How do export opportunities affect the choices of firms, their characteristics and the wages of their workers? In their BSE Working Paper (No. 800), “Betting on Exports: Trade and Endogenous Heterogeneity,” Alessandra Bonfiglioli and Gino Gancia characterize how differences among firms arise from their choices of innovation riskiness and map into wage inequality, and how these react to trade openness.

The role of firm differences

Like people, firms are quite unique. Economists tend to assume their homogeneity to simplify their analysis; looking at the distribution of the entire population of existing firms shows that they share common features. However, under all that aggregation lies a great deal of variation in firm characteristics across sectors. And the role that those differences play, especially when studying international trade, is becoming ever more relevant.

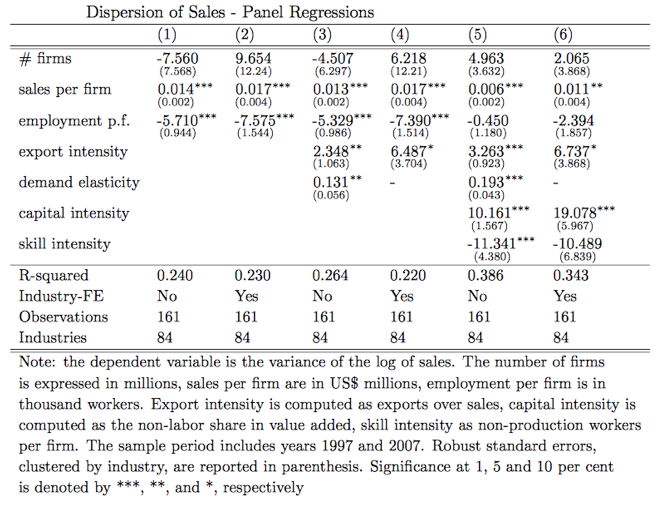

To motivate their work, Bonfiglioli and Gancia document how the variation in sales of US manufacturing firms has changed over time and how this variation correlates with sector characteristics (such as the log of sales, export intensity of firms in the sector, employment/firm, demand elasticity, to name a few). The authors first document that across sectors the dispersion in sales has increased by 25.9% between 1997 and 2007, a result that is not driven by the sample size of firms in any one sector. And, as they demonstrate in their panel regressions below, sector characteristics such as sales per firm, export intensity, and responsiveness of demand to prices (the elasticity) are quite significant and have a positive association to the sector variation in log sales. These results are qualitative in that they do not establish causation (precisely because some of the covariates can be considered endogenous), but do demonstrate existing patterns in the data.

The role of choosing risky technologies

To understand the determinants of the dispersion of firm sales, Bonfiglioli and Gancia develop a theory whose central hypothesis is that the riskiness of the technology chosen by firms entering an industry affects its characteristics. Conceptually, the framework consists of firms in a given industry choosing the type of technology they want to use to produce their variety. Riskier technologies, that may be more productive, may require higher initial investments to enter the industry, but may offer larger expected profits. The higher the ex-ante riskiness, the larger the ex-post realized differences in productivity and performance between firms.

The authors consider first a closed economy, then one with the opportunity of exporting. In the closed economy, the authors show that, since expected profits increase more than proportionally with the innovation risk, firms tend to be risk loving. The key result here is that higher fixed costs of production or higher demand elasticity will induce firms in an industry to choose riskier technologies. This in turn increases the dispersion in an industry’s productivity and revenues.

Export opportunities amplify the previous result because they redistribute profits toward more productive firms in the industry, thereby increasing the returns to risk.

Bonfiglioli and Gancia show that, as openness to trade increases, firms tend to choose riskier technologies, thereby leading to a further increase in the dispersion of productivity and sales at the industry level.

How do risky innovations and exporting affect wage inequality?

Other researchers have documented empirically that exporters are generally larger and pay higher wages. Hence, Bonfiglioli and Gancia next turn to analyze the effect of trade liberalization on wages. To do so, they introduce heterogeneity in workers’ ability, which is unknown to firms prior to hiring. However, firms may engage in costly screening to identify and weed out low ability types. This, paired with labor market frictions, induces positive sorting between firms and workers in terms of productivity and ability, which gives rise to a positive correlation between the productivity of a firm and the wages paid to its workers.

The analysis delivers two main results:

- The dispersion of firm productivity is endogenously larger in sectors with a greater heterogeneity in worker ability, and in those where returns to scale decrease at a slower rate.

- Since wages are increasing in firm productivity, more openness to export in a sector leads to greater wage dispersion both among workers employed by domestic firms and among those employed by exporters. That is, not only does the presence of a minority of exporting firms lead to greater wage inequality because the more productive exporters pay higher wages relative to domestic firms; even within both groups there is higher inequality.

This result, hinging on the choice of the innovation risk, differs from the previous contributions in the literature, and strengthens the mechanism through which trade liberalization may affect wage inequality.

Still more questions…

The authors acknowledge that their theory raises yet more questions. First, the causality between export and dispersion of firms’ productivity is still not resolved by their theory: although export opportunities lead to differences between firms, the dispersion in productivity itself may lead to an increase in the number of exporters. This open question on the direction of causality is an empirical one. There are also normative aspects that the authors have not touched upon, and which call for further research.