In their BSE Working Paper (No. 927) “Labor Share Decline and Intellectual Property Products Capital,” Dongya Koh, Raül Santaeulàlia-Llopis and Yu Zheng explore to what extent the inclusion of Intellectual Property Products (IPP) capital in the national accounting explains the secular decline in the labor share in the US.

Call the accountant!

Suppose you are the CEO a company. One morning, before even opening your email, you find a complaint of the union over your desk. Your employees declare that the wage bill has declined compared to other factors of production (i.e., capital). It has not been your policy to fire workers; in fact you have tried to avoid layoffs as much as possible, you might have even raised wages. So what happened?

You call the accountant to address the situation, and there you have it! Your accountant has started to follow new accounting rules by the Bureau of Economic Analysis (BEA) and the company’s books now treat software, R&D, and artistic originals as investment (hence, capital) as opposed to expenditure in intermediate goods. During the past years the company has changed the inventory software (twice) and made huge R&D and PR investments. Your company has developed an image, a jingle, and even produced a DVD to send to the customers whenever you dispatch a product. Of course, there is also the website, Facebook, Twitter, Pinterest, and Instagram. So, after digging in the accounts, you realize that if the labor share declined is because the company has been investing in software, R&D and artistic originals (i.e., ideas) that require larger investments and become obsolete at a much faster rate. Before, none of these expenditures were treated as capital, so of course, the share of labor expenses remained constant.

US labor share has declined from 68% in 1947 to 60% in 2013

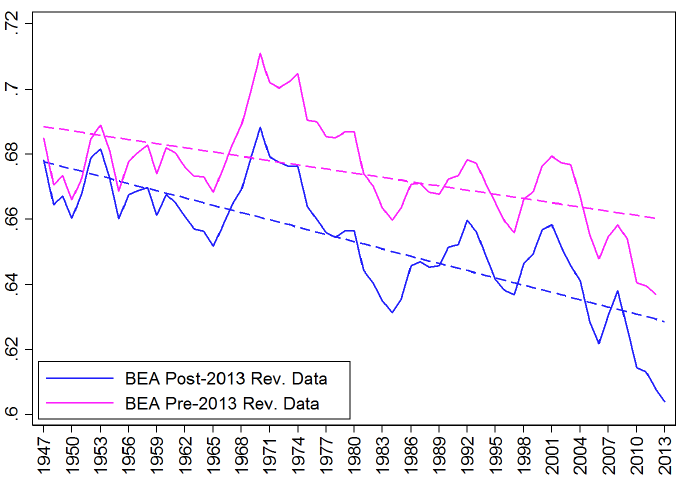

A similar situation has occurred within the US economy. According to official data, the share of income going to wages and other forms of labor compensations has declined from 68% in 1947 to 64% in 2013. Note that these data had software as investment due to an important BEA revision in 1999. In addition, in 2013 the BEA introduced a revision in the national income and account products in which the investments in R&D and private investments in artistic originals start to be treated as investment (hence, capital) instead of intermediate non-durable or final consumption goods. Together with software, these two items form the so-called IPP. With this new accounting, the labor share has declined even more to 60% as the next Figure shows.

Why are IPP and traditional capital different?

But let’s begin from the basics. In order to understand why IPP and traditional capital may affect differently the labor share we need to understand in which dimensions IPP and traditional capital are different (and in which they are not):

- IPP grows at 4.9% a year and traditional capital grows at 2.7%, hence they have very different investments flow. Currently IPP accounts for almost one third of aggregate investment (40% in the corporate sector).

- IPP and traditional capital investment prices are very similar, both prices have declined by slightly more than 40% since the 40s.

- IPP depreciates at 21.4% and traditional capital at a 3.8% rate, so IPP becomes obsolete faster, and needs to be replaced more frequently.

To investigate the effects of IPP capital on the falling labor share, Koh, Santaeulàlia-Llopis and Zheng, compare the labor share with and without the IPP in the 1947-2013 period.

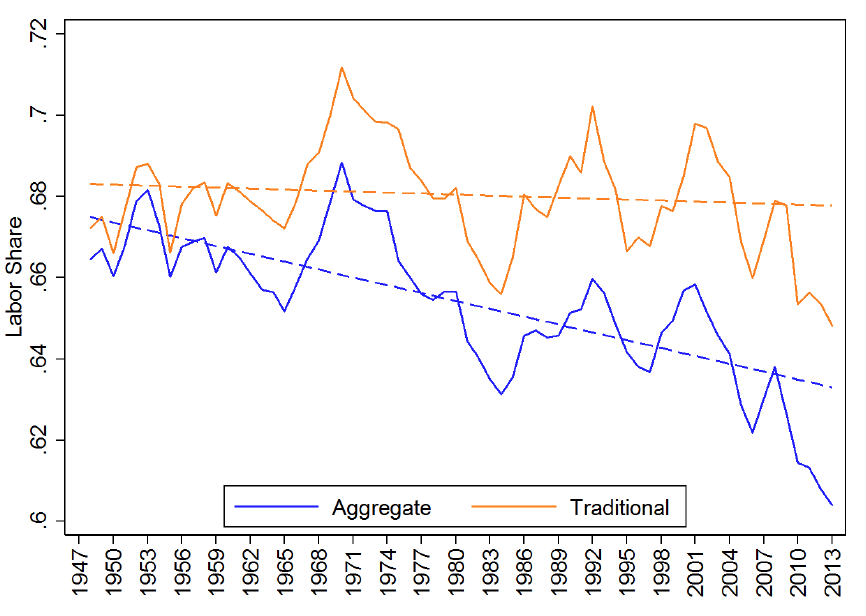

To do the so, the authors construct two labor share series: one with the current Bureau of Economic Analysis accounting including both IPP and traditional capital (i.e., aggregate capital), and one using the traditional capital only. Note that aggregate output also increases due to the new flow of IPP capital income and, hence, the counterfactual labor share without IPP corrects for output as well.

Comparing labor share with and without IPP capital

The labor share is the part of the income not associated to capital. In other words, it is one minus the ratio of capital income and total income. Capital income is the product of the stock capital and its gross return.

While the stock of capital and the total income are observed from the data, the gross return is not. To recover the rate of return of IPP and traditional capital, the authors use an investment model where the only restriction is that if the all the factors of production increase, the output should increase in the same proportion, i.e., the production function has constant returns to scale. Afterwards, they can reconstruct the labor share series.

The next Figure presents their main result. The blue line depicts the labor share using aggregate income. The orange line depicts the labor share that contains only capital income. While the traditional labor share remains trend-less over the last 65 years, the aggregate labor share secularly falls. That is to say: the fall in the labor share is entirely explained by the introduction of IPP capital in national accounts.

Why is it the case?

Since the ratio between the price of aggregate and traditional investment remained constant around 1 during the entire period, the effect of the IPP in the decline of labor share can only come from differences in investment flows or in the depreciation rate. In a simple decomposition exercise the authors show that IPP depreciation accounts for two-thirds of the labor share decline. The remaining one third is accounted by the net IPP capital income.

What do we learn?

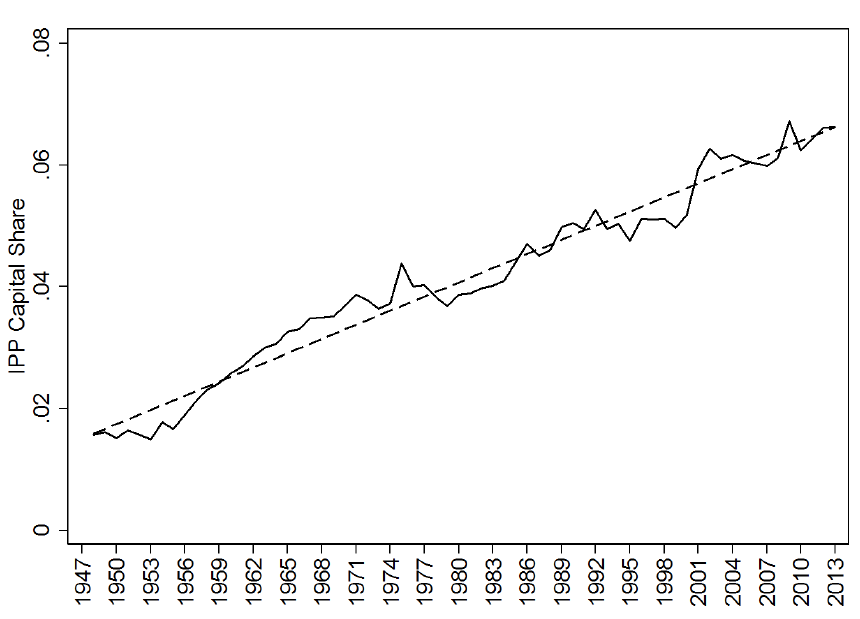

If the answer lies in the accounting strategy, does it mean that we should not care about the falling labor share? Not at all. The authors argue that the labor share that incorporates IPP is a better representation of the US economy. After all, IPP investment represents almost one third of aggregate investment and should not be neglected. The authors’ takeaway is that the US is going through a profound transformation toward a more IPP capital-intensive economy without sign of deceleration (see next Figure) and that this is what economists should be modeling.

In practice, it is up to each modeler to choose which labor share uses in her/his models. But it is clear that from now on we must be extra careful in mapping our models’ labor share to the data. Given the results in Koh, Santaeulàlia-Llopis, and Zheng (2016), models that do not incorporate IPP can still claim and call in a constant labor share, but bear in mind that in that case they would be ignoring a large (and increasingly important) part of aggregate investment that defines the US economy.