Stock price fluctuations and the efficiency of markets

Despite the large impacts of busts the standard approach remains to assume that stock price fluctuations are fully efficient. Under this view stock price fluctuations reflect investors’ expectations about future firm profits, therefore policy makers should leave the stock market alone. However, as demonstrated by last year’s Nobel Prize winner Robert Shiller, it is very difficult to reconcile observed stock price volatility in the data with the efficient markets view.

In the Barcelona GSE working paper (No. 757) “Stock Price Booms and Expected Capital Gains”, Klaus Adam, Johannes Beutel, and Albert Marcet show that a very simple model of stock prices can explain very well the stock price volatility found in the data assuming that investors do not understand perfectly well how prices are formed.

Investor’s expectations

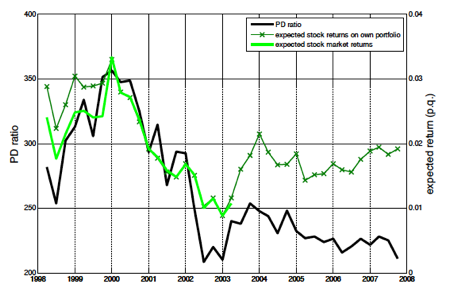

With a very simple model the Barcelona GSE researchers fit stock price volatility as well as the most sophisticated efficient market models available the literature. In addition, they consider the following fact: investors’ expectations tend to be most optimistic at the top of a bubble. For example, investors’ expectations about future stock returns peaked in 2000, precisely at the top of the dot-com bubble. The authors show that this evidence based on surveys is in contrast with models of efficient markets, while it is perfectly compatible with their model.

Adam, Beutel, and Marcet present an asset pricing model that incorporates beliefs about expected capital gains. In the model investors’ subjective expectations are influenced by observed past capital gains. Investors behave optimally given their limited knowledge of how prices are formed. The model explains that if agents become optimistic, this causes an increase in actual stock prices, confirming agents’ expectations, and feeding a stock price bubble. The reverse happens during a stock market bust. These belief dynamics are not only intuitively appealing, they explain observed stock price volatility and they also corroborate the behavior of expected returns. The bubble ends endogenously in the model. At some point, assets form a too large share of the investors’ wealth because the dividend income finances only a small share of total consumption. Then stock prices stop growing, consequently disappointing investors’ optimistic expectations, this fuels pessimism amongst investors, which gives rise to a downward spiral of prices and expectations.

The inefficiency of stock prices and policy intervention

Agents’ expectations are measured through the UBS Gallup Survey, which is based on a representative sample of about 1000 US investors that own at least 10,000 US$ in financial wealth each. As indicated in the Figure below, the correlation between the expected own portfolio’s returns and the price dividend ratio is 0.7 and even higher for the expected stock returns (0.82).

Their model can explain this behavior, in contrast with any rational expectations (efficient markets) model. The claim that stock prices are not efficient has large implications for policy. If stock prices do not represent expected future firm profits there is room for policy intervention, leading to the issue of whether policymakers could and/or should intervene in financial markets. The policy implications are left for future research.