In Barcelona Working Paper No. 1229, “Borders within Europe,” Marta Santamaría, Jaume Ventura and Uğur Yeşilbayraktar investigate the effect of borders between European countries on trade. They estimate the average border effect across the continent and conclude that despite the drive to reduce trade barriers, Europe is far from having a single market.

A striking aspect of market shares across Europe is the prevalence of a national bias. For the average region across Europe, that region’s sales as a share of total spending in each destination is 2.2 for intranational markets but only 0.08 for international markets.

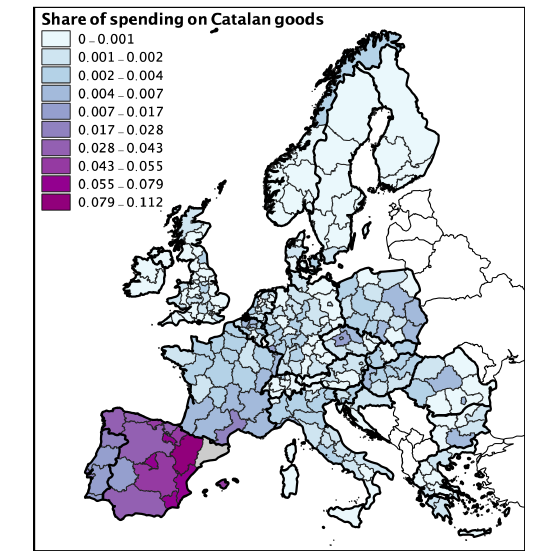

Throughout the paper, the authors provide an example of their findings using Catalonia, Spain as an origin region. Figure 1 shows the relative market share held by Catalonia across Europe. They contrast the market development between Catalonia and Languedoc-Roussillon, France in comparison with Valencia. Key to their identification strategy is that the French-Spanish border runs across Catalonia and Languedoc-Roussillon, and not across Catalonia and Valencia.

Catalonia’s average market share in all the 269 regions in their sample is 1.5 percent. Given how close Catalonia is geographically and culturally to Languedoc-Roussillon and Valencia, it is not surprising that these two markets be especially important for Catalan exporters. Indeed, 2.7 percent of all the spending of Languedoc-Roussillon is on products that come from Catalonia. Yet 7.9 percent of all the spending of Valencia is on products that come from Catalonia, far exceeding that in Languedoc-Roussillon.

This example leads to several pertinent questions which drive the underlying motivation of the paper. To what extent is the observed difference in trade shares caused by the French-Spanish border? What would have happened if this border were southwest of Catalonia, thus separating them from Valencia?

Trade by road: a new dataset

One issue faced by the authors was the availability of an appropriate dataset. To overcome this hurdle, they created an original dataset using the European Road Freight Transport Survey (ERFT). Trade by road is important in Europe and between 2011 and 2017 road freight accounted for about 49 percent of all intra-EU trade.

Their dataset contains two types of regional pairs such that either: origin and destination regions belong to the same country or origin and destination regions belong to different countries. They find that the average value of trade among intranational pairs is almost 30 times larger than among international pairs. Not only do they consider the value of trade but also the frequency at which pairs trade with one other. While 96.8 percent of intranational pairs trade with each other, only 61.7 percent of international pairs do. Thus, they conclude that a national bias manifests itself both on the intensive and the extensive margins.

Modeling the border effect

To answer the questions posed previously, the authors compare observed market shares with the counterfactual case which would have occurred had Catalonia landed on the French side of the French-Spanish border.

By assuming that if the French-Spanish border were southwest of Catalonia, the roles of these two markets for Catalan exporters would reverse enables them to compute the common border effect. They find that the French-Spanish border reduces Catalonia’s share of the Languedoc-Roussillon market to a third of its potential. To estimate an average border effect however, the authors were faced with numerous sources of potential bias.

They estimate the average border effect as the average log change in market shares caused by the border. Using the causal inference framework (Imbens and Rubin, 2015), the authors estimate the average border effect using their observational dataset as if it had come from an experiment. Since this requires satisfying the conditional independence assumption, the authors must identify a range of possible confounding geographical variables that can affect both border assignment and trade flows.

Geography affects trade costs and market shares since, for instance, mountains introduce physical barriers while rivers can increase market access. In addition, they were often natural determinants of border placements. Thus, the authors face endogeneity in both border placement and cross border trade. For example, is the reduced trade between Catalonia and Languedoc-Roussillon a result of the political border or the physical barrier to trade, the Pyrenees mountain range? To draw causal conclusions, the authors estimate the probability of observing a border between every pair of European regions based on geographical factors and build subsamples for which this probability is constant across all region pairs. Within these subsamples, the border effect can be estimated by comparing trade between intranational region pairs and international region pairs.

| ESTIMATED βATE | ||

|---|---|---|

| ALL CONTROLS | WITHOUT NUMBER OF BORDERS | |

| Weights: Size of blocks | -1.744 | -1.299 |

| Weights: Treated pairs | -1.747 | -1.303 |

Average effects across borders, industries, and time

By grouping region pairs by the propensity score, the probability that a border separates the pair, and ensuring an equal balance of both control and treatment groups the authors estimate the border effect across eight subsamples of region pairs ordered in increasing probability of having a border. They present two possible average treatment effects, weighting the coefficients by the size of the block (row 1) and weighting by the number of treated units in each block (row 2).

As can be seen in Table 1, the average effect of the border is negative, and the weighting method does not make much of a difference. Their findings suggest that the border reduces trade between two regions to 17.5 percent of what they would trade without the border.

The authors believe that this large average effect may hide some cross-industry heterogeneity and their belief was confirmed through further specifications. The presence of a border reduces the Food, Beverage and Tobacco industry share to 12.3 percent while the Textiles industry falls only to 38.9 percent. The authors suggest that this could be indicative of an increasing border effect for more differentiated or more transformed goods.

Finally, the sample contains borders that were created several centuries ago, such as the French-Spanish border, together with borders that were put in place only some decades ago, like the border between the Czech Republic and Slovakia that was established in 1993. It is plausible to think that the effects of these borders might be quite different. Europe saw a process of political fragmentation throughout the 20th century such that one third of regions who shared a country in 1910, no longer did so in 2010.

They find a negative and significant border effect for post-1910 borders, albeit smaller than the average border effect without conditioning on historical borders. Post-1910 borders reduce the market share to 28.3 percent of its potential. Therefore, borders that have been in place for less than a century have large trade reducing effects, although smaller than those of older borders.

Conclusions

In summary, the authors use a newly created dataset to estimate the average border effect on trade between European regions. They consistently find that the effect is negative and sizeable. This contributes to a wider research effort aimed at disentangling the channels through which country borders affect trade. The authors pose further questions to follow on from this paper. For example, how much would the border effect be reduced were the European Union to eliminate the large observed national bias in procurement or build a truly European transportation network?

Very interesting.

Does language matter?, i.e if two regions are in different countries but share language does this have an effect?

I see that Norway and swizerland are included. Is there a EU effect?

A. M-C