Original photo by Samuel Sianipar on Unsplash

Does financial globalization benefit global productivity growth? Researchers uncover a novel link between the United States and developing countries.

In the BSE Working Paper No. 1165, “The Global Financial Resource Curse,” Gianluca Benigno, Luca Fornaro and Martin Wolf study the impact of capital flows from developing countries to the United States – the so-called global saving glut – on global productivity growth. They show that capital flows from developing countries to the United States can generate a global productivity growth slowdown, by triggering a fall in economic and innovation activities in the U.S. tradable sectors. This novel effect, “the global financial resource curse,” offers a new perspective on the consequences of financial globalization, and on the appropriate policy interventions to manage it.

Reconciling empirical trends

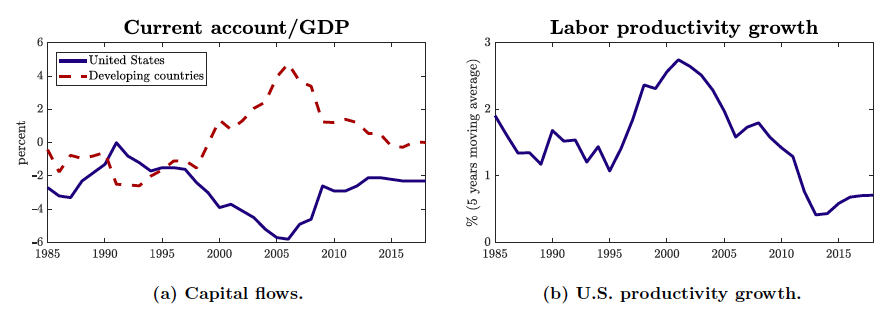

Since the late 1990s, the United States has received large capital flows from developing countries – mainly China and other East Asian countries (Figure 1a) – a phenomenon known as the global saving glut. Concurrently, the U.S. has experienced a marked productivity growth slowdown (Figure 1b). While the existing literature has studied these two facts in isolation, the paper suggests that the global saving glut might have reduced productivity growth in the U.S., as well as in the rest of the world, by triggering a “global financial resource curse.”

The paper studies a framework composed of two regions: the United States and a group of developing countries. The technological leader, i.e. the United States, determines the evolution of the world technological frontier. Developing countries, in contrast, experience productivity growth by absorbing knowledge originating from the United States.

Compared to standard frameworks, the model has two novel features. Firstly, sectors producing tradable goods are the engine of growth in our economy. This assumption captures the notion that such sectors, as manufacturing, have more scope for productivity improvements compared to sectors producing non-tradables, such as construction. In fact, the bulk of spending in R&D activities is concentrated in manufacturing. Secondly, agents in developing countries have a higher propensity to save compared to Americans. This assumption captures the high appetite for U.S. assets by agents in developing countries.

How is the global economy cursed?

Due to the heterogeneity in propensities to save across the two regions, once financial integration occurs the United States receives capital inflows from developing countries. Capital inflows, in turn, allow Americans to finance an increase in consumption. Higher consumption of tradables is achieved by increasing imports of tradable goods from developing countries, so that the United States end up running persistent trade deficits.

But non-tradable consumption goods have to be produced domestically and so factors of production migrate from the tradable sector toward the nontradable one. This generates a drop in the profits earned by firms in the tradable sector, reducing their incentives to invest in innovation. The result is a fall in U.S. productivity growth.

In comparison, financial integration leads developing countries to run persistent trade surpluses. This stimulates economic activity in the tradable sector, at the expenses of the non-tradable one. Higher profits in the tradable sector induce firms in developing countries to increase their investment in technology adoption. Their proximity to the technological frontier thus rises and productivity growth in developing countries initially accelerates. However, the drop in innovation activities in the U.S. reduces the productivity gains that developing countries can obtain by absorbing knowledge from the frontier. In the long run, therefore, productivity growth in developing countries slows down below its value under financial autarky. Combining both regional effects, the process of financial integration generates a fall in global productivity growth.

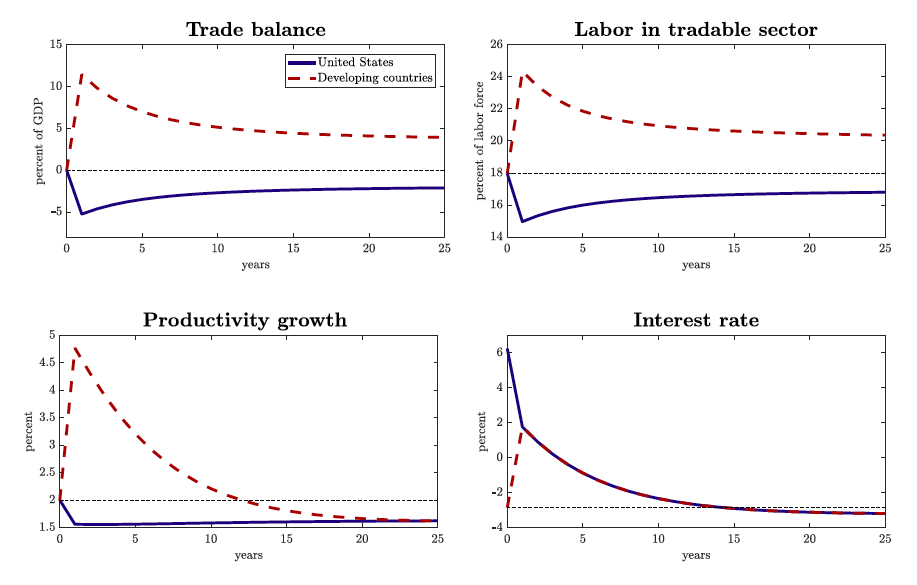

To back-up the aforementioned theoretical results, the authors rely on numerical simulation to study the transition from a regime of financial autarky to financial integration. Figure 2 displays the economy’s transitional dynamics, following the opening of international credit markets to developing countries. One can see that the simulation results illustrate the model findings.

The top-left panel shows that the process of financial integration is characterized by a persistent spell of trade balance deficits for the US. In turn, the U.S. rate of productivity growth drops (bottom-left panel). This happens because of the reallocation of production from the tradable to the nontradable sector (top-right panel) induced by the deficits in the trade balance.

As a mirrored image, for the developing countries, financial integration is associated with large trade balance surpluses (top-left panel) and an initial acceleration in productivity growth (bottom-left panel) due to an increase in economic activity in the tradable sector (top-right panel). Hence, in the medium run, the model reproduces the positive correlation between productivity growth and capital outflows. Eventually, however, productivity growth in developing countries slows down, falling below the growth rate in the initial autarky steady state. The reason, of course, is that low productivity growth in the United States reduces the scope for technology adoption in developing countries.

The bottom-right panel of Figure 2 shows the path of interest rates. Financial globalization leads to interest rate equalization between the United States and developing countries. This situation, however, is only temporary. As global growth slows down the world interest rate keeps falling until it converges to a level below both autarky rates. Therefore, in the long-run the world, i.e., both the United States and developing countries, enters a state of super low interest rates.

Conclusion and policy implications

By proposing a new link between international financial integration and global productivity growth, the paper pushes forward a non-trivial and not advantageous effect of globalization. It explains why the cheap access to foreign capital by the world technological leader depresses global productivity growth by inducing a contraction in economic activity in tradable sectors. The “global financial resource curse” then reconciles the empirical evidence of international capital flows towards the United States and the decline in global productivity growth.

The results shed light on a new channel between the central role played by the United States in the international monetary and technological systems. Besides, they have policy implications. The authors use the model to revisit two common policies implemented by Governments to foster productivity growth. First, the paper revisits the notion of export-led growth, that is the idea that governments in developing countries might foster productivity growth by stimulating trade surpluses. The paper shows that this strategy, while it might be effective if implemented by a few countries, will backfire if put in place by a large number of countries. The reason is that trade surpluses in developing countries produce a fall in innovation in the U.S., and so reduce the scope for technology adoption in developing countries.

The authors also show that capital flows from developing countries to the U.S. might not trigger a slowdown in growth, as long as the U.S. government reacts by implementing policies that sustain investment in innovation by U.S. firms. In fact, cheap capital flowing from developing countries might even help the U.S. government to finance policies to sustain growth. This means that the negative impact of capital inflows on U.S. productivity growth is not inevitable, and that large capital inflows and healthy growth can coexist as long as the right policy responses, aiming at sustaining investment in innovation, are implemented.