In their BSE Working Paper (No. 1136), “Pharaoh’s Cage: Environmental Circumscription and Appropriability in Early State Development,” Laura Mayoral and Ola Olsson study early state development by analyzing historical, archaeological and paleoclimatic records corresponding to one of the most relevant and longest-lasting states in history: Ancient Egypt. The authors focus on the role of productivity shocks on political stability and state capacity to explain the survival of the first states in history.

Taxation, environmental circumscription and early state development

Modern humans have lived in stateless societies for roughly 98% of their 260,000-year-long history. In the later part of the fourth millennium BCE, the first two states in history arose in Mesopotamia and Egypt. From there on, the world experienced a transition from stateless to state-based societies, bringing with it fundamental transformations in all aspects of human life, such as urbanization, taxation, public architecture, writing, bureaucratic structures, etc. Although the rise of civilizations and the creation of states is arguably more of a qualitative change than the Industrial Revolution, modern political economy has paid much less attention to it.

Most of the literature in this area has dealt with the question why these original states appeared where and when they did. A less frequently studied topic concerns the economic factors influencing the subsequent consolidation of these states, a development that arguably worked as a model for numerous later states in history. All of the early states were characterized by highly intensified agricultural systems of production, a (relatively) dense population, and large-scale public goods. But why did centralized political power sometimes prosper for centuries in some places but then stagnate, fragment and even collapse?

Recent research suggests that states were more likely to form in places where output could be easily taxed. The present paper argues that environmental circumscription, i.e., the existence of a large productivity gap between the territory under control of the state and its surrounding areas, was a key factor that facilitated tax collection and, therefore, played a significant role in the development of the early states. In territories that were very heavily circumscribed, the elite could impose high levels of taxation that the population was forced to accept, since leaving the territory under state control was not a viable option.

Ancient Egypt as a laboratory

To investigate the role of environmental circumscription, the authors introduce a dynamic model of extractive state consolidation where individuals can choose between two activities, one that is easily taxable and another one that is difficult to tax. In periods when the core (the area under state control) is substantially more productive than the hinterland (the surrounding territories) people are pulled towards the core, implying a greater population to tax, higher revenues and, therefore, higher political stability and state capacity. When the reverse situation holds, people are pushed towards the hinterland, tax revenues fall, and political instability and lower state capacity follow.

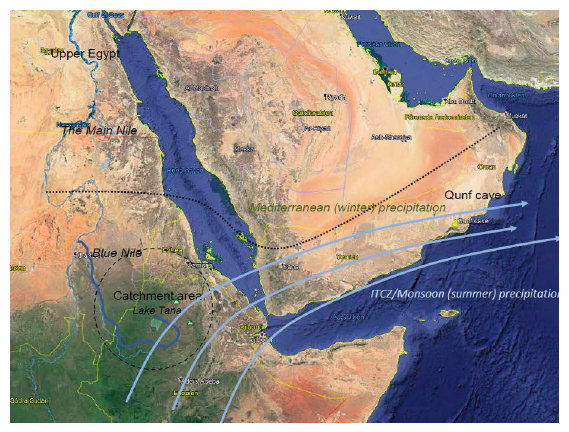

To examine the empirical validity of these predictions, the authors analyze the impact of changes in the degree of circumscription on political instability and state capacity in Ancient Egypt during a period of approximately two millennia. The Egyptian state is an ideal case study due to the particular geography of the Nile valley, characterized by the sharp contrast between the productivity along the Nile banks (the core of the state) and that of the surrounding areas (the hinterland). But, more importantly, changes in the degree of circumscription in Egypt are largely driven by two largely independent weather systems: the Mediterranean Winter rainfall and the African monsoon summer rainfall in the Ethiopian highlands.

The Mediterranean precipitation system provides winter rains to the Nile delta, to the northern parts of the Sinai desert, and to the neighboring lands in Southern Levant. The amount of rainfall in the hinterland surrounding the Nile valley determines to a large extent the type of activities that can be undertaken and the amount of population that can be sustained there. On the other hand, precipitation in the Ethiopian highlands was the main source of the summer floods of the Nile, which in turn determined the productivity of the Nile banks. Productivity was maximised in years of intermediate floods, i.e., those that were high enough to inundate the surrounding fields but that were not excessive, in which case irrigation infrastructure could be destroyed. The extent of these monsoon rains is determined by the latitudinal positioning of the Intertropical Convergence Zone (ITCZ), a weather system in the Indian Ocean. The further north that the ITCZ reaches, the greater the amount of summer rainfall in the Ethiopian highlands and the greater the seasonal floods of the Nile.

The authors use novel paleoclimatic records to reconstruct weather shocks in those areas for a period of over 2000 years. To measure the degree of political instability they use historical records on tenure durations of individual rulers and dynasties. State capacity is proxied by examining variations in the intensity of pyramid construction as well as in the area under state control.

Matching theory and empirics

The theoretical results in the paper predict that political stability and state capacity should be high whenever environmental circumscription is high. This hypothesis is then empirically tested by assessing the impact of the time-varying exogenous weather shocks on measures of political instability and state capacity, described above.

The empirical results reveal that political stability is highest when Nile floods are moderate, i.e., they are not two low (droughts) or too high (excessive floods). They also show that previous wet conditions in the hinterland will cause political instability and low state capacity, as predicted by the model. The size of both effects is large and their magnitudes are comparable, which supports the hypothesis that the ability to expropriate output not only depends on producing a large output but also on the ability of retaining the population and force them to accept a high tax.

In summary, the authors contribute to the literature of state development and consolidation by showing that political stability and state capacity are positively related to increases in the productivity of the taxable activity and decreases to the productivity of the non-taxable activity. Moreover, they introduce new data on climate shocks, political instability and state capacity for the Egyptian state covering thousands of years. Lastly, their results largely corroborate that the development of states is tightly connected to the ability of the elite to collect taxes.