The financial crisis that erupted in the summer of 2007 pushed many economies around the world into deep recessions. Many of these economies have recovered since or are well on their way to such recovery. However, this does not seem to be the case in Greece, Ireland, Italy, Portugal, and Spain – or ‘GIIPS’ – where the recovery seems more elusive. In these countries the financial crisis of 2007 gave way to a sovereign debt crisis in 2010. In a recent BSE Working Paper (No. 701) (June 2013), Fernando Broner, Aitor Erce, Alberto Martín, and Jaume Ventura provide a new and original view of this sovereign debt crisis, drawing heavily from insights obtained in their earlier theoretical work.

Setting the stage for sovereign debt crisis

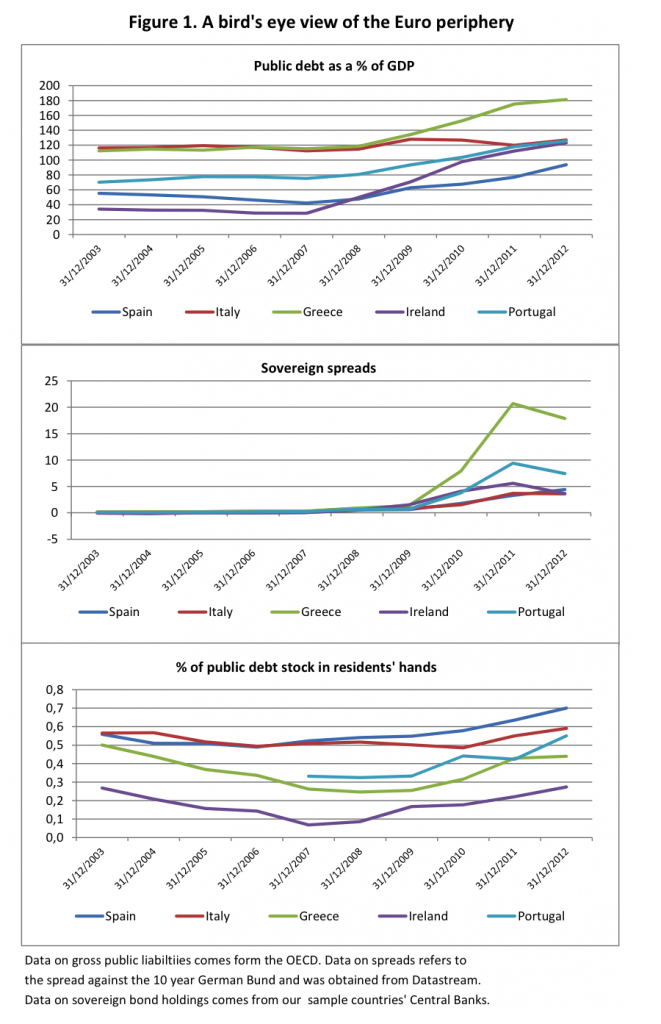

In 2007 the GIIPS were enjoying stable growth, their fiscal deficits were low, their public debts were not particularly large and their sovereign spreads were close to zero. During 2008 and 2009 a combination of low growth and large budget deficits led to rapidly increasing debt-to-GDP ratios. This did not seem worrisome at the time, though, as financial markets absorbed this additional debt as they had done in the past. Until late 2009, average spreads were still low and the share of sovereign debt in the hands of domestic residents was below 50% in all GIIPS, and even below 30% in Ireland and Greece. The evolution of public debt, sovereign spreads, and the share of public debt held in residents’ hands are summarized in Figure 1.

The situation deteriorated sharply at the end of 2009. One piece of bad news was that some of the GIIPS, such as Ireland or Spain, reported much larger budget deficits than previously anticipated. But the most striking development took place in Greece, where the new government revised the fiscal accounts for previous years and found deficits much larger than previously reported. These events did not slow down the growth of debt, but they did affect how markets absorbed it. Spreads started to rise sharply and, alongside them, the share of debt held by these countries private sectors increased. Contrary to the standard logic of optimal diversification, private sectors in GIIPS bought a lot of sovereign debt precisely as it became riskier and more correlated with domestic outcomes. As this appetite for debt grew, credit was reallocated from the private to the public sectors, reducing investment and deepening the recessions even further.

Too big to solve domestically

Soon these difficulties became too large to be handled domestically, and help from abroad came in a variety of ways. It all started with the approval of financial support packages crafted in the style of standard International Monetary Fund (IMF) programs. Greece received a first loan of 110€ bn. in May 2010 and an additional 130€ bn. in March 2012. The first loan was articulated through bilateral agreements with Euro area countries and an IMF program. The second was financed jointly by the IMF and the European Financial Stability Fund (EFSF), the first Euro-zone institutional mechanism designed to jointly support distressed Euro-sovereigns. In turn, Ireland received a loan of 67.5€ bn. in November 2010 and Portugal a loan of 78€ bn. in April 2011, both also jointly financed by the IMF and the EFSF. As the crisis deepened, the newly established European Stability Mechanism (ESM) provided financing to clean up the financial systems of Spain in 2012 and Cyprus in 2013.

An important additional form of support came through the various measures taken by the European Central Bank (ECB), most notably the Securities Markets Program (SMP) for purchases of distressed sovereign bonds in secondary markets.

Creditor discrimination and crowding-out effects

Despite these efforts by their European partners, GIIPS are still far from solving their sovereign debt problems. This is so despite painful fiscal adjustments and considerable efforts at implementing economic reforms. Even worse, there is still widespread disagreement about the underlying causes and potential remedies of this situation. Such an understanding requires a renewed analytical effort, and this is exactly what this new Barcelona GSE working paper offers.

Broner, Erce, Martin, and Ventura argue that, in turbulent times, sovereign debt offers a higher expected return to domestic creditors than to foreign ones. This happens in part because domestic creditors are less likely to be defaulted on by their governments. It also happens in part because of the plethora of ad-hoc domestic regulations imposed during these turbulent periods which tend to have a larger impact on domestic than foreign creditors. Whatever its origin, though, the authors argue that discrimination provides incentives for domestic purchases of debt.

If private credit markets worked perfectly, the purchases of sovereign debt by domestic creditors could be financed by borrowing from foreign creditors. But the authors argue that private borrowing is limited by financial frictions and, as a result, purchases of sovereign debt by domestic creditors displace productive investment. This displacement of productive investment is what is referred to as the crowding-out effect.

Therefore, the authors to develop a novel theory with the two mentioned key ingredients: creditor discrimination and crowding-out effects. Then the authors use their theoretical framework to analyze the effects of a rapid buildup of debt.

Such a buildup has a negative impact on investment and growth if and only if it is accompanied by an increase in sovereign spreads. After all, it is precisely the increase in spreads that induces domestic debt repurchases that displace investment and slow down growth. Indeed this effect could be so strong that it aborts the recovery and permanently traps the economy in a low-output equilibrium. This is undesirable since the country is using resources to repurchase its sovereign debt when investment is most needed. The picture that comes out of the model is in line with the evidence that what matters for the recovery is not only the size of the debt, but also the level of sovereign spreads. Indeed, the level of debt of the GIIPS is not higher than that of other European countries. What makes the GIIPS different is the level of their spreads.

When will a debt buildup be accompanied by an increase in sovereign spreads? The theory shows that this is likely to occur in economies with weak enforcement institutions. This raises the probability of default and hence the likelihood of creditor discrimination. Moreover, weak enforcement institutions also open the door to self-fulfilling crises driven by negative shifts in investor sentiment. To see this, note that, if the market expects the probability of default to be low, sovereign spreads are low and there are no domestic debt repurchases. Thus, investment and growth are high. Under these circumstances, the probability of default is low validating market expectations. But, if the market expects instead the probability of default to be high, sovereign spreads are high and there are domestic debt repurchases. Thus, investment and growth are low. Under these circumstances, the probability of default is high validating market expectations.

Extending the analysis: economic union

Broner, Erce, Martin, and Ventura then extend their analysis to the case of an economic union. Their key assumption here is that creditor discrimination is lower within a union. The analysis explains how the crowding-out effects due to creditor discrimination spread across the union, alleviating the GIIPS at the cost of shifting some of these effects to their European partners. The authors also show that union members with strong enforcement institutions can intermediate between the international financial market and the union’s distressed members. This intermediation reduces crowding out and raises growth in the countries with weak institutions. If well designed, such a scheme can benefit all members of the union. Interestingly, the loans to GIIPS by the European Financial Stabilization Facility (EFSF) and the European Stability Mechanism (ESM) facilities for purchasing debt both in primary and secondary markets can be thought of as such a policy.