After the financial crisis, many countries have adopted a strong accommodative monetary policy, namely a strong decrease in short-term interest rates and flattening of the yield curve (for example, even negative nominal rates and quantitative easing buying long-term sovereign bonds). At the same time, the net effect of monetary policies on bank profitability remains an empirical question. Specifically, it is not well understood the implications of a scenario of low or ultra-low interest rates protracted for an extended period of time on the banking system. Some theoretical academic papers and also commentators argue that the ultra-low monetary policy rates by causing lower bank profitability hurt the overall economy via the credit channel. Carlo Altavilla, Miguel Boucinha and José-Luis Peydró investigate the impact of conventional and unconventional monetary policy on bank profitability in their BSE Working Paper (No. 1101), “Monetary Policy and Bank Profitability in a Low Interest Rate Environment.”

The authors focus on the euro area and study a micro and a macro econometric model to address their question. They use different types of data – both proprietary European Central Bank (ECB) data and data from commercial providers – since the creation of the euro area.

Why the euro area?

The euro area constitutes an interesting case study firstly because it exhibits substantial bank and country heterogeneity within a monetary union and a broad set of unconventional policies, including negative interest rates, credit and quantitative easing has been implemented. Secondly, bank profitability in this area has remained at relatively low levels (compared to the USA).

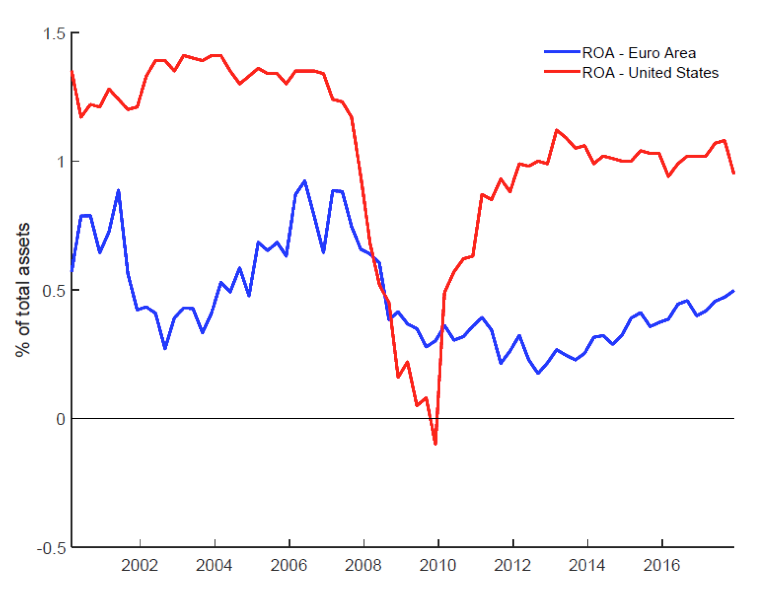

Note: the chart reports the Return on Asset in the Euro Area and the United States. For the US banks, the source is: Federal Financial Institutions Examination Council (US), Return on Average Assets for all U.S. Banks [USROA], retrieved from FRED, Federal Reserve Bank of St. Louis. For the euro area banks the source is: Bankscope, SNL, Bloomberg and Capital IQ. Details on the dataset used in the analysis are provided in Section 3.1.

Figure 1 illustrates that there is a persistent difference in the level of return on assets between European an US banks. This could suggest that that low profitability is a major challenge for the European banking system since it impairs the sector’s ability to face and overcome unexpected adverse shocks.

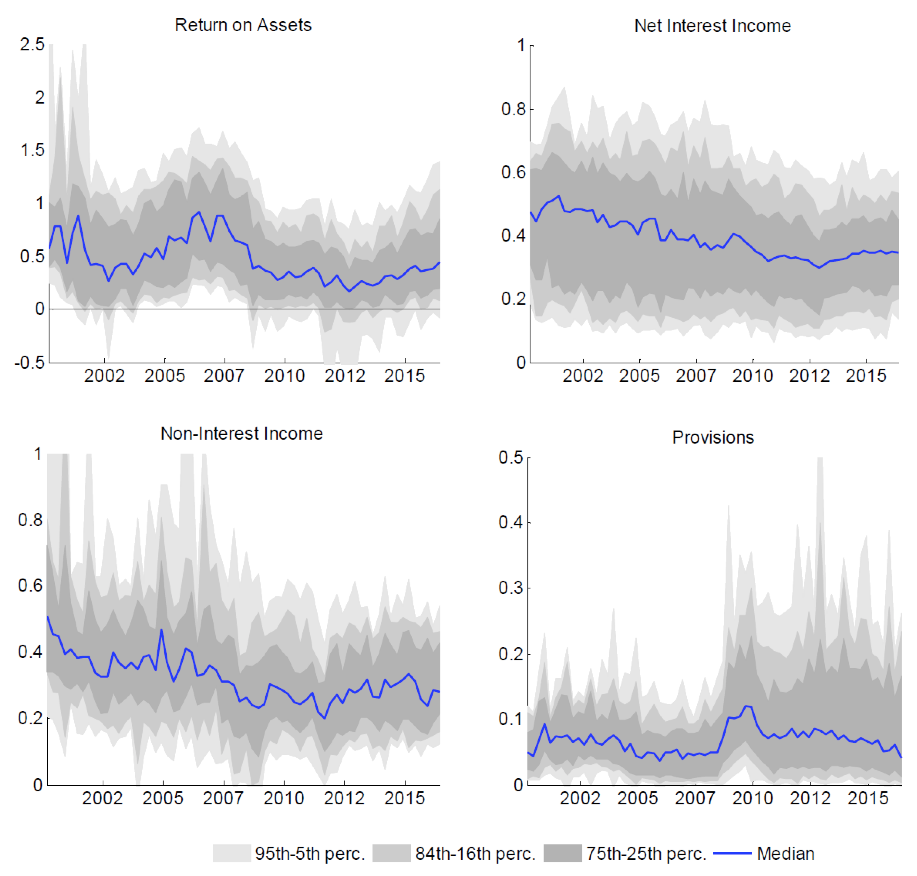

The impact of monetary interest rate changes on bank profitability depends on the relative effects on its main components: net interest income, non-interest income, and provision. Figure 2 depicts the developments over time and the cross-sectional dispersion of banks of these variables. After the crisis, banking profitability declined reflecting an abrupt increase in loan loss provisions. More recently, there has been a gradual profitability recovery supported by increasing net interest income and declining provisions.

Note: the figure illustrates the developments over time in the main components of bank profitability (as a percentage of total assets – reported on the y-axes) and their cross-sectional dispersion across the available sample of banks. The blue line represents (for each quarter) the median for the cross-section of banks. Similarly, the shaded areas comprise the interquartile range, the 50%, 68% and the 95% of the cross-sectional distribution of banks. Data are from Bankscope, SNL, Bloomberg and Capital IQ. Details on the dataset used are provided in Section 3.1.

Regarding the main components of bank balance sheets in the euro area, loans and advances are the main components of total assets. The largest component of the liability side is deposits followed by securities. About 40% of the total assets and 60% of deposits are to/from the non-financial private sector.

What the data on European banks reveals

To analyze the impact of monetary policy on bank profitability, the authors exploit first accounting data for a cross-section of European banks. They use return on assets as a measure of profitability and perform regression analysis to explore its drivers and mainly look at the role of monetary policy, the macroeconomic outlook and bank balance sheets characteristics. The paper reports a set of robust results that is the main contribution of the authors to the current literature.

The first result is that both actual and expected real economic activity matters when evaluating the impact of monetary policy on bank profitability. Policy easing is associated with lower bank profits only if there are important variables omitted in the analysis. Once current and expected overall economic and financial conditions are controlled for, the association between monetary policy and bank profitability breaks down.

Second, the main components of bank profitability are asymmetrically affected by accommodative monetary policies with a positive impact on loan loss provisions and non-interest income, offsetting a negative one on the net interest income.

Third, heterogeneity of bank balance sheets matters for the transmission of monetary policy to bank profitability. An accommodative policy is relatively more beneficial for banks with higher operational efficiency and lower asset quality and that rely more on maturity transformation activities.

The authors also find that being exposed to a low interest rate environment for a protracted period might exert downward pressure on bank profitability that, however, only materializes after a long time period and is counterbalanced by improved macroeconomic conditions resulting from looser policies.

A dynamic macro model

To complement the aforementioned micro evidence, the authors propose a dynamic multivariate model estimated at the euro level in order to capture the main channels through which a monetary policy easing affects bank profitability.

Overall, this impact is broadly neutral for bank profits and for mostly not statistically significant, reflecting the evidence that the effects on different components of bank profitability tend to largely offset each other. However, expansive monetary policy helps the economy, and also the bank credit volume, and indirectly banks via an improvement in overall economic conditions.

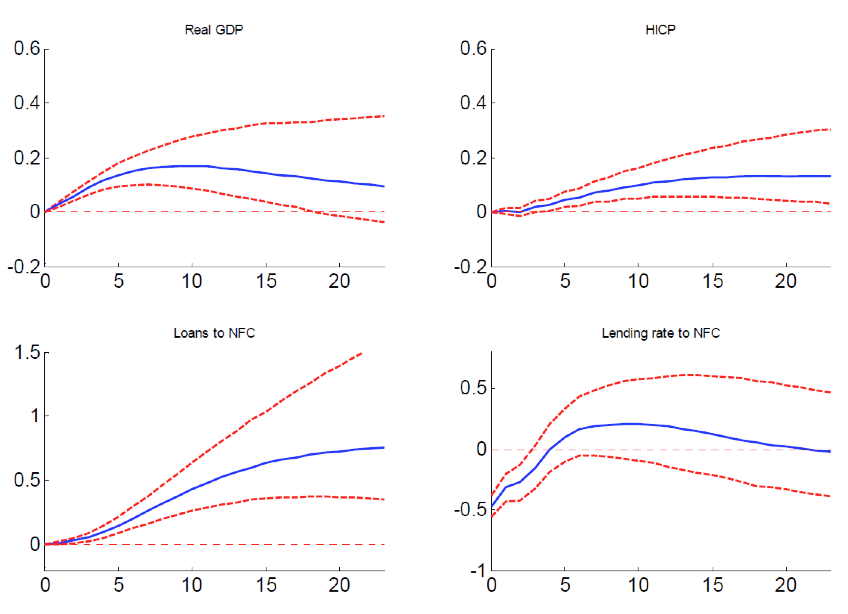

Notes: The horizontal axis refers to quarters after shock. The solid blue line represents the median response, while the dotted red lines refer, respectively, to the 16th – 84th percentile of the posterior distribution of the impulse-response functions.

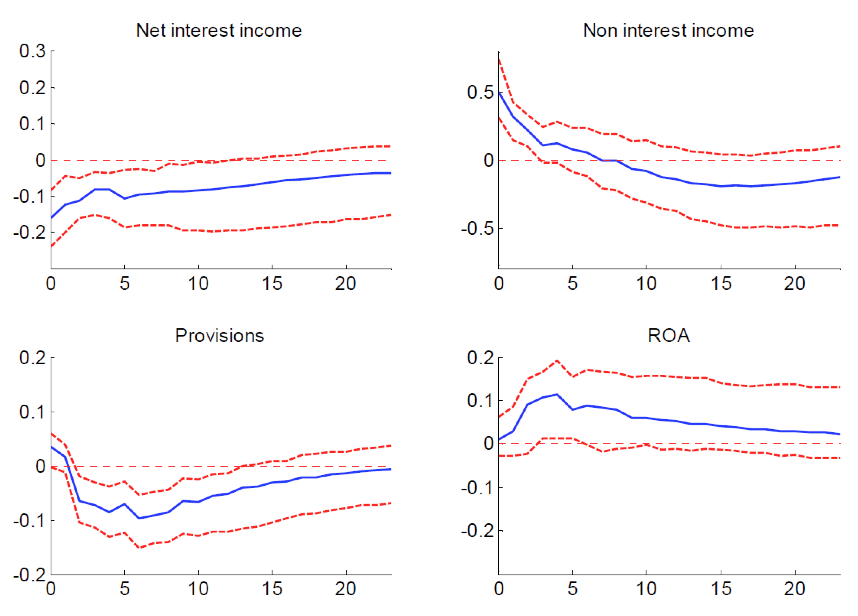

Notes: The horizontal axis refers to quarters after shock. The solid blue line represents the median response, while the dotted red lines refer, respectively, to the 16th – 84th percentile of the posterior distribution of the impulse-response functions.

Figures 3 and 4 show the reaction of macro variables to the policy shock and its impact on bank profitability. Real GDP, lending volumes and HICP inflation increase and lending rates to firms declines. The transmission of such improvements in economic activity to bank profitability and its components reveals that indeed the total effects on bank profitability are muted, with the negative effects on net interest income being offset.

Market expectations and bank profitability

As a final exploration, the authors investigate market-based expectations on future bank profitability by looking at the high-frequency changes in bank stock returns around monetary policy announcement dates. Results show that monetary policy easing does not hamper bank profitability, shareholder and bond-holder values.

After all major monetary policy easing announcements during the period of very low rates, most banks experience an increase in the market-based expected profitability and a decrease in market perception of bank credit. Hence, the evidence from financial markets supports the conclusions drawn from the analysis of bank balance sheets.