Ever since the Global Financial Crisis of 2007-2008, a growing body of research has been dedicated to the role of central banks in preventing asset price bubbles. The long-standing consensus of monetary policy acting solely towards the stabilization of inflation and output gaps has been called into question, with some authors calling for a Leaning-Against-the-Wind policy to counteract asset price booms. In BSE Working Paper No. 1184, “Monetary Policy and Asset Price Bubbles: A Laboratory Experiment,” authors Jordi Galí, Giovanni Giusti and Charles N. Noussair investigate the effects of such interest-rate policy on asset prices using an experimental study with an overlapping generation structure.

Bubbles and interest rate policy

Asset price bubbles are usually defined as a speculative-driven increases in asset prices, that is, when the price of an asset rises dramatically and sequentially, reaching levels that appear to greatly exceed valuations of the asset’s future cash flows – its fundamental value. Bubbles are of interest to economists because they can have real effects on the economy, especially when they burst. And it’s precisely for this reason that an active reaction from the Central Bank (CB henceforth) in this case has often been argued to be necessary.

The present paper investigates one way the CB can act against asset price bubbles by adopting “Leaning Against the Wind” (henceforth, LAW) monetary policies. A policy of this type specifies that the interest rate be raised in response to speculative asset price increase in order to attenuate the growth of a bubble. The rationale for LAW is that higher (lower) interest rates increase (decrease) the opportunity cost of the speculation that generates price bubbles since it lowers (increase) the asset’s present discounted dividend stream and thus its price.

However, the literature (Galí, 2014) has pointed out that a LAW policy could end up increasing, rather than decreasing, the size of the bubble. If agents have Rational Expectations, while the initial effect of a change of interest rate on price is indeterminate, the bubble component would subsequently grow at the rate of interest (and at a greater rate if traders are risk averse and the asset carries some risk), meaning that higher interest rates may lead to larger bubbles, all else equal. Moreover, in practice it is virtually impossible to establish whether or not asset prices reflect their fundamental values, given the difficulty in measuring the latter.

The experiment

Motivated by this lack of consensus, the authors study the relationship between interest rate policy and bubble dynamics in a lab experiment where they recreate an overlapping generation structure. Each participant is active in two consecutive periods: in the first she is labelled as “young”, and in the second as “old”. When young, the player decides how to allocate their cash endowment between a single-period riskless bond, yielding a known interest rate, and a long-lived asset that pays no dividends. Then, when old, the player collects the principal plus interest from their bonds, as well as the proceeds from the sale of the asset to the current young generation. The only incentive to purchase the long-lived asset comes from the possibility of realizing a capital gain when the asset is resold. Hence, a positive price for that asset indicates a pure bubble as the asset has zero fundamental value.

Within this experimental environment, the authors consider three different treatments as monetary policies, each specifying a particular rule determining the interest rate on bonds. In the first two treatments, the interest rate remains constant at either a “LOW” (3%) or a “HIGH” (15%) level, over the entire experimental session. In the third treatment, the interest rate varies as a function of the change in the price of the long-lived asset in the previous period: it begins with a 9% interest rate, which is raised (lowered) by 3% each time that the asset price increases (declines) by more than 10% from one period to the next. This third treatment is interpreted as a LAW policy.

The experiment is designed to address three main questions: do bubbles grow more quickly under high or low interest rates? What is the initial effect of an interest rate change on the size of a bubble? What is the effect of a LAW policy on bubbles in the period after the rate change? Notice that these questions are at the heart of the present study since the theory behind a LAW policy and its main criticisms would offer contradicting answers.

Experimental findings

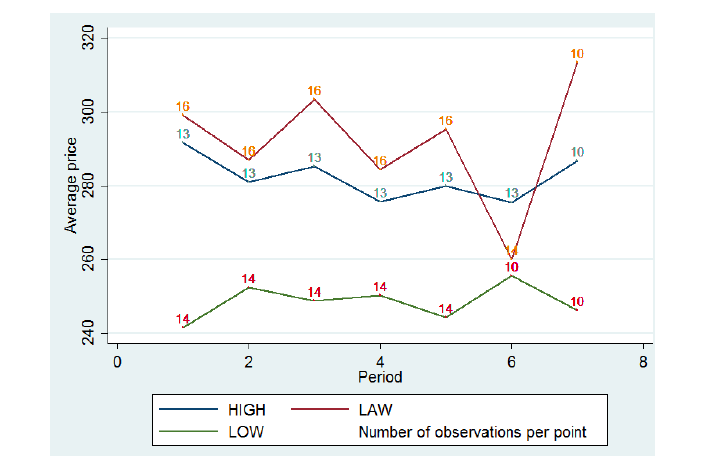

Figure 1 compares the average asset price in the HIGH and LOW treatments. It shows that the average price in the HIGH treatment, 278, is slightly greater than under the LOW treatment, 251, though the difference is not significant. Thus, higher interest rates exert neither a dampening or boosting effect on the bubble size.

When looking at the asset average return, the authors find that it is not significantly different from zero in both LOW and HIGH treatments. Moreover, the returns are also not significantly different between these two treatments.

To investigate the role of the LAW treatment, the authors test whether interest rate increases (decreases) correlate with a contemporaneous decrease (increase) in the asset price. They also consider how interest rate changes affect the change in the return of the asset compared to the prior trend. They find that the immediate effect of a Leaning Against the Wind Policy is to push asset prices in the intended direction: interest rate increases have the effect of lowering prices, while rate reductions increase them in the current period. However, the effect one period ahead is very different: In the overwhelming majority of cases, the price bubble in the asset is increased by a rate hike and lowered by a rate decrease.

The role of expectations

The authors find that it is hard to reconcile paper’s main results with the standard rational expectation assumption. To characterize agents’ subjective beliefs and to investigate whether or not these expectations have an effect on asset pricing, they conduct an additional experiment addressing how participants form their expectations about future asset prices.

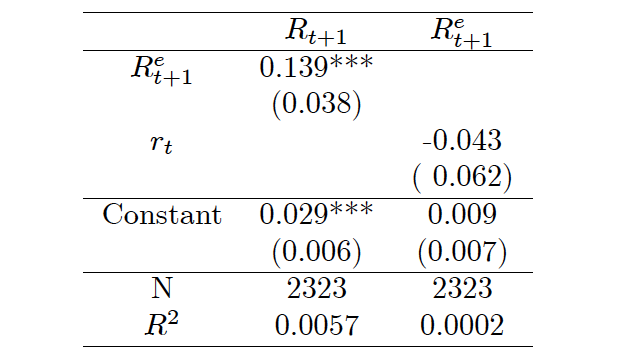

First, they check whether or not agents are rational. Two notions of rationality are considered: if expectations are unbiased predictors of the subsequent price; and if asset expected return is equal to the risk-free interest rate. Table 1 presents estimation results on both tests. If participants are rational, column 1 should be equal to 1 in row 1 and 0 in row 3, and column 2 should be equal to 1 in row 2 and 0 in row 3. Clearly, the experimental data is inconsistent with the rational expectations hypothesis.

Giving the aforementioned findings, authors further perform additional tests under three different expectation formation rules: Trend Extrapolation, Adaptive, and Hybrid – including components of the former two alternative rules. They find that expectations are backward-looking, with adaptive and trend extrapolating elements, suggesting that the source of the departures from the theoretical framework lies in the manner that agents form expectations. They conclude that assuming Trend-Following or Adaptive Expectations can account for a number of patterns in their experimental data.

Main takeaways

By designing an experimental setting to investigate the relationship between a LAW policy and asset prices, the authors benefit from observational precision and are able to compare results between different environments. Hence, they can isolate the different interest rate policies on the size and evolution of an asset price bubble.

The experiment results show that there is an immediate, short-term decrease in the price of the risky asset following an interest rate hike and similar increases following an interest rate cut. However, when a higher interest rate is in effect, the bubble asset appreciates more than under a lower interest rate. Thus, the typical effect of a rate hike is to decrease a bubble in the current period, but magnify it subsequently. These findings suggest that the effects of a Leaning Against the Wind policy on the bubble size may be short-lived.

Finally, the experimental data is inconsistent with the standard assumption of agents having rational expectations. This suggest that one prominent source of asset bubbles may be the way agents form and act on their beliefs. Further investigation on this matter can benefit the understating of financial crisis and how the Central Bank should react against speculative asset prices episodes.