What is the impact of capital inflows on domestic credit and borrowing costs? In their BSE Working Paper (No. 953), “International Spillovers and Local Credit Cycles”, Yusuf Soner Baskaya, Julian di Giovanni, Sebnem Kalemli-Özcan, and Mehmet Fatih Ulu argue that, during periods of high global risk appetite, capital inflows fuel a credit expansion in emerging markets by reducing the costs of borrowing. For the Turkish economy, exogenous capital inflow explain 40 percent of the cyclical credit growth of the corporate sector.

Capital inflows fuel credit markets by reducing the costs of borrowing

The underlying mechanism is rather intuitive. When global risk is low, investors are more willing to tolerate the higher risk associated with investing in emerging markets. As a result, capital flows into the country and reduces local banks’ funding costs. Banks, in turn, reduce the cost of lending to firms and local credit expands.

Quantifying this effect, however, is challenging. First, supply and demand factors for capital inflows must be separated. Second, the identification of the impact of supply-driven capital flows requires data on both the quantities and prices of credit.

The VIX index isolates supply-driven capital inflows

There are several reason why capital might be flowing into the Turkish economy. It can be due to increases in firms’ demand, due to an increase in the worldwide supply of capital, or due to a combination of both factors. When capital inflows are supply driven, loan volumes increase and borrowing rates fall. When capital inflows are demand driven, loan volumes increase and borrowing rates rise. Since demand and supply factors have opposite effects on borrowing rates, a naive regression of borrowing costs on capital inflows will bias the estimated relationship between the two variables towards zero.

To solve this issue, Baskaya, di Giovanni, Kalemli-Özcan, and Ulu proxy global risk appetite with the VIX index. This index is a measure of uncertainty and market risk aversion of the Chicago Board Options Exchange, which captures the market’s expectation of 30-day volatility, using a wide range of S&P 500 index options. Because Turkey is a small-open economy, movements in the VIX are exogenous to domestic fundamentals, and the index can therefore be used to isolate supply-driven capital flows.

Data on outstanding loans and borrowing rates at the firm-bank level

The second challenge for quantifying the impact of capital inflows on domestic credit markets is the lack of quantity and price data. The authors overcome this hurdle by exploiting a unique administrative dataset from the Turkish Banking Regulation and Supervision Agency (BRSA), which contains monthly records for the universe of loans that banks issue to firms between 2003 and 2013. Besides identifying firm and bank relationships, the dataset contains information on principal outstanding, interest rates, maturity, collateral, and the currency denomination of every loan. These credit records are matched with bank and firm balance sheet information to create an unbalanced panel of 28,339 firms and 49 banks. The final sample consist of 19,982,267 firm-bank-quarter loans over the 2003–2013 period.

The availability of these loan-level data is crucial because it allows the authors to control for latent bank and firm characteristics, which, if omitted, would bias estimates. Furthermore, the fact that firms borrow from multiple banks over time allows the authors to identify heterogeneous effects of capital flows on lending at the firm and bank level.

In Turkey, supply-driven capital inflows lead to a credit boom

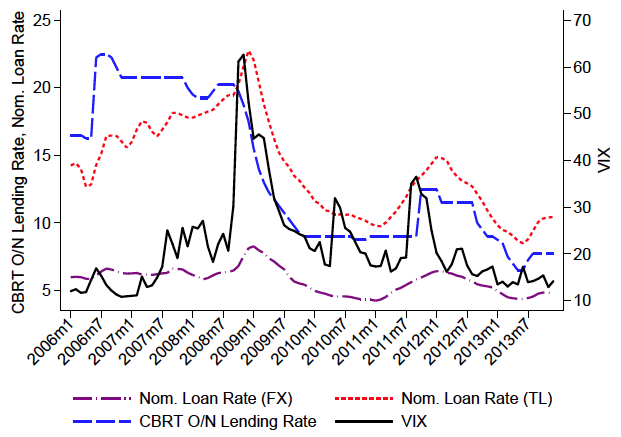

As it can bee seen in the following figure, the overnight (policy) rate of the Turkish Central Bank (CBRT) and the aggregated nominal interest rates for loans in Turkish Lira (TL) and loans in foreign currency (FX) correlate with VIX. Nevertheless, these are not causal relations.

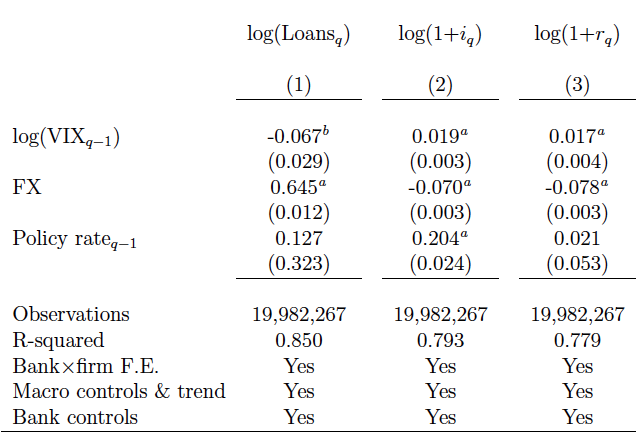

The next table, instead, presents the causal effect of exogenous capital inflows —as proxied by VIX— on the Turkish credit market. The regressions not only control for the VIX, but also the currency denomination of the loan, the local monetary policy rate, and a host of bank-level and macroeconomic controls. The elasticity of loan growth with respect to VIX is −0.067; the elasticity of the real interest rate with respect to VIX is 0.017. The first estimate implies that changes in the exogenous component of capital inflows explain forty percent of cyclical loan growth of the corporate sector from 2003 to 2013. The second estimate implies that an increase in the logarithm of VIX, equivalent to its interquartile range, reduces the real borrowing rate by one percentage point.

Credit pricing changes with firm and bank heterogeneity

The estimated effects are even larger for credit supplied by banks with higher non-core funding. The channel underlying this is result is that when the global risk is low, these banks, which rely more on wholesale funding relative to traditional funding (i.e., deposits), can raise funds in the international capital markets at lower funding costs.

With lower funding costs, these banks can then provide loans at lower borrowing rates in the domestic economy. Moreover, the elasticity of the real interest rate with respect to VIX is 50% larger for high non-core banks lending to low net worth firms than for high non-core banks lending to high net worth firms. That is to say, when banks that raise their funds in the international capital markets face lower funding costs, they lower the cost of borrowing relatively more for low net worth firms than for high net worth ones. Yet low net worth firms do not receive a relatively higher volume of loans than high net worth ones when VIX is low. Why? Because low net worth firms face collateral constraints and therefore cannot increase their quantity of loans.

“Financial trilemma”

The empirical evidence provided by Baskaya, di Giovanni, Kalemli-Özcan, and Ulu are key for policy makers. Conditional on the policy rate and the exchange rate, capital flows lower real borrowing costs and fuel credit expansion. The policy maker can slow down the credit expansion and prevent future asset price bubbles by raising the policy rate. However, a higher interest rate attracts even more capital flows fueling further the credit expansion, and leading to a loss in international competitiveness via the appreciation of the currency. All in all, this means that national financial regulation, free capital flows, and the global financial cycle make financial stability a difficult target.