image sources: Freepik / flaticon.com

Every country has identified facilities and infrastructures of little practical use or value at some point in time. In most cases, such projects have negative social return and are referred to as “white elephants”. In their BSE Working Paper (No. 1134) “The Simple Economics of White Elephants,” Juan-José Ganuza and Gerard Llobet discuss how these bad projects may come about in the construction of public infrastructure by private firms, which are compensated through a concession contract. The authors argue that standard contracts do not provide incentives for firms to get informed about relevant characteristics of the demand (or the cost) and, as a result, contractors engage in an insufficient screening of projects and end up building unnecessary infrastructures.

The role of information and project selection

Concession contracts, typically signed between a government agency and a private firm (or consortium of firms), involve the transfer of the construction and/or the operation of an asset from the former to the latter for a period of time. They are now common in the construction of roads, prisons, airports, hospitals, railway infrastructure, etc., where the government and/or the users pay a fee according to their usage. As opposed to what occurs in public-work contracts where the government assumes all risk and manages the infrastructure directly, concession contracts are used to transfer the risk to the concessionaire. The risk of such projects is high due to their long-term contracts and difficulty in forecasting their profitability.

Empirical studies suggest that in many of these projects the realized demand is systematically lower than expected and costs usually higher. The typical example are toll highways for which, for example in the case of Spain, the expected demand has been overly optimistic. This underperformance of the concession contract is striking since one of its main advantages is the fact that the firm’s money is at stake and this should provide incentives to acquire the necessary information to screen out projects with low demand and insufficient profitability.

The authors provide an explanation that arises from the interaction between the asymmetric consequences of the unpredictability of the demand and costs and the incentives for firms to acquire information. Regarding the asymmetry, it is often the case that when the revenues are higher than expected firms get to keep them. However, when the demand is lower than expected and the concession is close to bankruptcy the contract is renegotiated, typically by increasing the duration or raising the fees paid.

In this context, white elephants should be understood as projects with a negative social return that should have been screened out using information about its profitability but this information was not acquired by the firm. In this sense, the main investigation in the paper is how these potentially avoidable bad projects end up being built, and how standard contracts could be adapted to provide the proper incentives to invest in information and reduce the cost of these white elephants for society.

The model

The authors introduce a model where the public sector wants to promote a public-work project characterized by an uncertain return. The project is not carried out directly by the government but by a private firm, the contractor.

The dynamics of the model arises from the fact that the unknown value of the project might be uncovered with an investment in obtaining information, which can only be done by the contractor before the construction takes place. Hence, the main effect of acquiring information is to screen out bad projects (those with a low value compared to their cost). In exchange for construction, the public sector awards the contractor a compensation consisting of a fraction of the project’s return.

The main purpose of the paper is to characterize the optimal contract to be offered to the firm and compare it with the social optimal allocation. Maximizing social welfare requires the pursuance of two goals. First, to undertake only those projects that have a positive social value. Second, to provide incentives for firms to acquire information when it is valuable to do so. The authors show that these two goals cannot be attained at the same time and, consequently, some white elephants inevitably emerge in equilibrium.

Choosing among distortions

The optimal contract is determined by a negative relationship between the contractor’s return and its incentives to invest in acquiring information. The first major result is that the efficient allocation will be possible only when information cost is either small of sufficiently high. In the former case, the firm has incentives to get informed and all bad projects get screened out. In the latter, however, it is socially optimal not to acquire information and all projects are undertaken. In all remaining situations, when the first best cannot be attained, the government trades off two types of distortions: it can prevent bad projects or forestall some good ones.

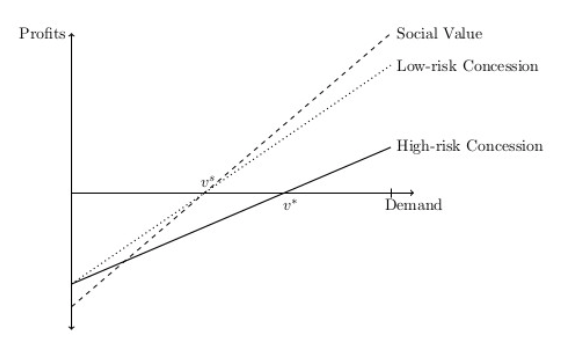

To make the intuition for this finding clear, Figure 1 illustrates the social value of the project as a function of the realized demand. Good projects are the ones with a high-demand which generate a positive social value for society. In the figure these would be the projects for which the demand is above a threshold level vs. If demand is known only those projects should be carried out. However, whether it makes sense to acquire information or not depend on how costly it is compared to the losses that are avoided when the bad projects are not undertaken.

The government awards a concession to the firm which has a value that increases in the level of the demand. The risk of the concession depends on how much the firm can benefit from the demand for the infrastructure, through for an example a longer period or a higher toll. A concession can be low risk if the firm can appropriate a lot of the value that it generates for customers. In the figure this means that a low risk concession provides incentives for the firm to only carry out those projects that have a high social value.

This argument, however, relies on the fact that the firm already knows the demand. Does this firm have incentives to acquire this information? If the risk of the concession is low this also means that the potential losses from carrying out bad projects (low demand) are small. For this reason, unless the costs of information are sufficiently low the firm would have little incentives to get informed.

The government can foster information acquisition by increasing the risk of the concession. As the firm is more sensitive to the social value of the infrastructure, it also has more incentives to make sure that only high demand projects are undertaken. The figure shows this case and it illustrates the downside of this contract. Some projects are not privately profitable but socially valuable (those between vs and v*) and, therefore, they are lost to society.

The (white) elephant in the room

As explained earlier, if the cost of acquiring information is low, low-risk concession contracts are enough because they foster information acquisition and they yield an efficient solution. At the other extreme, if the cost of information is very high, it is not worthwhile for this information to be acquired and the purpose of the concession contract is limited to cost reimbursement.

The aforementioned distortions arise in the intermediate situation. The government has to chose between two strategies. It can award a high-risk concession that provides incentives to acquire information but prevents some good projects from being undertaken (what it is known as a Type-I error). Alternatively, it can choose a low-risk concession that induces the firm to carry out all projects without their proper screening. We denote this as a Type-II error and the bad projects (those with value lower than vs) that are undertaken as a result are denoted as white elephants.

One lesson from this discussion is that the incentives to screen out bad projects are linked to the potential losses of the firm when a low demand is realized. If firms are in some way protected from these losses due, for example, to contract renegotiations or a generous limited liability arrangement the incentives to acquire information are undermined and both type of decision errors will increase as a result. Countries with weaker institutions that limit the commitment power to translate the low social value projects into firm losses will magnify these two kinds of previous distortions and will result in a poorer selection of projects. Some good projects will not be privately profitable and herds of white elephants will march in.

The authors also analyze the Least Present Value of Revenues Contract (LPVR) which have been recently advocated in the literature, aiming to reduce the incentives for renegotiation when demand is low. They show that this kind of concession contracts, which stipulate a duration that depends on the realized demand, do not perform well. To the extent that they compensate low demand realizations with a longer duration, they reduce incentives for firms to become informed. However, a variation of this contract that subsidizes information acquisition could overcome these problems and attain the efficient allocation.

The takeaway

This paper shows that the classical concession model implies a trade-off between promoting the optimal selection of projects and the incentives for firms to acquire information. White elephants emerge when low value projects are undertaken because the contractor does not acquire the appropriate information to screen them out. Institutional arrangements aimed at reducing the risk that the contractor bears increase distortions and generate more white elephants.