When organizations seek to promote the adoption of new technologies, many choose to increase the incentives provided to local agents. As a result, the efficacy of such schemes in fostering effort is well studied. In BSE Working Paper No. 1233, “When Transparency Fails: Financial Incentives for Local Banking Agents in Indonesia,” Erika Deserranno, Gianmarco León-Ciliotta, and Firman Witoelar are the first to empirically analyze the combined effect of raising the level and transparency of financial incentives for local agents working in the Indonesian banking sector.

In partnership with a large bank, the authors designed an experiment in 401 rural East Java villages. Indonesia provides a particularly interesting testing ground for their analysis. The lack of trust and information about the financial sector and a low penetration of financial services lead potential clients to rely on cues and heuristics, such as the agent’s incentive level, to evaluate products.

Experimental design

Two years prior to the experiment, the Indonesian government approved the implementation of “branchless banking” services. Under this system, the bank hires and trains village-based agents (e.g. well-known business owners) to promote their products. Every village was randomly assigned a single representative on a commission-based salary that depends on both the number of new clients and the number of transactions made.

The experiment introduces exogenous variation in two layers:

- An agent’s commission level can be either high or low (10,000 IDR vs. 2,000 IDR per client)

- Whether the compensation is made public or not to potential customers.

There are thus, four possible treatment groups: high-private, high-public, low-public, and low-private (status-quo).

Empirical strategy and results

The experimental design allows the authors to separately identify the supply and demand side effects of both larger financial incentives and increased public information on the take-up of new technologies. On the one hand, the supply channel reflects variation in the agent’s effort due to the compensation scheme. On the other, information disclosure will likely change clients’ perceptions about the product’s quality, the agent and/or the bank, thus modifying their demand.

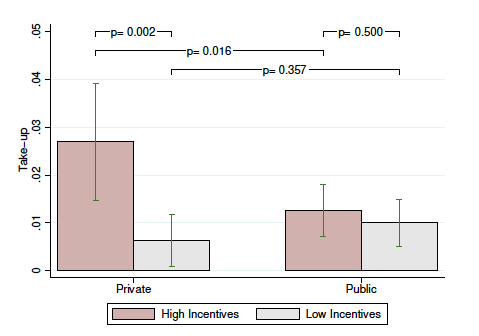

Notes: This figure presents the means and 95 percent confidence intervals of the take-up rate by treatment

group. The two bars on the left (right) display the means when incentives are private (public). The top

horizontal bars show p-values for t-tests of equality of means between different treatment groups.

Figure 1 provides some insights on how both effects interact. When the information is kept private, larger incentives lead to an increase in take-up. This reflects the supply side effect of incentives through increased agent motivation. The ability of incentives to induce agents to exert higher levels of effort is the underlying force behind this outcome. In contrast, when information about the level of incentives is made public, both supply and demand changes interact. Under public information, a comparison between high and low incentives show only a small difference in take-up.

Supply and demand effects

The paper proceeds to disentangle the channels behind the supply and demand changes. From the supply side, estimations using different proxies for agent effort indicate that agents do react to higher earnings, regardless of whether the information about them is made public or not. Why then has take-up remained low in the public group even though agents have exerted more effort?

The answer is due to clients’ perceptions. Estimations indicate that when clients become aware that their agent earns a high commission, their levels of trust in the bank, agent, and product equally diminish, corresponding to a lower demand for financial products. This is so, especially for those individuals with little information on the branchless banking system or the agent.

Conclusions

All in all, the paper serves as an important reinforcement of previous findings related to financial incentives. For contexts in which agents suffer informational constraints and use observable cues to make decisions, disclosure of information on incentives and compensation creates a relevant signal about product quality. Special attention needs to be paid to transparency in markets where information about a promoter’s incentives may convey negative signals to consumers.