Immigration is a worldwide phenomenon. In many developed countries, incomers cluster in particular cities. At the same time, such places do not seem to experience lower wage or employment growth. Trade shocks are alike immigration in being unevenly distributed across locations. However, unlike immigrant shocks, they seem to lead to long-lasting consequences for the labor market. That is, evidence on the labor market effects of both shocks are in sharp contrast. But, why is this the case?

In BSE Working Paper No. 1223, “The Regional Impact of Economic Shocks: Why Immigration is Different from Import Competition,” authors Christoph Albert and Joan Monràs argue that differences in housing market characteristics across local labor markets experiencing immigrant and trade shocks are behind these contrasting results. First, they argue that a fundamental difference between trade and immigration is that whereas immigrants systematically enter metropolitan areas with high housing prices, import competition is uncorrelated with local price levels. Second, population is less reactive to local shocks in low-price than in high-price locations. The authors provide supporting evidence for those claims and rationalize them with a novel spatial equilibrium model with non-homothetic preferences for housing.

Let the data speak

From a theoretical perspective, it is not clear why trade and immigration shocks should lead to different outcomes. Import competition and immigration are comparable to the extent that imports are thought of as the labor embedded in imported goods. Hence, exposure to either shock is predicted to lead to wage and employment rate declines, as long as there are no absorption mechanisms that help mitigate such local effects.

Yet prior literature has documented otherwise: large and persistent employment effects in regions exposed to import competition, but non-lasting effects in locations receiving large immigrant waves. To understand these shocks more deeply, the paper follows prior literature in using data from the United States and in comparing changes in local labor market outcomes in response to international immigrant shocks and to import competition from China. Different from prior literature, the paper studies the heterogeneity of past results as a function of local housing market characteristics.

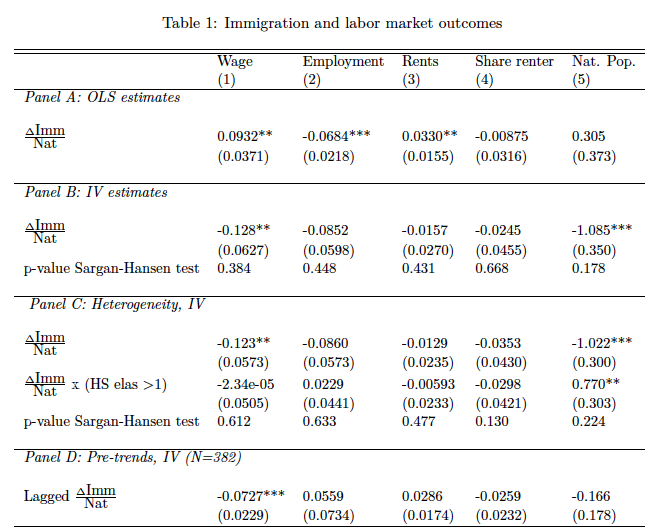

Table 1 shows results for the immigration shocks, measured as the inflow of immigrants during the decade divided by the native population at the beginning of the decade. These shocks do not seem to have a large impact on (native) wages or employment across local labor markets (columns 1 and 2) but they do have a large effect on internal migration (column 5). For each immigrant arrival, one native relocates (panel B). More importantly, these relocation results come exclusively from what happens in expensive cities with low housing supply elasticities and large population levels, which is exactly where immigrants tend to concentrate (panels C).

Table 1: Immigration and labor market outcomes

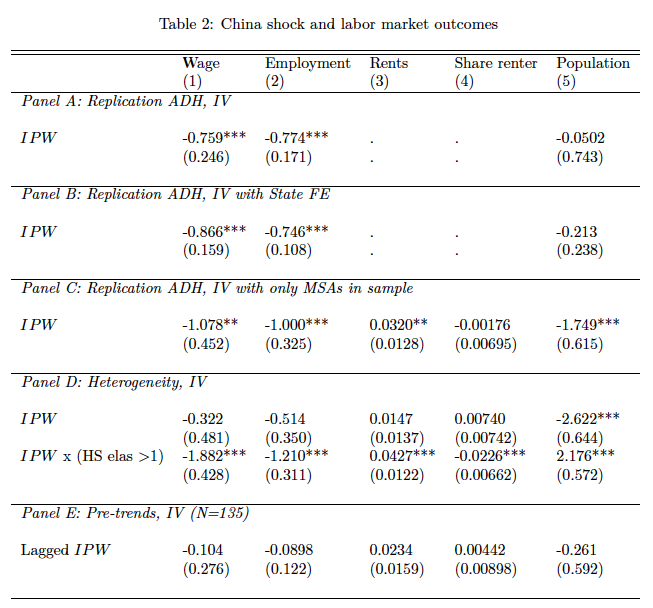

Table 2 show results for the trade shocks. Overall, import competition (IPW in the table) seems to have large effects on wages and employment and internal migration seems to be unresponsive (panels A and B). However, these results, which replicate prior literature, mask the existing heterogeneity. Whereas locations with low housing supply elasticity experience a large population response and small wage and employment effects, those with housing supply elasticities above 1 experience no population responses but wage and employment declines (panel D). In other words, the long-lasting effects of import competition documented in prior literature concentrate exclusively in the less expensive, less populous, and less productive American metropolitan areas and commuting zones.

Table 2: China shock and labor market outcomes

Housing and the nature of shocks

The aforementioned findings reveal that, on average, population responds to international immigration and does not respond to import competition. However, when allowing for the effect of the local shock to vary with the local housing prices, internal migration responses are similar irrespective of the nature of the shock. In both cases, local population seems to leave from locations with low housing supply elasticity that experience a local shock and seems to be non-responsive in those with high elasticity.

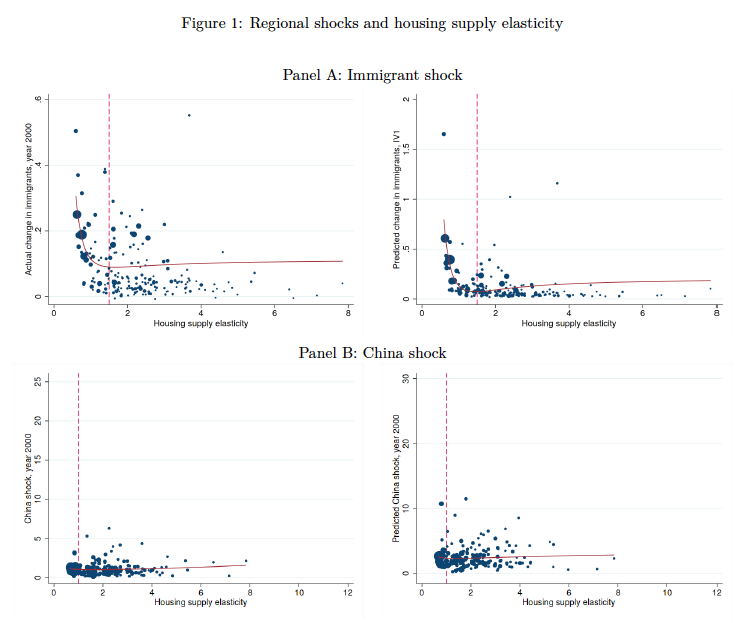

The authors argue that the housing market is key to explaining the patterns in the data. That is, to understand why immigrant shocks dissipate rapidly while trade shocks do not, crucially depends on where they occur. Figure 1 depicts the relationship between immigration shocks, trade shocks, and housing supply elasticity. Immigration shocks concentrate in metropolitan areas with housing supply elasticities below 1 (Panel A). In contrast, import competition from China does not concentrate in those expensive locations with low housing supply elasticities (Panel B).

Figure 1: Regional shocks and housing supply elasticity

Hence, the main difference between import competition and immigrant shocks is that the latter are concentrated in housing constrained metropolitan areas, whereas import competition is uncorrelated with the housing supply elasticity. The paper highlights that internal migration responds to local shocks only in expensive locations and that the nature of the shock shapes the seemingly different results obtained in prior studies.

As a final contribution, the paper introduces a spatial equilibrium model with non-homothetic preferences for housing that rationalizes the empirical results. The key insight is that, different from standard models, how much the price of housing matters for indirect utility depends on the share of income devoted to housing. The authors show that this has implications for the population response to local shocks.