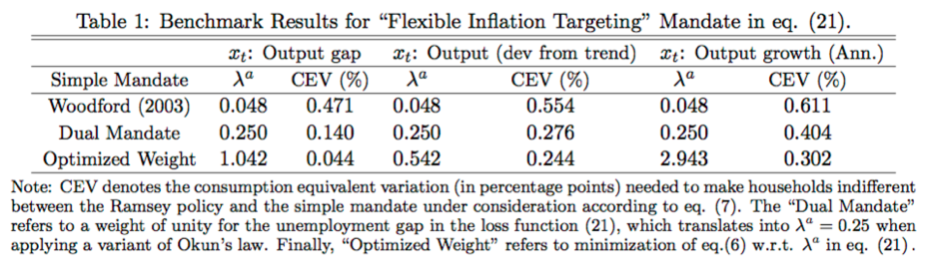

A common result in the monetary policy literature is that stabilizing measures of economic activity should receive a small weight relative to stabilizing inflation. For example, the seminal work of Woodford (2003) shows that within a simple model with rigid prices, the optimal weight on output stabilization is negligible, only 4.8% of the weight on inflation. Also, according to a speech by Janet Yellen (2012) –now the Chairman of the US Federal Reserve– the weight that would correspond to a dual mandate would be about 25% of the weight on inflation.

The work of Debortoli, Kim, Lindé and Nunes revisits these results. In contrast to previous works, the authors consider an economic model similar to those actually in use at central banks and policy institutions. That model is used as a laboratory to study the welfare implications of increasing the weight on economic activity in the central bank’s objective. Welfare is quantified in terms of the Consumption Equivalent Variation (CEV), which indicates the percent increase in consumption that would be needed to make households equally well off under the simple mandate and under the fully optimal policy.

As shown in Table 1, increasing the weight on economic activity from a negligible value (Row 1) to the value consistent with the dual mandate (Row 2) leads to a sizeable reduction in welfare losses. In addition, the weight that minimizes the welfare losses (Row 3) is higher than the values considered in the literature so far, regardless of the specific measures of economic activity considered.

A high weight on output? It depends on the structure of the economy

The key driver of these results is that stabilizing measures of economic activity helps stabilizing welfare relevant variables that might not be part of the central bank’s simple objectives.

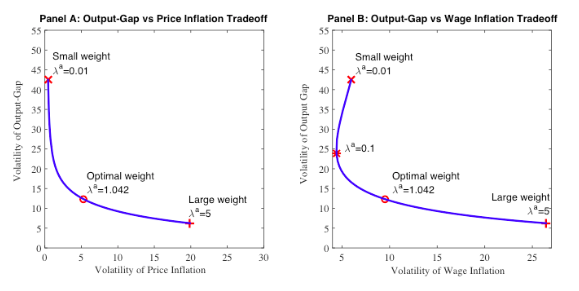

For example, Figure 1 illustrates the relationship between the volatility of a measure of economic activity (the output gap) and the volatility of price and wage inflation, letting the weight on economic activity to vary from small (0.01) to high values (5). The figure shows that a higher weight on economic activity reduces the volatility of output gap, but at the expense of a higher volatility of price inflation (Panel A). At the same time, however, it may help reducing the volatility of wage inflation (Panel B). This is the case for instance when the weight is in between 0.01 and 0.1.

In this example, the desirability of stabilizing the output gap depends on the welfare costs associated with price and wage inflation. In economies with sizeable wage rigidities, stabilizing economic activity is more desirable, since it helps stabilizing wage inflation, which generates high welfare costs. On the contrary, in economies where prices are much more rigid than wages, the central bank should focus almost exclusively on maintaining price stability, and thus the optimal weight on economic activity should be low.

The same logic applies to other sources of inefficiencies, such as labor market frictions, monopolistic power in the goods market, etc. Stabilizing economic activity may help mitigating the costs associated to those inefficiencies.

Through a series of quantitative exercises, the authors show that the weight on economic activity should be high in a variety of scenarios. For instance, the result is robust to the presence of substantial measurement errors in the size of economic activity, to the presence of large shocks that generate a trade-off between stabilizing inflation and economic activity, and also when ensuring a low probability of hitting the zero lower bound on interest rates.

Economic activity is more important than previously recognized

All in all, the key point of the paper is that the academic consensus that central banks should primary focus on price stability may not be right. Whenever the economy is affected by non-trivial rigidities and inefficient shocks, a central bank maximizing welfare should look at measures of economic activity, and not only at price stabilization.