The idea of financing a fiscal stimulus with money creation has long been a taboo and, as such, has been disregarded as a policy option even in circumstances where other policies were not available in order to stimulate the economy. But is this justified?

In his BSE Working Paper (No. 786), “The Effects of a Money-Financed Fiscal Stimulus,” Jordi Galí investigates the effects of a government engaging in just such a stimulus as compared with a debt-financed stimulus.

Why consider a money-financed stimulus?

The previous financial crisis has severely tested the limits of conventional policies that monetary and fiscal authorities engage to combat economic downturns. Unfortunately policy rates hit the zero bound pretty quickly in the crisis, while the rising debt-to-GDP ratio of many countries led to austerity measures that likely delayed recovery from the crisis. The unconventional policies that the Fed, ECB, and other major central banks engaged may have buoyed the financial sector, but they failed to provide a boost to aggregate demand to bring national outputs and employment back to their potential levels.

One option is to finance a stimulus “entirely through money creation,” as Galí states. This has the benefit that aggregate demand –and, as a result, output and employment–is directly affected by such a policy, without having to reduce the nominal interest rate or increase the stock of government debt (or raise taxes). Of course the fear of high inflation is mainly why this option is viewed as toxic in policy circles. The path through which money supply and inflation are linked is highly nuanced, but the theory is quite clear that eventually prices will catch up. The question is how the timing of events is affected by the factors in the economy.

Effects in a classical economy of money and debt financed stimulus

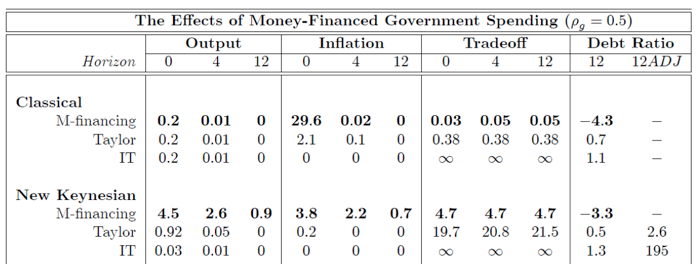

Galí first examines the effects of a fiscal stimulus in a “classical economy”, i.e. an idealized economy with perfect competition and fully flexible prices and wages. In short the benefit of money financing a stimulus comprised of 1% of the steady state quarterly output of the economy is not laudable in such an economy. It can be seen in Table 1 that under money financing there is a large, front loaded increase in the inflation of the economy at nearly 30% immediately upon enacting the stimulus, which quickly tapers to nearly 0% after 1 year. This is not the case with either of the debt-financing mechanisms Galí further considers as a comparison: 1) via a Taylor rule; and 2) strict 0 inflation targeting (IT for short). In these cases inflation is either low (in Taylor) in the first quarter and tapers to 0, or simply 0 (by design of IT). This result corresponds to the money supply dynamics, where there’s a sharp increase in the money supply as a result of the money-financing stimulus and hence inflation – as theory would predict. The welfare result on consumption and hours worked (although not shown, but available in the paper) are likewise not favorable under any of three forms of financing. Further, the result on output of all options is almost inconsequential: the government multiplier in all three cases is only 0,2 – or that for every $1 spent on the stimulus national output increases by only 20 cents, indicating that the government may be crowding out consumption.

The main benefit from the money-financed stimulus is found in the effect to government debt-GDP ratios. After 3 years there’s a debt reduction under money financing of just over 4%, whereas debt financing results in slight increases. This latter result is due to the central bank simultaneously trying to reduce inflation while financing a stimulus. To accomplish this it must sell some government bonds on its balance sheet, temporarily decreasing the money supply and increasing the overall debt burden in the long run above the debt issued for the fiscal stimulus. The high, unanticipated inflation under money financing erodes the real rate that the government pays back on its existing debt, thus decreasing the debt burden in the long run.

What happens if prices and wages don’t instantly adjust?

The assumption of fully flexible prices and wages underlying the classical economy are hardly realistic. The microeconomic data shows that prices and wages do not adjust instantly, or even quickly; it takes time for an economy to adjust to changes. Galí next looks at the above situation from a New Keynesian perspective, which builds in these rigidities to price and wage adjustments. The effect here is much different than the case in a classical economy, as can be seen in Table 1 under the New Keynesian results.

Compared to the classical economy, a money-financed stimulus would have a large, impactful consequence on national output, increasing it by 4,5%, falling slowly after 1 year to 2,6% (compare this to the debt-financing options, which barely reaches an immediate increase of 1% and falling to nearly 0% after one year). The increased output has a positive consequence on employment and consumption, which increase, respectively, 6% and 5,5% (slowly tapering over time). That is, the stimulus directly affects aggregate demand and employment. Inflation is now mild at 3,8% when the stimulus is enacted and slowly tapers off. By contrast, under debt financing and inflation targeting, inflation hardly responds, but the effect on output and employment are much smaller, and the stimulus generally leads to negative consumption and lower welfare.

Finally, the overall government debt ratio under the alternative financing options after 3 years looks similar to the classical economy, but with a slightly smaller reduction in government debt load under money financing.

The welfare impact of a money-funded stimulus

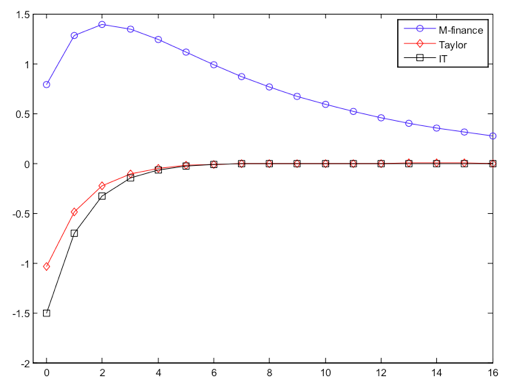

So how does society fare under these types of stimulus? Galí finally considers the overall impact on welfare. As shown in Figure 1 below, welfare under a money-financed stimulus is much higher relative to the debt-financed option. Upon enacting the stimulus welfare slowly increases and then decreases, but remaining positive throughout the adjustment. Under the debt-financing options overall social welfare decreases up to 1,5% under the strict zero inflation case and slowly reaches pre-stimulus levels after 4 years (what 0 welfare indicates in the graph). Thus, the option of a money financed fiscal stimulus is clearly preferred to that of a debt-financed stimulus.

The finding that money-financed fiscal stimulus raise welfare even if based on purely wasteful government spending hinges on the assumption that output is sufficiently below its potential level, a condition that is likely to hold currently in many euro area countries. A fiscal stimulus program that focused on productivity-enhancing public investment projects (instead of wasteful government consumption) would likely have even more desirable effects.