How does competition in the banking sector affect the various risks that a bank is exposed to? In their BSE Working Paper (No. 781) “Banking Competition and Stability: The Role of Leverage,” Xavier Freixas and Kebin Ma reexamine the classical issue of the possible trade-offs between banking competition and financial stability by highlighting different types of risk and the role of leverage. By means of a simple model, they show that competition can affect portfolio risk, insolvency risk, liquidity risk, and systemic risk in different ways.

What are the types of banking risks?

In the course of conducting their business, banks are subject to several types of risk. Freixas and Ma analyze the most prevalent types, which competition may affect:

- Portfolio risk

- Insolvency risk

- Liquidity risk

- Systemic risk and contagion

Broadly, portfolio risk is the risk of the assets a bank holds, mainly the loans that a bank originates. So the risk is the possibility of default by the firms/entrepreneurs that have been granted these loans. Since it is from these loans that banks derive their cash flow (and profits through the interest rate), portfolio risk adds volatility to a bank’s cash flow.

As liquidity and insolvency risk are related and at times are difficult to distinguish the, empirical literature rarely considers the former. However, a rigorous approach to banks’ risk taking should consider both types of risk, because they determine the risk that a bank will become bankrupt (thus the two in union are known as a bank’s credit risk). The authors analyze the two separately in order to show how each one impact the credit risk a bank is exposed to.

Insolvency risk attempts to measure a bank’s ability to actually meet its liability obligations with the value of its assets, so that the value of its equity is positive. An insolvent bank is, therefore, one that has a market value for its assets lower than the face value of its debt obligations. The concept of solvency is thus tied to portfolio risk and liquidity risk, as any shortfall in meeting obligations with its cash flow or with the rolling over of debt (for example, if there are a lot of bad loans) must then be met by selling the assets. However, there is still the possibility that a bank is solvent in the long run, but illiquid in the short run. This happens when the bank is able to repay its debt if it its creditors rolled over their claims but is not able to survive an early bank run. Such a situation is due to the maturity mismatch, which is characteristic of banks’ balance sheet, as the provision of liquid claims to depositors is one of the main justifications of the existence of banks. A bank in this situation is facing pure liquidity risk as its ability to meet its obligations now rests solely on its ability to sell its assets.

Liquidity is then the ability of a bank to quickly sell assets or raise funds to cover calls on its liabilities. So the risk stems from a bank’s inability to liquidate its long-term assets for fair values upon short notice. For example, if short-term creditors decide to withdraw their funds early, the bank must sell some assets (in the current case, the loans that generate cash flows) on the secondary market at a discount to meet the obligation, a situation known as asset fire sales.

Finally, systemic risk is the situation where a number of banks fail simultaneously. This is related to a contagion effect, whereby the risk of a bank failure increases given that another bank has failed. To clarify how contagion works, suppose a bank is facing a bank run and prior to failure dumps its assets in the secondary market at a fire sale discount, causing a general drop in the price of bank assets. There may then be a run at a second bank, because the debt holders of the latter start panicking when they observe the lower market value of their bank, now priced at fire sale asset prices. The exposure to contagion of the second bank will, obviously, depend on the leverage and its cash flow position given the first bank failure.

Differing leverage types and banking industries

The authors find that competition affects these risks differently depending on the leverage a bank chooses and the type of banking industry present. To start, a bank’s leverage can be considered exogenous, if, for example, the regulatory capital requirement is binding; or endogenous, in which case banks choose the level of the equity buffer beyond the capital requirement, so as to maximize shareholders’ value. The main benefit of increasing a bank’s leverage is that it is cheaper than the equity provided by shareholders; its main disadvantage is the increase in insolvency and illiquidity risk it implies. So banks must rationally adjust leverage in order to equalize the marginal costs and benefits.

Regarding the impact of competition on banks’ risk taking, two different views coexist: the charter value view and the risk shifting view. According to the charter value hypothesis, more market power makes banks more cautious in their investment choices. On the other hand, the risk shifting hypothesis considers that it’s the firms’/entrepreneurs’ project decisions that originates the risk and that higher market power, with the corresponding higher interest rates, will lead firms to choose more risky investment projects.

So how does competition affect these risks?

Portfolio risk is heavily tied with the firms/entrepreneurs that seek funding for their projects, where the return on these projects is the difference between the expected pay off and the cost (or interest rate) of their loan.

In a setting with low competition (or alternatively, where banks have high market power), banks are able to charge higher interest rates; whereas a competitive setting (i.e. one where banks have low market power) would require banks to lower their rates. So as the interest rate increases, firms/entrepreneurs seek riskier projects to obtain a required level of payoff. This translates into riskier loan portfolios with more volatile cash flows for banks, as it is impossible for banks to discern the moral hazard on behalf of the firm/entrepreneur.

Conversely, a competitive environment that reduces interest rates should reduce the riskiness of the projects undertaken as firms/entrepreneurs select safer projects. This helps reduce banks’ portfolio risks and the volatility inherent in the cash flows derived from these loans. Still, as banks’ portfolios become safer they may choose to increase their leverage to produce a higher return. Unfortunately, these lower interest rates translate into lower profits and thus a lower buffer to protect against bad loans. So, even if competition reduces portfolio risk, it does not necessarily reduce insolvency and liquidity risk.

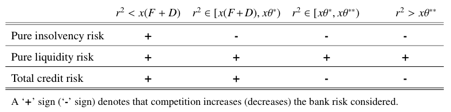

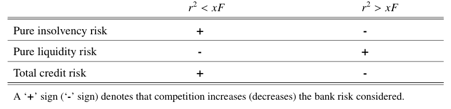

The two tables below show the authors’ findings on the effect of competition on insolvency, liquidity, and the cumulative credit risk when leverage is either exogenous or endogenous. In both tables, a ‘+’ indicates that more competition increases the indicated bank risk, whereas a ‘-’ indicates the opposite effect of increased competition. From left to right, the tables detail the relative productivity of the firms (with the term x the return on project, r the interest rate, and F the amount of deposits): the two left-hand columns of Table 1 and the left-hand column of Table 2 correspond to relatively productive firms, higher levels of secured deposits, and low interest rates; whereas the remaining right-hand columns correspond to the existence of less productive firms, lower levels of secured deposits, and higher interest rates.

When firms/entrepreneurs are relatively non-productive and interest rates are correspondingly high due to higher market power among banks (the right-hand columns), competition works to increases banking stability. While the high interest rates lead to higher margins, the loan portfolios tend to be riskier, as there exists higher moral hazard. In such a case, competition is helpful to generate financial stability since the risk-shifting view prevails in lowering portfolio risk, and thus the insolvency risk. The liquidity risk increase is associated with a tendency of these banks to engage a liability structure consisting of more short-term funding (investment banks, for example). Competition in this environment also tends to reduce the chance of systemic crisis in both cases of exogenous and endogenous leverage. However, exposure to contagion increases with competition.

In more productive economies where firms/entrepreneurs have higher returns on projects relative to already low interest rates, generated by lower market power in the banking industry (the left-hand columns of the above tables), competition produces the opposite effect. In this environment, banks tend to be financed with deposits and are correspondingly more conservative with their choice of leverage because in this case the lower interest rates translate into lower margins. Since moral hazard in this environment is already low and loan portfolios less risky, the link between competition and financial stability is the profit that a bank generates through its market power. Therefore, in this charter value environment, competition threatens financial stability (via the increase in credit risk as shown in the tables). This occurs because the further lowering of interest rates reduces banks’ profits and thus their buffers against insolvency, which the authors show is the main driver of bankruptcy. This reduction in margins also encourages the banks to increase their leverage to fund riskier loan portfolios so as to increase the value to their shareholders, which in turn increases their insolvency risk and lowers the charter value. An increase in competition here also has the effect of increasing both systemic risk and exposure to contagion.

What are the implications for policy?

The different environments imply that policy is nuanced since the effect of competition is contingent upon banks’ liability structures and economic productivity. Competition among banks with high market power will increase stability, while the opposite result occurs with competition among banks with already low market power.

Further, the threshold productivity of firm/entrepreneur projects that inverts the relationship between competition and stability is reached earlier when banks are able to choose their liability structure above regulatory capital requirements. Therefore, a one-size-fits-all approach is insufficient since it seems that once the banking industry has reached a sufficient level of competition any further increase leads to financial instability. The authors suggest that proper policy should determine where along the competition spectrum the banking industry lies and either foster or prevent competition.