During the economic crisis in countries that had experienced housing bubbles, from the US to Spain, thousands of homeowners faced foreclosures. With such a large number of home evictions, civil organizations took action against banks, which were blamed for the crisis, and judges often ruled in favor of homeowners. However, would the outcomes have been any better if the judicial rulings had instead been aligned with banks’ preferences?

In their BSE Working Paper (No. 913) “Fragile Markets: An Experiment on Judicial Independence,” Benito Arruñada and Marco Casari use an experimental framework to explore how different institutions that allocate enforcement rights affect credit transactions.

Lenders, borrowers, and judges

Credit typically involves two transacting parties (lenders and borrowers) and a third-party enforcer (judges). Lenders’ decisions concern whether or not to provide loans, while borrowers decide whether to repay the loans. If borrowers opt for default, the enforcer can intervene to force the borrower to pay. When judges fail to guarantee a sufficiently high enforcement rate, lenders will refuse future loans and the credit market will collapse. As a result, enforcement rules determine the very existence of such fragile markets.

An experiment to isolate enforcement institutions

The experiment has the following structure. Fifteen participants take part in a session. At the beginning of the session, participants are randomly placed in groups of three, where one member is assigned the role of lender, another of borrower, and another of judge. Participants play the same game for several rounds, with new groups formed at random after each round, but retain the same role for the entire session.

In every group and at every round, each lender decides to lend or not; each borrower decides to repay or to default; and, if the borrower defaults, the corresponding judge can enforce repayment. If the lender does not lend, the lender receives 60 tokens and the borrower 16. If there is a loan and there is repayment, the lender receives 67 and the borrower 33. If the lender provides the loan and the borrower does not pay back, both lender and borrower receive 50 tokens. Note that if no transaction takes place, a lender earns more than three times as much as a borrower does. In contrast, if a transaction does take place, inequality is reduced as, after repayment, a borrower holds about half the wealth of a lender, and after a default, a borrower earns the same as a lender. Thereby, credit generates a surplus and equalizes income distribution.

Judges are paid according to three institutional arrangements:

- Lender constituency

- Borrower constituency

- GDP

In the GDP treatment, judges are paid in proportion to the aggregate income of the economy. In contrast, in the Lender constituency and Borrower constituency treatments, judges are paid according to how close they are to the average preferences of the corresponding voting constituency regarding the enforcement rules. For instance, in the Borrower Constituency, if the number of judges enforcing equals the number of lenders also favoring enforcement, judges earn 50 tokens. For every person in disagreement, judges’ earnings are lowered by 5 tokens.

The timing of the game is as follows: Lenders are the first movers. After them, each transacting party votes on whether or not they would like judges to enforce repayment. Next, borrowers decide on repayment, and judges decide on enforcement. Finally, each individual observes his own payoff, each group learns the group payoff, and all the participants observe the social history. This social history includes the number of loans and defaults, the number of judges that enforced, the votes of lenders and borrowers, and the average earnings of borrowers, lenders and judges.

The Borrowers’ Paradox

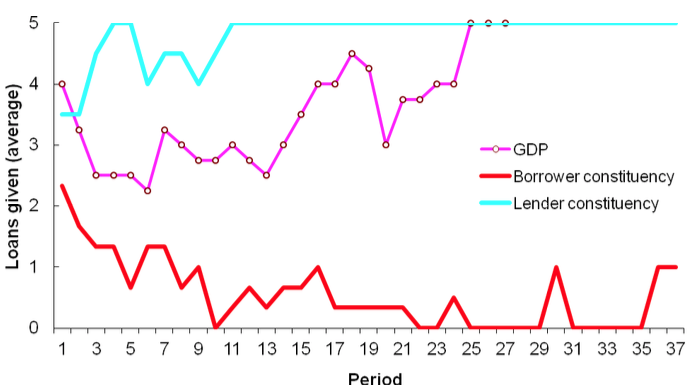

In the experiment, the market for loans tends to flourish when enforcement is in the hands of lenders or of a third party with an interest in the aggregate surplus, but it dries up when enforcement is controlled by borrowers. This result is a paradox because when borrowers are in control, their earnings are lower than when lenders are in control, both in absolute and in relative terms.

Moreover, when enforcement depends exclusively on lenders, the market maximizes the total surplus. While in the Lender constituency subjects reach near 100% of the potential surplus and in the GDP treatment they reach 69%, in the Borrower constituency they only reach 10%, making the whole society poorer and wealth distribution more unequal.

Arruñada and Casari focus on two possible conjectures that could explain the Borrowers’ Paradox: participants’ pro-social preferences, or their difficulty in understanding market interactions.

Pro-social preferences could explain the Borrower’s Paradox because borrowers and judges may want a redistribution of the surplus in favor of those most in need. For this to be an explanation, the interpretation of pro-sociality must be of a type that requires immediate action during the round without looking any further. Before the market experiment, the authors elicited participants’ pro-sociality level. They report that those with strong preferences for equality or for the group achieving a high total surplus were less likely to vote for enforcement under the Borrower constituency. Hence, pro-sociality may well be the underlying cause of the Borrowers’ Paradox.

To test this hypothesis, the authors ran a modified version of the game in which, instead of dealing with other people, judges dealt with robots that do not receive any payment. If pro-sociality was at stake, the difference between the Borrower constituency and the GDP treatment should vanish when the subjects face robots. Yet, even in this modified game, Borrower constituency performed worst.

In fact, the explanation that is most in line with the empirical data is bounded rationality: at the individual level, participants’ choices are linked to the cognitive reasoning they exhibited in the task performed at the beginning of the session. If those who—through their votes—control enforcement have a poor understanding of the systemic consequences of their decisions, they trigger insufficient enforcement, and hence waste exchange opportunities.

Fragile impersonal credit markets

The experimental evidence provided by Arruñada and Casari suggests that the functioning of impersonal markets is fragile because some institutions pose problems that are too difficult for agents, and their poor understanding of the long-term consequences of their decisions leads them to take decisions against their own interests.

In the simple laboratory situation, agents may not have been fully aware of the constraints posed by the functioning of markets. This sometimes backfired and led them to unwelcome outcomes. In the field, many other considerations may play a role, such as income shocks and banks’ misbehavior.

One lesson from this study is that exchange opportunities depend on the political structure and the functioning of the judicial system. In particular, it shows that collocating information and decision rights promotes growth and equality by reducing the cognitive limitations that might otherwise induce agents to damage themselves by taking wrong choices about enforcement.