Startups are engines of growth, fostering innovation and technological progress. Despite their possible small size, these new businesses are characterized by their intention to grow large beyond the founders. To do so, not only venture capital (VC) investment is key, but also the enticement of individuals stakeholders is pivotal, that is, what happens before the introduction of VCs matters. However, the influence and relevance of each of the distinct stakeholders in the early stages of the startups is still not well understood. In BSE Working Paper 1127, “Early Individual Stakeholders, First Venture Capital Investment, and Exit in the UK Startup Ecosystem,” Albert Banal-Estañol, Inés Macho-Stadler, Jonás Nieto-Postigo and David Pérez-Castrillo create and make use of a novel data set of UK-based VC-backed startups to study the effects of the pre-institutional individual stakeholders on the eventual success of the startups.

The paper reveals previously unknown characteristics of the startups and finds that individual features make a difference. Authors show that the quantity and experience of founding and non-founding directors and other individual investors affect the firm’s type of, and value at, exit. Moreover, they indirectly affect success through the type, quantity and quality of the first-VC investors.

Novel and insightful evidence

Startups rely on several types of individual stakeholders, i.e., founders, directors and other individual investors, including the business angels (BA). Meanwhile, there is a lack of systematic and reliable information about these parties. This might be due to the fact that in many countries, such as the US, individuals are not subject to regulatory disclosure requirements. In the UK, however, all private companies must submit mandatory fillings to the registrar of companies, which includes extensive details on the identity, number and value of the shares owned by each and every shareholder.

The authors benefit from this British legal environment and pioneer the construction of a comprehensive dataset of UK-based VC-backed startups. The final sample includes 910 unique firms receiving first-VC investment from 1999 up to 2005. One major contribution of the paper is that it reveals fresh features about startups.

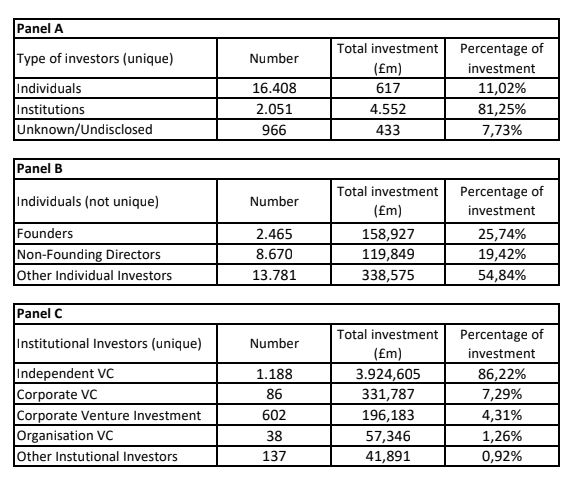

Table 1 breakdowns the importance of different investors in this database, both in terms of number of investors as well as the size of their investments. Panel A shows the distribution of investors. Individual investors, despite accounting for the 84% of the number of investors, bring only 11% of the total investment. Institutions, despite being only 11% of the body of investors, account for 81% of the total investment. Panel B divides individual investors into founders, non-founding directors and others (i.e., non-director). Founders represent an important source of investment for the startups in relative terms, but a proportion of 15% of them never invest in the company though. Other individual investors represent the most important category with more than half of the number and investment (6% of the total, institutions included). Lastly, Panel C depicts the distribution of (unique) institutional investors. Independent VCs (IVCs) represent the main body of institutional investors, accounting for more than half of the investors and 86% of the investment. Corporate VCs (CVCs), despite representing only 4% of the institutional investors, are the second major source of funding.

Panel A: number of unique investors and their investment. Panel B (resp. Panel C): similar information about the different types of individuals (resp. institutional investors)

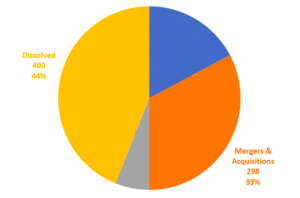

Concerning firm exit in this sample, the dataset reveals that about 39% of the companies can be considered successful, defined, following prior literature, as exiting in the form of an Initial Public Offering (IPO) or a Merger and Acquisition (M&A), whereas the rest end up dissolved or remain active without exit (44% and 17%, respectively).

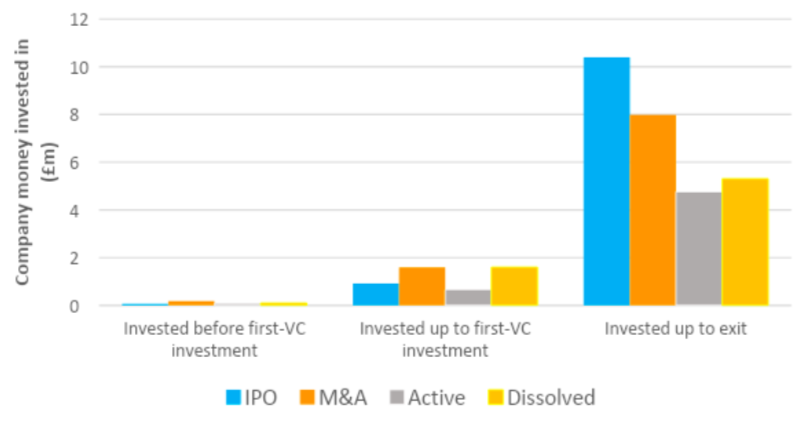

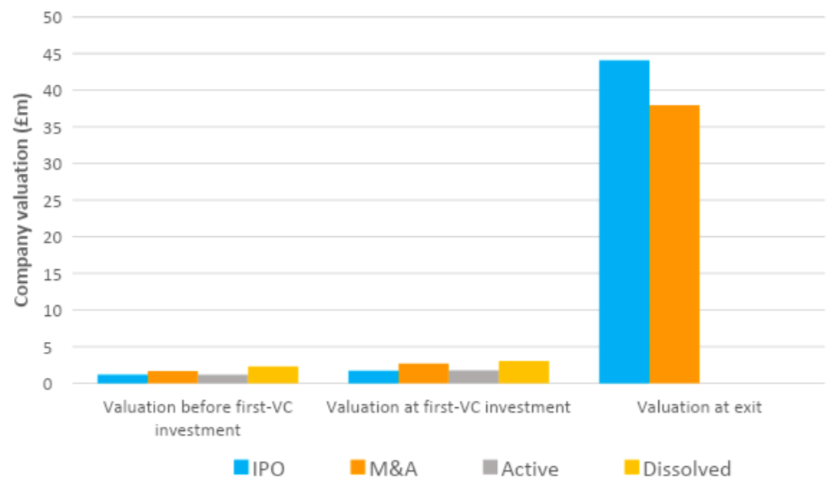

The average investment and valuation at first-VC investment do not differ significantly between eventually successful and unsuccessful ventures, as shown in Figures 2 and 3. Cumulative investment and valuation are, on average, increasing in startup life-stages. The former is $124K just before the first-VC investment and $5.4m 5 years after it or at the exit, whichever came earlier. Similarly, firm’s valuation is $1.8m just before first-VC investment and $8m up to the exit.

Cumulative investment prior to first‐VC investment, at first VC investment and at exit for the average company that exits through an IPO, an M&A, remains active, or ends up dissolved.

Valuation prior to first‐VC investment, at first VC investment and at exit for the average company that exits through an IPO, an M&A, remains active, or ends up dissolved.

Empirical analysis

The authors also conduct an empirical analysis to investigate the effects of pre-institutional individual stakeholders on the type of first-VC investment, and the effects of these former two on startup’s success.

Success is more likely in startups that have had larger founding teams, appointed greater number of non-founding directors, and included experienced BAs among its investors, before the first-VC investment. The features of early individual stakeholders also impact the likelihood of exit through an IPO or an M&A, having a significantly greater effect on the latter. Still, all the aforementioned characteristics positively affect startup valuation at 3 and 5 years since first-VC investment, and eventual startup final valuation.

Moreover, the quantity and experience of the early individual stakeholders also have an effect on the type, quantity and quality of the first-VC investment. For instance, authors find that startups with larger number of founding and non-founding directors are more likely to have IVCs as first-VC investors. The presence of an experienced BA investor makes it more likely that the startup will have an IVC but less likely that it will have a CVC.

Individual stakeholders also indirectly impact firm’s success through their determination of first-VC investment. For instance, the number of founders and non-founding directors, as well as the presence of a BA, make it more likely that the startup will have an IVC at first-VC investment, and the presence of an IVC increases the likelihood of IPO or M&A.

In summary, the present paper shows how the compilation and investigation of novel evidence unveil the still disregarded relevance and differential influence of the various types of individual stakeholders of startups. As authors argue, these findings and the newly introduced dataset can guide further research on the impact of pre-institutional startup features on their development and the role each type and source of VC funding plays.