Providing long term care (LTC) from a public institution is not common in many western countries; moreover, if allowed, it is not available to everybody due to the income requirements that have to be met to be eligible for it. The nature of public long term healthcare-care leads many households to organize informal care provision mechanisms towards elderly individuals. Taking this into account, many governments introduced subsidies to promote informal healthcare, as they recognized it as a valuable substitute to public healthcare.

In their BSE Working Paper (No. 929), “Thinking of Incentivizing Care? The Effect of Demand Subsidies on Informal Care-giving and Intergenerational Transfers,” Joan Costa-Font, Sergi Jiménez-Martin and Cristina Vilaplana Prieto investigate the effect of the 2007 universal care-giving allowances introduced in Spain, a.k.a. SAAD, and its subsequent reduction in 2012. Their research paper analyzes the impact of the introduction of the subsidy on households’ informal care arrangements decisions and intergenerational transfers with the purpose of learning a general lesson on the adoption of healthcare subsidies.

Why is SAAD particularly interesting for understanding the impact of healthcare subsidies?

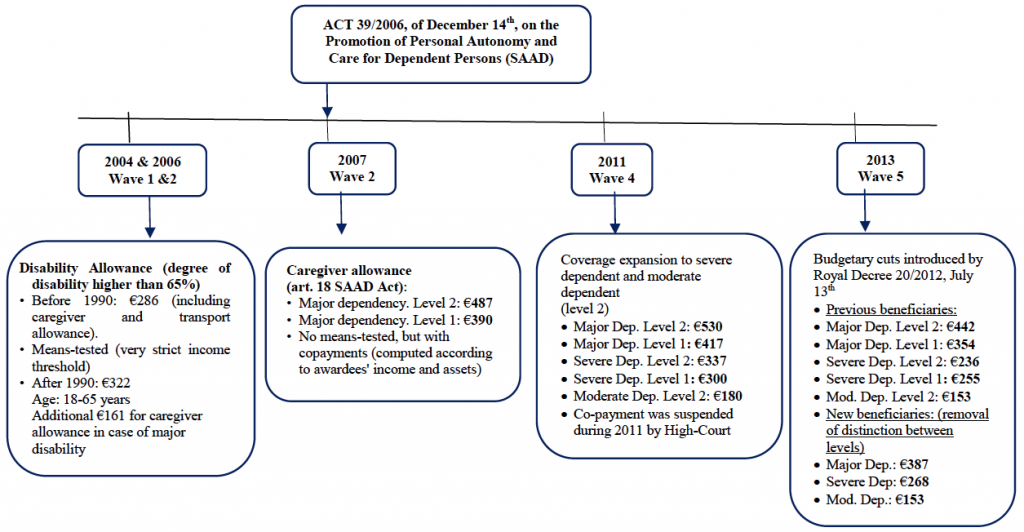

Let us first introduce the context for the 2007 Spanish healthcare reform. In recent years, healthcare reforms which subsidize informal care took place in several countries; for instance, they took place in Germany, Scotland, South Korea and in the US. Some of them provided or extended direct healthcare; others incentivized informal healthcare. In the specific case of Spain, the 2007 healthcare reform introduced a universal and unconditional subsidy to support suppliers of long term care to elderly Spaniards. The Spanish reform also introduced community level care services for home help.

Three features make the SAAD particularly suited for studying informal care-giving incentives: First, it was implemented during a period of temporary political change. In fact, the reform has been adopted under a socialist government, unexpectedly elected after the 2004 Madrid bombings. Second, its implementation was decentralized at a regional level, which caused some level of heterogeneity across regions in terms of timing of adoption. This feature is exploited in the analysis of survey data presented by the authors. Third, the reform had been cut in 2012 due austerity policies imposed at the European level. This provides additional variation in the data that is used by the researchers of this paper to test the robustness of their results.

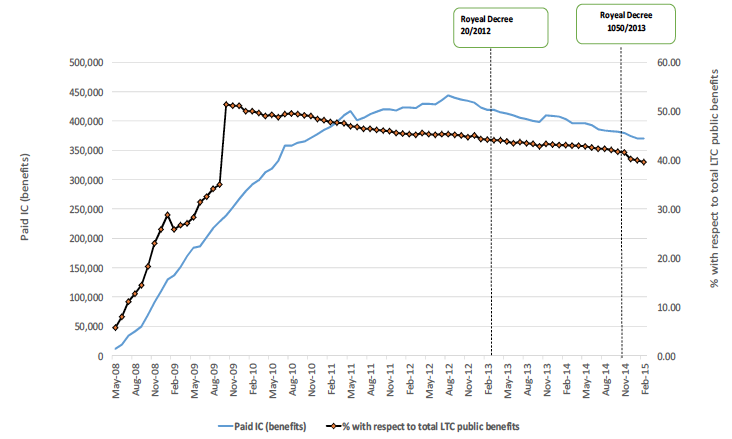

The following graph shows a visual representation how the implementation of SAAD took place in time, reflecting also the non-uniform implementation at the regional level.

Starting with a discussion on the set of reforms that took place in the last decade, the authors document counter intuitive evidence: In general, healthcare reforms reduce informal care. This result is driven by substitution effects between informal care-giving and other forms of long term healthcare. Interestingly, when reforms subsidize informal care-giving with monetary transfers, they have opposite and more reasonable effects. This is the case of SAAD.

In general, the consequences of healthcare subsidies on inter-generational transfers are more fuzzy. Still, the data on SAAD provide us with a clear picture: downstream transfers are incentivized; upstream transfers are not.

Which data have been collected for studying SAAD?

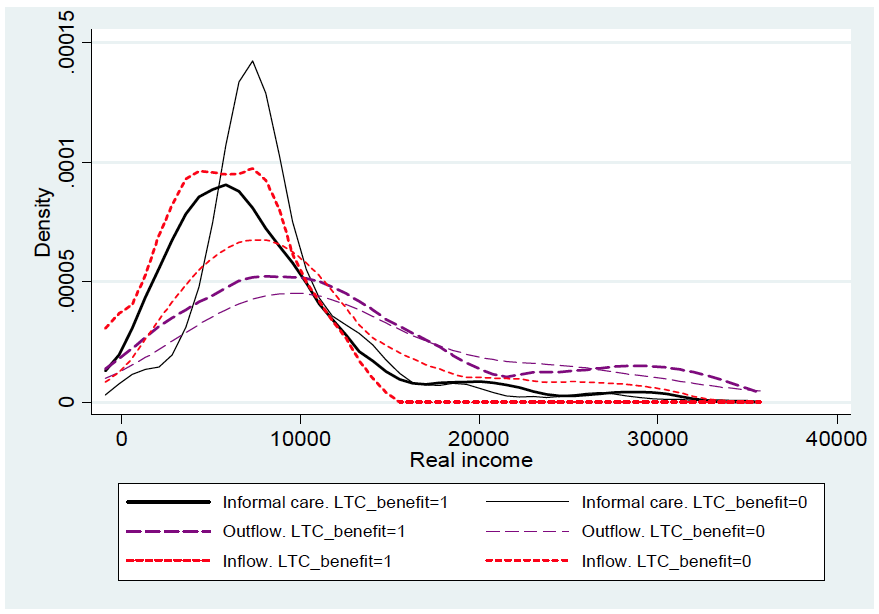

The authors use data from SHARE (Survey of Health Aging and Retirement in Europe) waves for the years 2004, 2007, 2011, 2014. Overall, the sample accounts for more than 100,000 individuals, among which about 20% show some form of dependency, defined as a complete or partial inability to perform daily activities. For each individual, the authors record the level of healthcare provision and the amount of transfers (both upward and downward) together with a set of excoriates on demographic and socio-economic characteristics. Also, data on macroeconomic regional conditions such as regional GDP, unemployment and deficit are collected in order to control for regional heterogeneity. The empirical density of the variables of interest can be seen in the figure below:

real income (2007-2013)

What can be understood from the data is that the 2007 reform had an evident impact on high income quintiles due to its universal nature. Indeed, these individuals were excluded from the scope of mean-tested reforms. In contrast to care provision, it is more difficult to account for the effects of subsidies on transfers since the reform affected both downward and upward transfers.

What impact did the reform have on households’ behavior?

The study provides a quantitative estimate of the extensive margins of interest. In particular, it is reported that, due to the generalized subsidy, the probability of an individual receiving informal care increases by more or less 31%; the probability of receiving downstream transfers increases by 29%; the probability of providing upstream transfers decreases by 10%. In order to obtain these results, the authors estimate a Differences-in-Differences model. The effects of interest are then computed from a Two Stage Least Squares regression (2SLS) using regional support for the socialist government as instrument for reform implementation. The purpose of this regression is to correct the attenuation bias due to regional heterogeneity. Finally, the 2012 austerity cut to public healthcare subsidies is used to estimate its impact on the extensive margins. It turns out that its impact is close in magnitude, but opposite in sign, to the one induced by the subsidy.

Which policy recommendation can we provide from the SAAD experience?

To conclude, the Spanish SAAD has been documented as being a very effective subsidy that definitely achieved its policy target. Additionally, we have evidence for intergenerational transfers that react according to a mixed motive between insurance altruism. These findings are strengthened by several robustness checks including testing the model after the 2012 contractive policy. This research shows that healthcare subsidies are an effective policy tool for incentivizing informal care in Southern Europe. Future public policy that subsidize LTC should be designed in line with what has been done for the SAAD.