Luca Fornaro is the recipient of a European Research Council Starting Grant for his project, “Economic Fluctuations, Productivity Growth and Stabilization Policies: A Keynesian Growth Perspective.” In this short video, Fornaro shares a brief overview of the project’s main objectives.

Project abstract

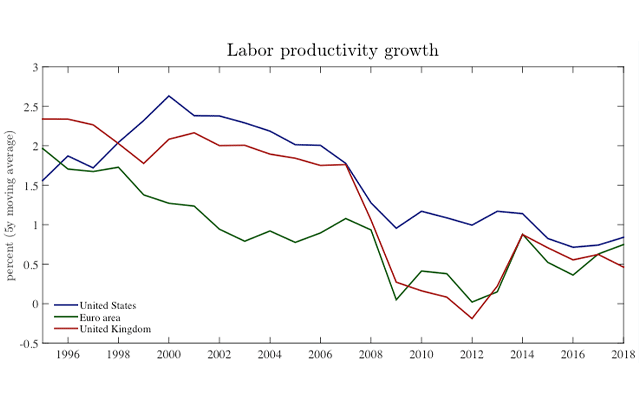

During the last 20 years, most advanced economies have experienced a dramatic productivity growth slowdown (see Figure 1). This fact has been a major source of concern for policymakers, who are now looking for policy interventions to revive productivity growth. So far, the debate has been centered around supply-side policies, such as structural reforms on the labor or product market. This project has been part of a larger effort to develop a novel Keynesian growth approach, which instead emphasizes the relationship between the demand side of the economy and productivity growth.

The development of a novel Keynesian Growth framework, integrating the study of business cycles and long-run productivity growth, represents a significant deviation from standard macroeconomic models, which typically treat economic fluctuations and long-run growth as two isolated phenomena. Instead, the Keynesian Growth model internalizes the lessons of two literatures. As in the Keynesian tradition, changes in aggregate demand can generate fluctuations in employment and business cycles. Moreover, following the insights of the Schumpeterian growth literature, long-run productivity growth is endogenous and results from firms’ investment.

Thinking jointly about growth and business cycles opens up several novel research questions. Do deep recessions, such as the one triggered by the 2008 financial crisis, depress long-run productivity growth? Should productivity growth enter among the monetary policy objectives? Can policies aiming at stimulating firms’ investment sustain aggregate demand, through their impact on long-run income expectations? These questions are at the forefront of the current policy debate, and the Keynesian growth model represents an ideal laboratory to address them.

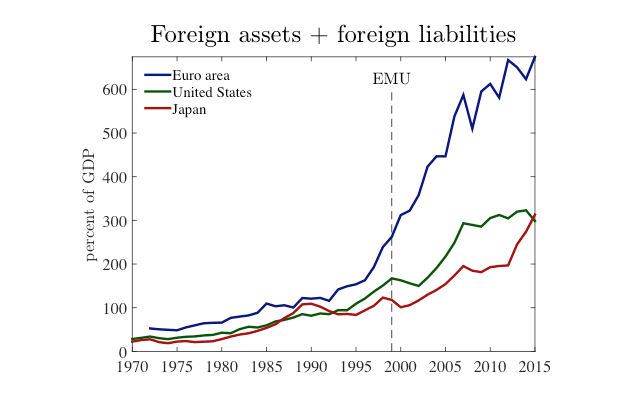

A second facet of the project explores the connection between financial globalization and productivity growth. Since the early 1980s, in fact, the world has experienced a marked increase in international financial flows (See Figure 2). The hope was that this process of financial globalization would lead to faster global productivity growth. But, at least for advanced economies, this has not been the case. Understanding why is important to design policies to manage the process of financial globalization.

See more ERC Grant recipients in the Barcelona GSE research community