How does bank size relate to the quality of loans? In his BSE Working Paper (No. 789) “The correlation of nonperforming loans between large and small banks,” Hugo Rodríguez Mendizábal presents evidence of a large and opposite relationship in loan quality between large and small banks in the United States.

How to look at loan quality: the non-performing loan

A non-performing (or non-current) loan (NPL or NCL) is one that is not generating a cash flow for a bank. In the U.S. the Federal Deposit Insurance Corporation (FDIC), which guarantees bank deposits for customers up to a certain amount, specifically classifies these as loans or leases that are 90 days or more past due. Of course if a bank is not collecting on these loans then interest, the source of profits, is also not being collected. So Rodríguez looks at the ratio of NCL-to-Total Loans and Leases (the NCL ratio) for each bank in a database obtained by the FDIC as his measure of loan quality.

The size of a bank is a tricky matter because there is no natural division as to what makes a bank big or small. Nor for that matter what’s an appropriate measure of size. Rodríguez shows, however, that the measure is not so much the issue as long as one considers the whole distribution for a chosen measure. He uses Total Assets/Total Liabilities, although Total Loans could also be used with no impactful change in the relationship he finds.

What’s the relationship between bank size and loan quality over time?

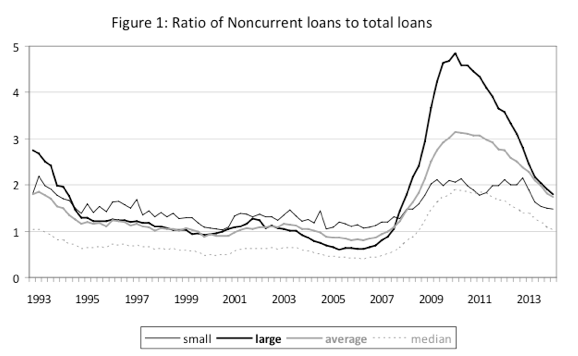

In the figure below Rodríguez depicts the evolution of the aggregate average and median quality of loans from the last quarter of 1992 through the first quarter of 2014, as well as for the average loan quality of the 5% largest and smallest banks in the distribution (grey areas indicate recessions). One of the important results here is that the overall average is larger than the median of the whole sample for all the time periods. This indicates that not only does there exist a consistent slant toward lower quality loans over the timeframe shown but also that the distribution is moving. He finds that when the data is observed in this manner the relationship of loan quality between the largest and smallest banks tend to move strongly in the same way. This would indicate that the stock of poor quality loans for large and small banks increase and decrease, in general, simultaneously.

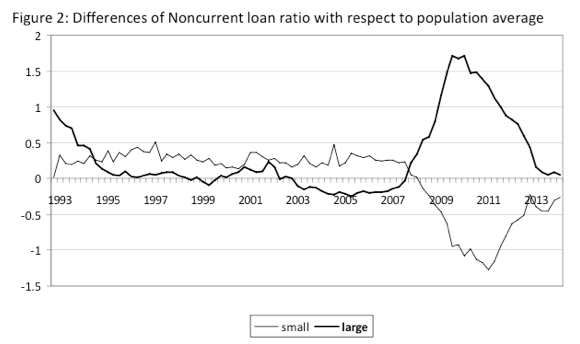

The problem with the above figure is that the overall average of bank quality is moving over time, principally because the distribution of bank size is moving. This is both because of cyclical patterns (NPLs tend to increase in recessions as compared to expansions) and because there are fewer total banks toward the end of the sample period than in the beginning (due to mergers and acquisitions, or simply some small banks closing). To account for this movement in the distribution Rodríguez subtracts from each quarterly observation the total average for that quarter. He reproduces the above graph accounting for this and finds instead that the relationship of loan quality between small and large banks over time moves strongly in the opposite direction.

Rodríguez further looks at whether the same relationship holds when looking at the median instead of the average, as well as splitting the sample according to: bank types, charter class, and Federal Reserve district. He consistently finds a similar opposite relationship between the smallest and largest banks, as well as when he looks at the largest and smallest 10% and 25% of banks.

What does this mean for Banks?

Rodríguez cites that aggregate worsening of loans is not evenly distributed within the industry. For this reason it does not seem satisfactory to look at aggregate measures. Different size banks have differing supplies of credit, which can affect the evolution of their loan quality. This can impact the aggregate loan supply and so must be taken into consideration. But more importantly loan quality is an indicator of future profits, and Rodríguez suggests that profitability could diverge along the bank size dimension. These new facts, therefore, call for more research on the effects of loan quality and size in the banking industry.