Forward Guidance in simple words is the policy whereby a central bank tries to steer expectations about the future path of the short-term interest rate that is the instrument of monetary policy. What should be the impact of such a policy on exchange rates? Does the existing theory hold water in the data? These are the questions that Jordi Galí tries to tackle in the BSE Working Paper No. 1021 “Forward Guidance and the Exchange Rate”.

Introduction

Post Crisis monetary policy in the developed world has been dominated by unconventional measures. One of the most prominent measures among these unconventional measures is forward guidance., i.e. the management of expectations about future policy rate.

With the implementation of these measures by central banks in advanced economies, a plethora of empirical and theoretical research has been produced which looks at the impact of such policies on various dimensions. Galí in this paper notes that the impact of forward guidance on exchange rates poses a stiff challenge for existing theoretical models. In this paper, Galí with the help of compelling evidence tries to demonstrate the divide between theory and facts pertaining to the link between forward guidance and exchange rates.

Theoretical results

Based on simple analysis of uncovered interest parity condition, Galí shows that, in partial equilibrium, the magnitude of change in the real exchange rate, both real and nominal, due to changes in real interest rate should be independent of the timing of the monetary policy intervention. Additionally, in a New Keynesian model of a small open economy, Galí finds that the size of the effect on the exchange rate is larger the longer is the horizon of implementation of a given adjustment in the nominal interest rate.

Forward guidance exchange rate puzzle

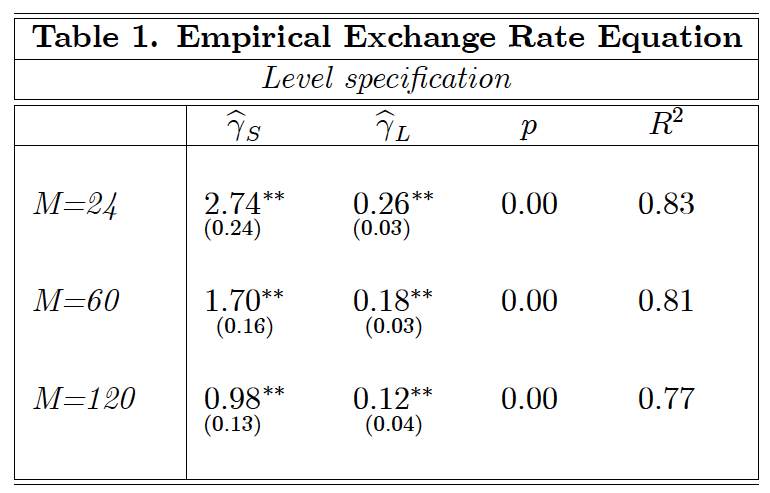

Using data on euro-dollar exchange rate and market-based forecasts of interest rate differentials between the U.S. and the euro area, the author provides evidence suggesting that expectations of interest rate differentials in the near (distant) future have much larger (smaller) effects on the exchange rates than is implied by the theory. Table 1 below illustrates the results of the main specification of the empirical analysis. As can be seen in the table the estimates of the coefficient (γS) for interest rate differential in near future is significantly larger from the theoretical prediction of 1 while the estimates of the coefficient (γL) for interest rate differential in distant future is significantly smaller than the theoretical prediction of 1.

This empirical finding is in contrast to the theoretical analysis in the paper. Galí calls this the forward guidance exchange rate puzzle. He notes that existing theoretical alternatives to the standard framework are unable to resolve this puzzle and hence demands deeper understanding of the links between unconventional monetary policy and exchange rate movements.