Startups are thirsty for cash to grow, but seeking too much equity investment dilutes founder ownership stakes. One channel for avoiding dilution is debt financing. So how can startups access lending markets?

In their BSE Working Paper (No. 792) “Patent Collateral, Investor Commitment, and the Market for Venture Lending,” Yael Hochberg, Carlos J. Serrano, and Rosemarie Ziedonis estimate the effect of patent trading activity on the rate of startup lending, and the role of venture capital in accessing lending markets.

Why do startups seek out lending?

In the early stages of their development startups require capital injections to finance their innovative activities. While startups will generally tap equity investors (such as venture capital – VC) for the capital to finance such activity, accessing external debt avoids additional dilution of their ownership stakes. However, accessing lending markets typically requires forking over collateral to abate the risk of the loan. With typically no assets or positive cash flow to secure a loan, economic theory generally views the external debt route as a problematic method of financing such activities.

Is equity the only feasible option?

Robb and Robinson (2014), however, point out that loans represent 25 percent of the startup capital for 200 companies in their survey. In fact, there has been a growing industry of non-bank lenders that provide “venture lending” to startups. The principal issue from an economic standpoint is how startups are able to obtain these loans. After all, the types of assets a startup has available at the development stage to post as collateral are typically nontangible – such as patents, which may be difficult to value.

The authors point out that lender expectations on the salvage value of a posted collateral are shaped by two factors: 1) the trading conditions in the secondary market for the asset; and (2) how specific the asset is to a firm (i.e., whether an asset can be repurposed, or if it is so specific that its use is limited by definition). The easier it is to resell the collateral the more value is retained, with a corresponding expectation that more lending will ensue. Firm-specific assets are more difficult to repurpose and the value retained is limited by the ability to find a buyer. Anecdotal evidence further points to a flourishing secondary market for U.S. patents over the past few decades. Additionally, lenders have been recording their security interest in collateralized patents with the U.S. Patent and Trademark Office to establish their lender status and convey the lien to other potential lenders.

Furthermore, a second mechanism exists that may facilitate lending: the intermediary with “skin in the game.” With a credible commitment to monitor and support a risky startup to ensure a return on its investment, an intermediary, such as a venture capitalist, can reduce informational frictions so that a lender may be more willing to issue debt. The lender piggybacks on the knowledge and reputation (skill in identifying promising startups) and the monitoring activities of the VC to alleviate its concerns regarding both the quality and the progress of the startup.

What’s the effect of patent trading and VC investment on venture lending?

The authors find that the probability that a startup obtains debt financing in a year, i.e., annual debt rate, is significantly higher when there is active patent trading for patents in the firm’s technology sector in the secondary market. The empirical results further imply that firm-specificity of the patents matters, but only when the patent market is liquid; if there were no robust trading in a secondary market for patents it would not matter if such patents were firm-specific, as the likelihood of obtaining a loan would be the same and quite low relative to the case when an active market exists. This is in line with the salvage value interpretation of collateral.

The estimation results also show that after their first infusion of VC investment, debt rates per year almost double. When the authors augment their estimation to include the possibility of highly reputable VCs investing in a startup, the annual debt rate of a startup increases by a factor of 2.5, a substantial and significant boost. The problem is that this VC-intermediary effect can be interpreted in both causal and non-causal ways.

Are VCs playing an intermediary role?

To illuminate whether the VC acts as a causal intermediary on startup lending, it is important to identify an exogenous shock to the commitment or credibility of the VC investors to continue financing and supporting the startup. To do this, the authors exploit an institutional feature of the VC industry – the fact that VCs raise individual funds, each with a fixed-term lifespan. These funds are raised in an overlapping fashion, with a new fund being raised for new investment approximately 3-5 years after the prior fund was raised. The spacing of this sequencing is tied to the fact that each fund has a pre-defined investment period during which new investments can be made, of approximately 3-5 years. If there is some unforeseen market shock during or immediately before the VC firm needs to begin fundraising for their next fund, such as the 2000 tech crash, a VC may find it difficult to source capital for their new fund – constraining the ability to make further investments, and changing their incentives with regards to support of their prior investments.

This insight allows the authors to determine whether the VC role is causal: as predicted in Holstrom and Tirole (1997), an intermediary will find it difficult to convince lenders of their commitment to continue to support their investment (here the startup) when a shock adversely impacts the amount of their investable capital. That is, lenders may engage in a “flight to safety” by lending only to startups backed by VCs that had, by virtue of the natural sequencing of their funds, managed to secure their next fund prior to the crash.

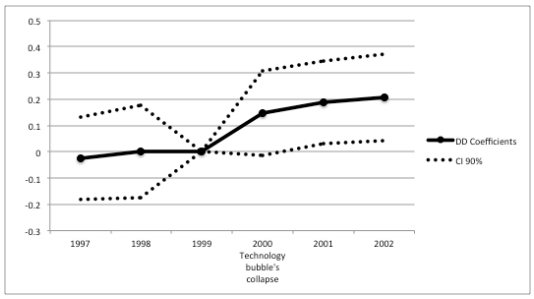

By looking at a subsample of the startups that are plausibly affected by the 2000 crash (such as those in the IT sector) the authors are able to show this “flight to safety.” The figure below illustrates the impact of the results. Before the crash all startups were treated equally by lenders (in that the trend line of the effect of VC funds is around 0). After the crash, however, those startups backed by VCs that had recently raised a fund just prior to the crash had annual debt rates higher by 18 percentage points relative to startups backed by VCs that had not recently raised a fund when the crash happened. This effect persisted for some time after the crash, and in fact increased slightly over time.

Calls for reform?

Recognizing that startups are important sources of economic growth, policymakers around the world are experimenting with ways to stimulate the innovative activities of young companies, whether through R&D subsidy programs, reforms to banking regulations, or through the efficacy and strength of intellectual property protection.

The authors’ findings are particularly relevant to an ongoing debate over bank sources of financing for new ventures. The study makes clear that venture capitalists play a vital intermediary role in lending relationships between banks and startups with high-risk projects. This “VC intermediary” finding suggests that the effect of policies aimed at stimulating entrepreneurial-firm innovation through debt channels alone will be muted unless a sufficient infrastructure of venture capitalists and institutional investors is in place.

The findings also are relevant to a growing debate on regulations that affect borrowing against intangible assets. As a recent report by Brassell and King (2013) points out, the international regulatory framework for banks, known as “Basel III”, heavily penalizes banks from taking into account the value of patent collateral when determining the capital requirements for a loan. Banks and governments in a variety of countries, ranging from Malaysia and Singapore to the U.K., are investigating insurance and loan guarantee programs in hopes of lowering this regulatory cost of patent-backed lending. Echoing claims in the popular press, this study shows that patents, as an asset class, have indeed grown far more “tradeable” since the late 1990s, particularly in information technology-related sectors. If these banking reforms are successful, startups rich in intangibles but poor in tangible assets and cash flows stand much to gain.

References

Brassell, M. and K. King (2013), Banking on IP? The role of intellectual property and intangible assets in facilitating business finance. Report commissioned by the UK Intellectual Property Office.

Holmstrom, B., J. Tirole. 1997. Financial intermediation, loanable funds, and the real sector. Quarterly Journal of Economics. 112(3): 663-691.

Robb, A., D. Robinson. 2014. The capital structure decisions of new firms. Review of Financial Studies. 67(6): 2247-2293.