In their BSE Working Paper (No. 961), “Vertical Integration, Supplier Behavior, and Quality Upgrading among Exporters,” Christopher Hansman, Jonas Hjort, Gianmarco León, and Matthieu Teachout explain how vertical integration is a strategy that exporters in developing countries use to be able to upgrade output quality, and gain access to high end markets in the developed world. Guided by the intuitions provided by classical theories of the firm, the authors use information from fishmeal manufacturing firms in Peru, the boats that supply their input, and buyers in the international market to document that firms that having more input supplied by vertically integrated suppliers improve the quality of the final output, and this is because the owners can provide boats with the right incentives to deliver high quality input (fresh fish). Moreover, they find that exporters are aware of this, and when there is high demand for high quality inputs, they act on this knowledge and rely much more on input supplied by vertically integrated suppliers.

Quality through coordination

Output quality is a fundamental attribute for determining whether fishmeal firms can export their products worldwide, charging a price that reflects the product’s quality grade. When many actors interact in the production process, quality reflects not only the effort of the final manufacturer but also the decisions taken by its suppliers.

For the fishmeal industry, the quality of final output is in large measure determined by choices made by fishing boats. The amount of ice carried on the boat, the time spent between catch and delivery, and the conservation method employed are some of the fundamental factors that eventually determine quality. Given the importance of quality for fishmeal producers, it is interesting to understand whether specific contractual arrangements can help coordinate the efforts of suppliers and manufacturers.

Christopher Hansman, Jonas Hjort, Gianmarco León, and Matthieu Teachout provide us with the solution to this problem. In their paper, the authors report the positive relationship between output quality and vertical integration in the Peruvian fishmeal industry. They find empirical support in favor of the hypothesis that vertically integrated downstream firms produce output of higher quality, and that the quality of fish delivered by integrated suppliers increases when demand for quality is high and when fishing conditions are bad. Moreover, they find that exporters choose a vertically integrated organizational structure to meet the quality needs of foreign importers.

Industry structure and supplier incentives in Peru

The Peruvian fishmeal industry is an ideal context for studying the relationship between organizational structure and output quality.

First, fishmeal manufacturers face textbook contracting challenges: the quality of the product’s primary input—fish—is difficult to observe, and the presence of outside options—other fishmeal manufacturers who may value input quality less—complicates controlling the incentives of an independent supplier. Therefore, setting the right incentives for suppliers is one of the key problems faced by firms that want to secure high quality inputs.

Second, changes in firms’ structure (whether the suppliers used are integrated or independent), the quality of the output produced, and foreign demand for quality all occur with high frequency during the period we study. This allows the authors to compare transitions independent-to-integrated and integrated-to-independent (within relationship) to provide the first evidence on the extent to which firms change their organizational structure in order to produce goods of a targeted type.

Data from three stages of the global value chain

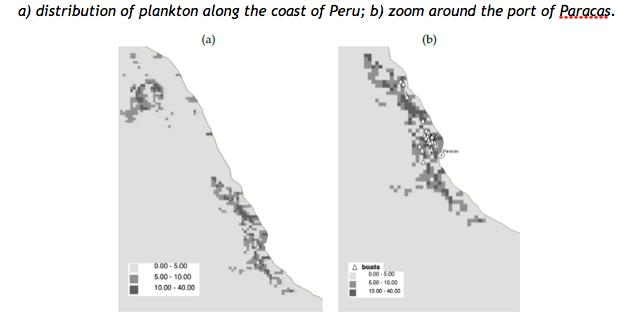

Three unusual types of data make the analysis possible. They directly observe the behavior of suppliers. Fishing boats are required to transmit GPS signals to the regulatory authorities while at sea. The activity of downstream manufacturers is observed from the data provided by the Ministry of production. These data allow the authors to construct an algorithm for approximating location and time of fishing, and traveling time to port, and to obtain proxies for input quality- and quantity-increasing actions to explore how a supplier’s behavior differs when integrated. An example of fishing boat’s activity is provided in Figure 1 below.

Additionally, they directly observe output quality. Firms (each of which consists of multiple plants) are required to report each plant’s monthly production of fishmeal in the “prime” (high) quality and the “fair average” (low) quality range.

Peru’s custom authorities provide detailed data on fishmeal export at firm level, including date of the transaction, the export port of transaction, the destination country, the weight of the fishmeal, the value of the transaction, and the exporting firm. At national level, BACI data measure the amount of fishmeal that Peru and other countries export and import each year. This is important, since allows the authors to infer a continuous measure of each export shipment’s precise quality grade. With these measures they avoid relying on the quality proxies used in the existing literature, which risk conflating quality with mark-ups and horizontal differentiation.

Finally, the authors observe all transactions between plants and suppliers in data from regulatory authorities. Domestic transactions data are rare; observing the transactions of an entire industry, including within-firm transactions, is especially unusual. In combination with plant production and customs data, the supply transactions data allow them to track the flow of goods across three different stages of a global value chain.

Why fishmeal is a big deal

The fishmeal industry in Peru is itself a relevant one to study. It is industry is one of the Latin America’s largest, and Peru is the world’s larger exporter of fishmeal. During the period of study, Peru’s fishmeal manufacturing sector accounted for 30% of world’s exports and 10% of global fish capture.

Classical theories of the firm provide a benchmark for understanding the link between organizational structure and output quality. When contracts are incomplete, downstream firms’ organizational structure matters for upstream suppliers’ behavior since the carrots and sticks used by downstream firms are different, therefore allowing them to better control the (unobserved) supplier’s behavior. An independent supplier decides how to allocate their time and effort fishing. If input quality is hard to observe, and therefore impossible to contract upon, independent boats will choose to provide higher quantity, even at the expense of quality. In contrast, firms can exert better control over the actions of integrated suppliers, and incentivize them to put effort on quality-oriented actions (e.g. searching for better fish).

Theory predicts that quality-oriented firms find it optimal to hire their suppliers through relational employment, while independent suppliers put more effort into quantity, and integrated suppliers put more effort in quality.

Empirical investigation of the link between output quality and organizational structure

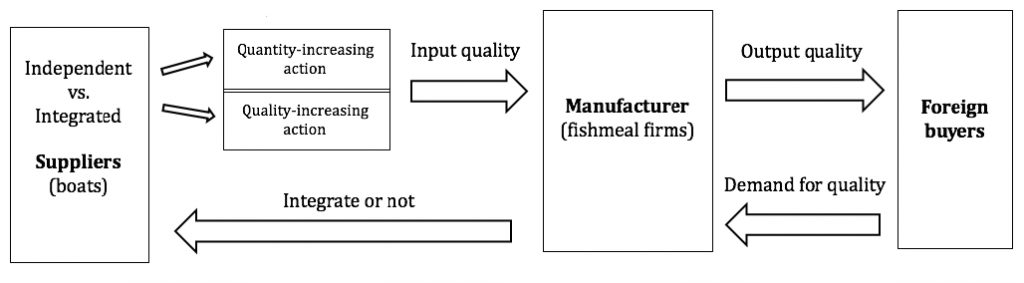

Following the predictions of the model described above, the authors show causal evidence for three key facts, summarized in Figure 2: (i) Vertically integrated boats show behaviors consistent with quality extraction, (ii) Firms that rely on vertically integrated suppliers export higher quality fishmeal, and (iii) firms vertically integrate more when demand for high quality fishmeal increases.

Vertically integrated boats behave consistently to extract high-quality fish. For example, they do shorter trips to keep the fish fresh, they bring smaller loads to avoid crushing the fish, etc. However, this could be due to the selection of boats, or captains. The authors compare the behavior of the same boat doing transactions with the same firm, as an independent versus when they are integrated, and vice versa, therefore establishing a causal relationship between vertical integration and boat behavior.

With the use of the GPS data collected at boat level, the authors find that, when integrated with downstream firms, suppliers devote more effort to enhance quality than to increase quantity. Under vertical integration, fishing ships travel closer to the destination port and use better storing technologies than independent firms.

The second key finding in the paper is that firms that get their supply from vertically integrated boats are able to produce higher quality fishmeal. The findings show that owning one more supplier is associated with an increase in the unit price charged by 0.3% and in the protein content of the fishmeal by 0.027%. Additionally, a firm contracting only with integrated suppliers can charge a 13% higher price and provides 1.3% higher proteins than a firm that does not own suppliers at all.

To avoid concerns about reverse causality, e.g. firms that export higher quality are wealthier and can purchase more boats, or omitted variable bias, the authors use an instrumental variable strategy exploiting the fact that independent boats move up and down the coast of Peru due to natural variation in fish density, weather, and decisions made by their captains. The logic behind the instrument is simply that a plant—holding fixed any intentions to produce high quality output—will be forced to source a higher share of its inputs from integrated suppliers when there happens to be a local scarcity of independent suppliers. As a result, the plant will increase the share on input from vertically integrated boats. To ensure that the instrument is not contaminated by the strategy of the plant (or firm) in question, the authors follow a leave-firm-out approach, using independent suppliers serving other local firms as a proxy for independent suppliers’ local presence. This approach yields results that are very similar to OLS estimates.

After presenting the results on how suppliers incentives change when they integrate with downward firms, the authors focus on firms’ behavior. Is it the case that firms choose a vertically integrated organizational structure when they have to deliver higher quality? To answer this question, the authors utilize the fact that individual export destinations tend to purchase very specific quality grades, and construct instruments for firm specific demand for high quality output based on shocks to demand from these export destinations. Specifically, they instrument for the quality composition of the demand a firm faces at a given point in time by interacting its initial export destinations with importer countries’ total, leave-firm-out imports from Peru at that later point in time. The results show that downstream manufacturers acquire more suppliers and thereby increase their share of input coming from integrated boats, when faced with greater relative demand for high quality output. In other words, a firm’s need to produce quality is a meaningful determinant of its degree of vertical integration.

Vertical integration is the key to high output quality and export success

In conclusion, the vertically integrated suppliers provide higher quality fish. This is due to the fact that parent companies can provide boats with the right incentives to take quality oriented actions. This is particularly important in contexts where quality is hard to observe and hard to contract upon, as is the case in this specific industry, but also in many others.

Firms are not only aware of the relationship between organizational structure and output quality, but they also choose the best organizational setup to fit the need for quality of their clients. These findings suggest that, in a context where contract enforcement is not fully possible, strategic organizational choices may lead Peru’s fishmeal industry to export-driven growth.