In recent years, one of the major developments arising from the fintech revolution has been “social trading”. It combines traditional trading practices with online communities. It has moved modern trading activities from licensed brokers or mutual fund managers into the hands of nonprofessional traders and has become a prosperous ground for the invention of new trading methodologies. One such methodology is “copy trading”.

Copy trading platforms are online brokerage platforms where users, organized in a social network, receive information about the financial positions of others. Importantly, these platforms also offer the possibility of copying the financial investment choices of others, by the click of a button. Prominent copy trading platforms include eToro, ZuluTrade, and Tradeo.

Jose Apesteguia, Jörg Oechssler and Simon Weidenholzer in their BSE Working Paper (No. 1048) “Copy Trading” conduct an experimental analysis of copy trading and its effects on risk taking. To this end, the authors have designed an experiment which reproduces the most important institutional features of copy trading. Namely, the provision of information of the investments chosen by other traders and the opportunity to copy others.

Experimental design

The experiment consists of three parts. In Part 1, risk preferences of subjects are elicitated by giving them the option of choosing one of four lotteries. Each lottery corresponds to a specific level of risk aversion. These lottery choices are used to estimate the underlying risk preference of subjects

Part 2 is divided into two trading blocks. In the first trading block, traders choose one of four financial assets. The prices of the assets fluctuate from one period to the other. The four assets are ordered in terms of their riskiness, such that they exactly correspond to the lottery choices previously elicitated. Correspondingly, subjects should optimally choose the asset that corresponds to their risk class. Once individuals have chosen an asset, they round after round decide whether to sell or hold for another period.

The three treatments of the experiment differ in the second trading block of Part 2. Treatment BASELINE repeats the asset choice problem in the first trading block of Part 2, that is, traders have to again choose one of the four assets and then decide when to sell. In treatment INFO, before choosing an asset, traders receive information about the performance of the traders in treatment BASELINE in the first trading block of Part 2. Specifically, they observe the traders’ choices of assets, selling periods and selling prices. The information is ranked from highest to lowest selling prices. In treatment COPY, participants receive exactly the same information as in INFO, but now have the opportunity of copying the decisions of a trader from the list. If they do so, then they automatically receive the same (yet unknown) payoffs as the trader they choose to copy.

Results

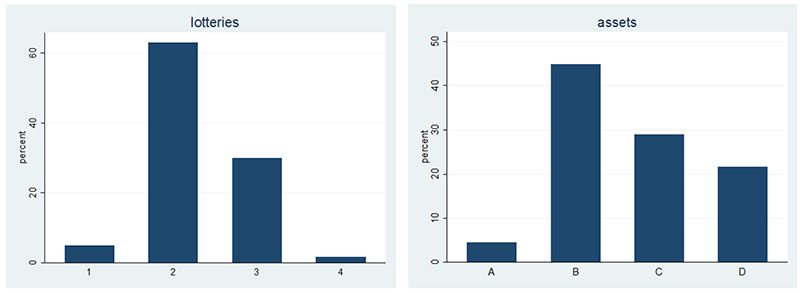

The lottery choices of traders in Part 1 indicate a fairly high level of risk aversion as can be inferred from left panel of Figure 1 which plots the distribution of lottery choices across individuals.

Analyzing the asset choices of traders in the first trading block (plotted in the right panel of Figure 1), the authors find that there is a considerable shift of traders towards more risk taking. This suggests that the context in which the decision takes place matters. It emerges that traders are more risk tolerant in the context of the financial task as compared to the neutral lottery choice.

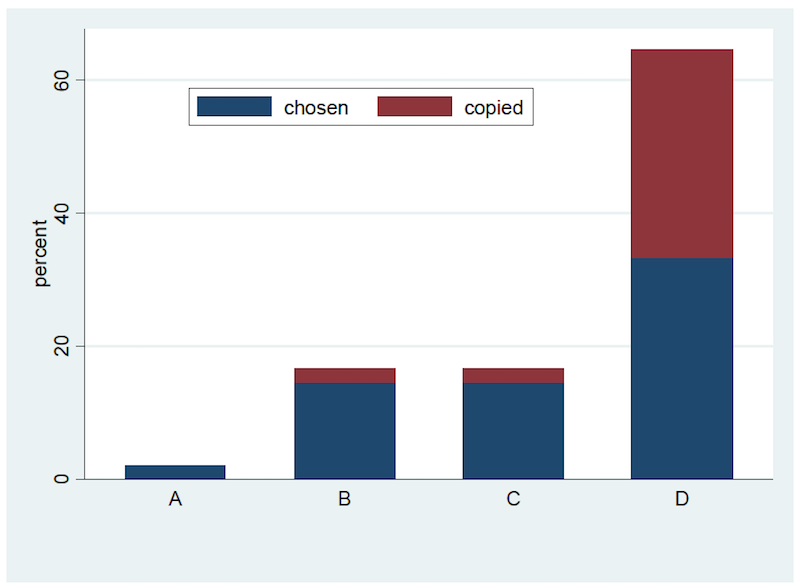

In a next step the authors assess the implications of copy trading for risk taking by comparing the distributions of assets choices in the second trading block across their treatments (see Figure 2). The distribution of asset choices in BASELINE represents the natural benchmark where agents neither receive information on the investments of others nor can copy them. Compared to this benchmark there is a significant increase in risk taking of traders when information on others is provided, as done in treatment INFO. A similar shift towards more risk taking can be observed when considering only those individuals who did not copy anybody in treatment COPY. Thus, the mere provision of information on the investment strategies and success of others leads to more risk taking.

Those who decide to copy somebody turn out to reinforce this trend of increased risk taking. More specifically, around a third of traders decide to copy another trader, and the vast majority of those copy agents who previously had chosen the most risky assets. As can been seen in Figure 3, this leads to a dramatic increase in the risk taken by traders.

The authors thus document that copy trading in their experiment reduces traders’ ex ante welfare, in the sense that traders’ choices involve higher levels of risk taking than those measured in the risk elicitation task and those revealed in investment decisions without the opportunity to copy trade.

While these welfare distortions so far have only been documented in the economic laboratory, it is reasonable to expect them to be also present on real life copy trading platforms. This, thus, raises the question of how regulators should optimally approach copy trading platforms. Ideally, any such approach should be guided by research and the present paper seems to be an important step in the right direction.