Investors holding in multiple firms give rise to common ownership. Do common owners of competing firms’ affect the entry decisions of these firms? In BSE Working Paper No. 1042, “Common Ownership and Market Entry: Evidence from the Pharmaceutical Industry”, Albert Banal-Estañol, Melissa Newham, and Jo Seldeslachts provide evidence on the impact of common ownership between pharmaceutical firms on generic drug entry in US pharmaceutical markets.

Introduction

When firms are largely owned or influenced by shareholders who also have sizeable stakes in competitors, then rather than maximizing their own value, commonly-owned firms should maximize the return to their shareholders i.e. their portfolio values. Case in point being BlackRock and Vanguard, the world’s largest institutional investors, are the top two shareholders in Johnson & Johnson, Pfizer, Abbott Laboratories, Perrigo and Allergan, which are clearly competitors in the US pharmaceutical markets. Such connectivity among firms may alter their strategic decisions. In this paper, the authors analyze the impact of common ownership on one of the most important strategic decisions for a firm: the entry into a product market. They provide evidence for the US pharmaceutical enterprises, in particular, the effect of common ownership on the propensity of a generic firm to enter a branded drug market.

The pharma industry

Pharmaceutical firms can be categorized as brand firms or generic firms. Brand firms undertake costly research and development to discover new medications and bring them to market. On the other hand, generic firms produce biologically identical replications of brand drugs at a much lower cost, after they have already been marketed as brand-name products. Generic firms are able to enter a particular drug market once the regulatory protections afforded to the brand product have expired.

Common ownership

In the literature, a number of authors have remarked that shareholder diversification across firms can lead to firms internalizing externalities they impose on rivals. Further, in the case of pharmaceuticals recent research have pointed out that, for a branded firm deterring entry is much more valuable than potential gains from an entry for a generic firm. Thus, generic firm’s entry decision may crucially depend on whether investors in a potential generic entrant also have an interest in the incumbent brand.

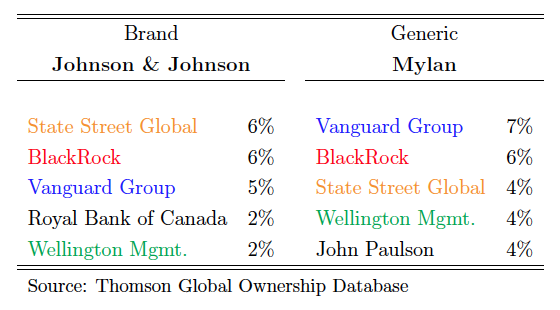

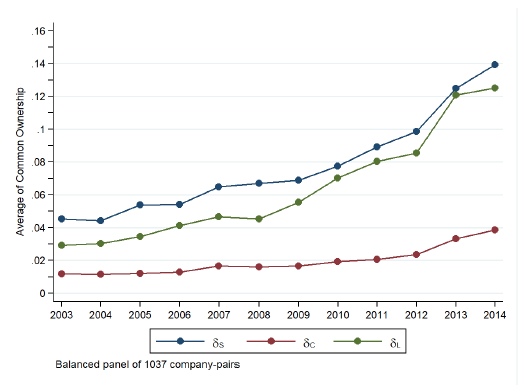

Table 1 below gives an example of the top 5 investors for the brand-generic pair Johnson & Johnson-Mylan in 2014. As can be seen, the top three shareholders are the same for both companies. Figure 1 shows the evolution of three measures of common ownership in the pharmaceutical industry. It is evident that on average common ownership has increased significantly from 2003 to 2014.

Findings

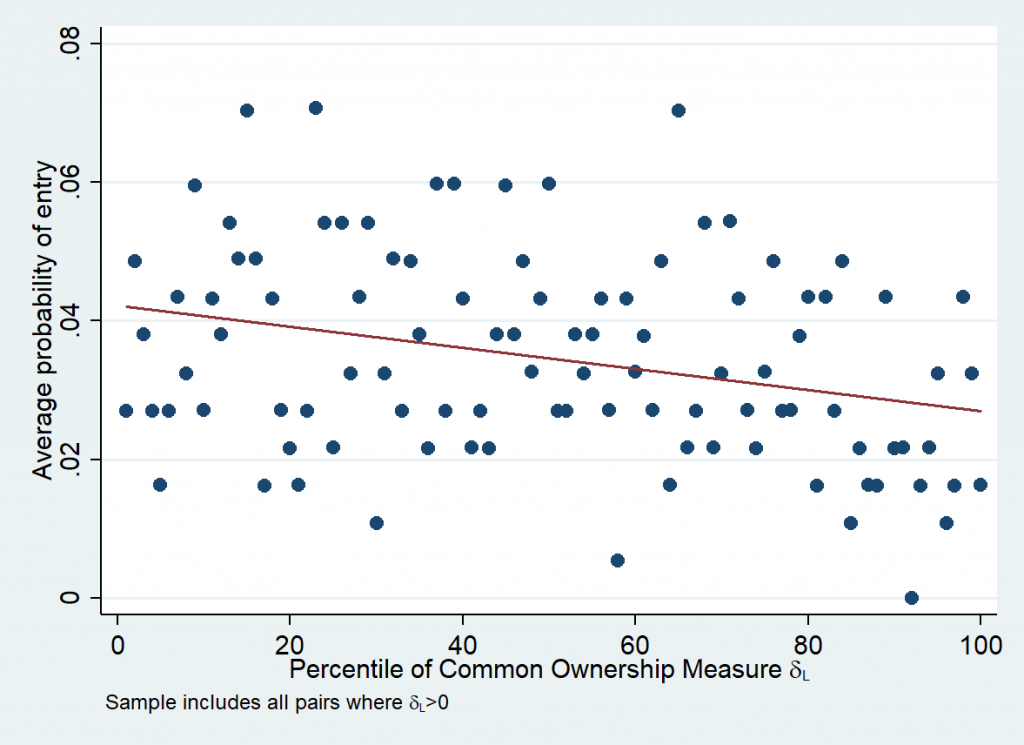

Equipped with a very rich database, which consists of 451 drug product markets and 58,737 drug product-brand-generic observations, the authors are able to show that a higher level of common ownership between a brand firm and a potential generic entrant reduces the probability of generic entry. Figure 2 shows that the correlation between entry probabilities and common ownership is negative. Their regression results show that this negative relationship is robust to several measures of common ownership, different econometric specifications, different definitions of the set of potential entrants and different time-horizons of the decision-making process. All in all the effect is large: a one-standard-deviation increase in common ownership decreases the probability of generic entry by 9-13%.