In “Financial Disclosure Environment and the Cash Policy of Private Firms,” (BSE Working Paper No. 1148), Marcelo Ortiz tests whether private firms are able to use peers’ financial reports to learn about liquidity risk. If that were the case, a more transparent financial disclosure environment would reduce the firms’ uncertainty regarding their future liquidity needs and, therefore, discourage cash accumulation. The author’s findings corroborate this idea: overall, private firms hold less cash when they operate in industries with a higher fraction of peers disclosing extended financial reports. Furthermore, the cash reduction is driven by a higher (lower) fraction of cash flow being used to reduce debt (to accumulate cash), and not by more investment.

Cash buffer and firms’ financial reporting environment

Cash accumulation is the main risk-management tool used by private firms, a tool that is particularly costly for those ones facing stronger financial constraints. This paper explores the consequences of the financial disclosure environment (FDE) for the costly cash buffer used by private firms. To do so, it analyses how the incentive for cash accumulation in private firms is reduced in better information environments, measured as the fraction of industry peers disclosing extended financial reports.

Specifically, the paper evaluates two channels through which the transparency in the FDE can affect cash holdings. On the one hand, peers’ disclosures enable more accurate future cash-flow estimates and thus discourages cash accumulation. The intuition of this mechanism is that the set of peers’ disclosures facilitates learning about cash flow patterns of new products, technologies, and markets previously explored by peers. Similarly, peers’ disclosures ease the trend estimation of sales and costs in the industry. In the presence of extended reports, the analyses of future cash flow include more accurate data since firms can observe detailed accounting information instead of aggregated accounting items. For example, firms can produce better estimates of both sales and cost of goods when they can look at the sales and cost of materials from the peers’ reports rather than by observing only their gross profit account. On the other hand, the level of transparency might also affect cash policy through a market-wide reduction in the cost of capital, which can make cash holdings cheaper. Therefore, in a scenario with a low cost of capital but the same level of cash flow uncertainty, firms might prefer to hoard more cash holding through cash flow saving or issuing new debt.

Since private firms are an economically important group, the potential externalities generated by disclosure regulations could have market-wide consequences through their effect on firms’ cash management. Thus, a better understanding of the mechanism behind this relationship is needed.

The case of European private firms

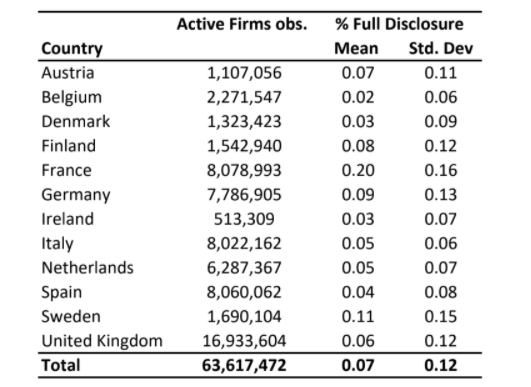

To evaluate the effect of the transparency in the FDE on cash holding, the paper uses a sample of private firms from 12 European countries for the period of 2003-2011 with similar disclosure regulations for public and private firms. For each private firm, the transparency in its FDE is measured as the percentage of peers (public and private firms) disclosing extended financial statements (henceforth, % Full Disclosure) at the country-industry-year level.

Table 1 shows the number of active firms and the FDE transparency in each country. The variation in average % Full Disclosure across countries is considerable: 20% in France (the highest), 11% in Sweden, 3% in Denmark, and 2% in Belgium (the lowest).

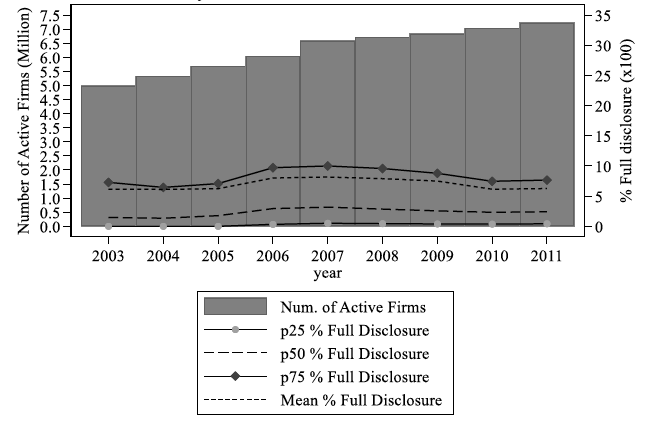

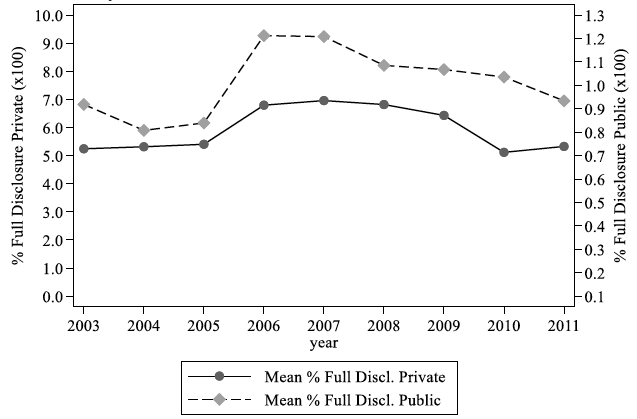

Figures 1a and 1b illustrate the evolution of the empirical distribution of % Full Disclosure. Figure 1a shows that the aggregate level of FDE transparency has not exhibited great variation over the years. This is also true for both private and public firms, as Figure 1b shows: the mean of the percentage of private firms with extended disclosure oscillates smoothly between 5-7%, while the percentage of public firms varies between 0.8-1.3%.

Quantitative results

The estimation results indicate that private firms hold less cash when they operate in industries with greater transparency in the FDE. The author finds that an increase in % Full Disclosure of 6.9% represents a reduction of 6% (18%) of the average (median) cash holding. This relationship is stronger in industries with high cash-deficit risk.

At the same time, and given the same level of transparency in the FDE, not all of the firms reduce their cash holdings by the same proportion. The estimated effect is weaker the older the firm is. Furthermore, the relation with firm age is nonlinear and has a higher marginal effect for younger firms, especially in industries with high cash deficit risk.

The author documents different roles of public and private firms’ disclosures to the overall level of transparency in the industry. Disclosures of private peers affect the cash holdings in a market-wide scale independently of the presence of a public peer. However, the findings also show a substitutive relationship between public and private peers’ disclosures, suggesting that the presence of public peers might alleviate the information requirements for the cash-flow estimation of private firms.

The previous cash holdings analyses generate multiple results consistent with the hypothesis of private firms being able to use peer reports to learn about liquidity risk, and, therefore, having lower incentives for holding a costly cash buffer. But, how does FDE transparency affect private firms’ allocation of cash-flow? To this end, the author investigates cash flow sensitivity of cash, investment, and debt, that is, if firms are more likely to use their cash-flows to invest, save, or reduce debt when they operate in a more transparent reporting environment.

The findings indicate that a better reporting environment discourages the use of cash flow for building cash reserves and promotes its use for reducing debt, but there is no evidence that transparency increases the cash-flows allocation in investment. Therefore, it seems that the FDE transparency is associated with less cash accumulation rather than with more conversion of cash to productive assets.

In sum, the results in this paper indicate a robust negative connection between the level of transparency in the FDE and the cash accumulation of private firms, especially for the firms facing stronger financial constraints. The findings are consistent with the argument that a more transparent FDE facilitates the elaboration of more accurate estimates of future liquidity needs and, therefore, discourages cash accumulation.