In their BSE Working Paper (No. 848) “Securities Trading by Banks and Credit Supply: Micro-Evidence”, Puriya Abbassi, Rajkamal Iyer, José-Luis Peydró and Francesc R. Tous explore the effects of the financial crisis on securities trading by banks and the subsequent effect of the latter in credit supply. The authors find that banks with higher trading expertise increase their investments in securities and decrease their lending during a crisis.

Banks’ security portfolios

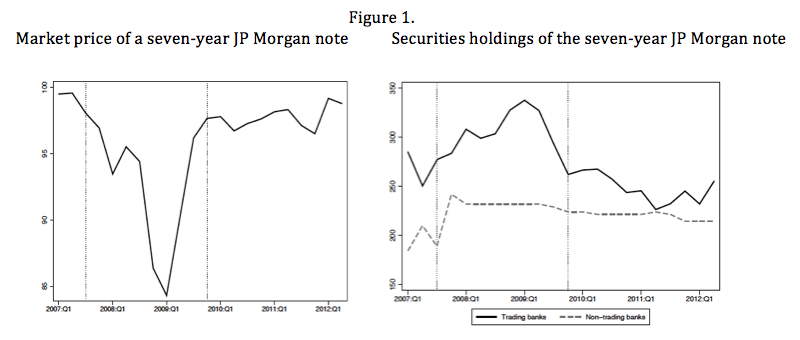

Banks today hold a considerable amount of securities among their assets. However, there is debate as to whether they should be able to trade these securities for profit. An example of the investment behavior of banks is portrayed in Figure 1. The left panel shows the sharp decline in price of a security around the Lehman failure; at the same time, German banks with higher trading expertise increased their holdings of said security (right panel).

Although there is a growing theoretical literature that argues that, during crises, securities’ trading has negative externalities on credit supply, there is insufficient empirical evidence about this phenomenon. This paper contributes to that evidence by employing an empirical identification strategy to a unique dataset on German banks.

Data and hypotheses

Authors use a proprietary security and credit quarterly registers database from the Deutsche Bundesbank, from the last quarter of 2005 until the last quarter of 2012. For each security, this dataset includes information about the amount held by each bank, which was merged other sources1 of security data (e.g. issuer, price, rating, coupons and maturity). Regarding data on individual loans, banks report -on a quarterly basis- on all borrowers whose overall credit exceeds €1.5 million (which amounts to about 70% of the total credit volume). The authors also used supervisory bank data encompassing capital, total assets, retail deposits, type of bank, etc.

The main testable hypothesis of this paper is that, during a crisis, banks with a higher trading expertise (“trading banks”) increase investments in securities, in particular the ones that present a larger drop in price. Authors also test whether or not this increase, if it exists, has implications in the supply of credit.

Descriptive Statistics and Empirical Strategy

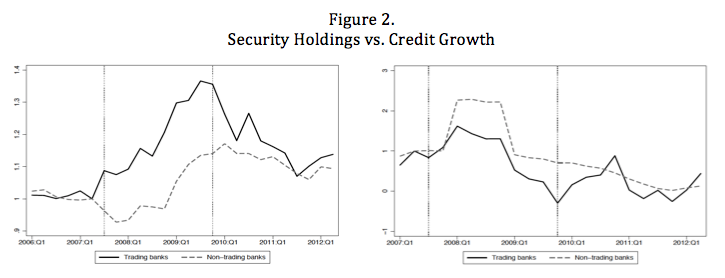

Summary statistics suggest that trading banks increase their security holdings during the crisis and decrease credit, as can be observed in Figure 2.

This paper uses an empirical model that controls for the unobserved and time-varying features of securities (e.g. risk, liquidity, outstanding volumes), borrowers (e.g. new investment opportunities, downgrades) and banks (e.g. reputation, management policies) in order to isolate the effect of interest and to test the former hypothesis.

Results

- Do trading banks increase their security investment during the crisis?

Yes, the authors find that they do. Trading banks buy and sell nearly twice as much securities as non-trading banks. - Is there heterogeneity in the previous finding?

Yes. The authors find that trading banks buy more of the securities that presented a larger drop in price in the previous quarter. Moreover, there is a stronger impact for securities with lower than triple-A credit ratings as well as with residual maturity above one year. Furthermore, trading banks with higher capital increase their securities investment even more. - Does the increase in security investment affect the supply of credit in the economy?

Yes. The authors encounter evidence that trading banks decrease their lending during the crisis. This decrease is greater for trading banks with higher levels of capital.

Conclusion

The previous results suggest that during a crisis securities trading by banks crowd out credit supply. However, at the same time, the increase in security holdings largely stems from the acquisition of risky assets, which implies that banks act as risk absorbers. Thus, restrictions on banks could affect the liquidity of the market precisely in times of stress. As a result, the debated question as to whether banks should engage in securities trading has an ambiguous answer according to the findings of this paper.

1 Bloomberg and FactSet.