Did massive war-fueled government debt help Britain industrialize and become the world’s leading economy? In their BSE Working Paper (No. 830) “Debt Into Growth: How Sovereign Debt Accelerated the First Industrial Revolution,” Jaume Ventura and Hans-Joachim Voth argue that a sharp rise in government borrowing during the 18th century allowed the landed gentry to move their wealth out of unproductive agricultural investments, freeing resources to be used by industrializing entrepreneurs and enhancing growth.

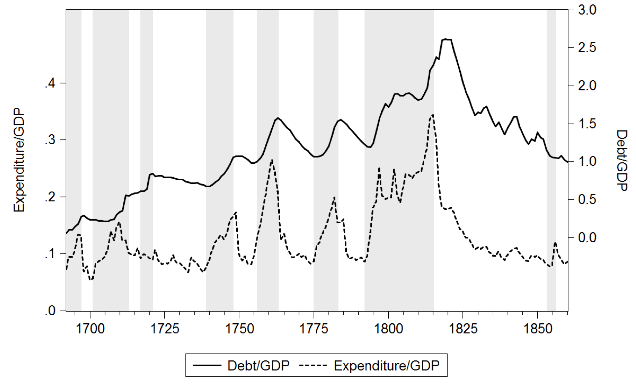

Ventura and Voth argue that by borrowing massively from the nobles, the crown induced them to stop making low-return investments in agricultural projects, which freed up land and workers to be used by capitalists bringing in new, highly profitable technologies. Without this assist from war-fueled debt, they argue, Britain’s inefficient capital markets, strangled by government regulations, would have slowed the transition to an industrial economy even more and could even have led to a lower level of investment in the long run. This contrasts with the findings of other economists who have investigated Britain’s 18th-century debt boom, which is illustrated in Figure 1, with periods of war shaded gray. Without considering the inefficiency of Britain’s capital markets, these studies concluded that this borrowing must have either slowed down the Industrial Revolution by crowding out good investments, or had no effect at all.

Inefficient capital markets: the evidence

In the modern day, those with wealth may choose to invest in a huge variety of investment vehicles, which then distribute funds across more or less the full spectrum of productive investments available in the economy. This contrasts sharply with the situation in Europe at the beginning of the 18th century. There, a small elite group owned nearly all wealth, and invested in one thing and one thing only: agricultural land. This was because there was no other investment vehicle that could reliably store wealth over time. So everyone who wanted to preserve wealth bought land, and when they could not buy more land, they tried to increase the productivity of the land they had: digging irrigation canals, draining swamps, etc. The problem was that by the time the 18th century rolled around, none of these investments were very profitable any more, and the only reason people kept on making them was they had few alternatives. Swamp drainage, for example, was only profitable with help from government subsidies.

In this situation the nobles should have been happy to invest their wealth in the highly profitable technologies that began emerging in the 18th century, but the historical record provides no evidence whatsoever that this ever happened on a significant scale. Largely due to government regulations, private banks were small and did little business lending during this period, while the Bank of England was legally prohibited from making any business loans. The only companies that were legally permitted to sell stock were a handful of corporations who had been favored with a royal charter, so even equity financing could not reach most entrepreneurs. The result of this investment environment was that even though many nobles may have been happy to provide funds to the promoters of innovative technologies, there were few vehicles that would have allowed them to.

The final effect was that the only way for industrialists to expand their business was to reinvest retained profits, severely limiting the rate at which they could grow.

Government debt to the rescue

Knowing about the situation in the market for investments, it does not seem strange that the rapid growth of government debt in the 18th century, and the fixed-rate government bonds it made available, came as a great relief to many among the nobility. As one noble, Lord Monson, was quoted as saying: “What an infernal bore is landed property. No certain income can be reckoned upon. I hope your future wife will have consols [government bonds]…”

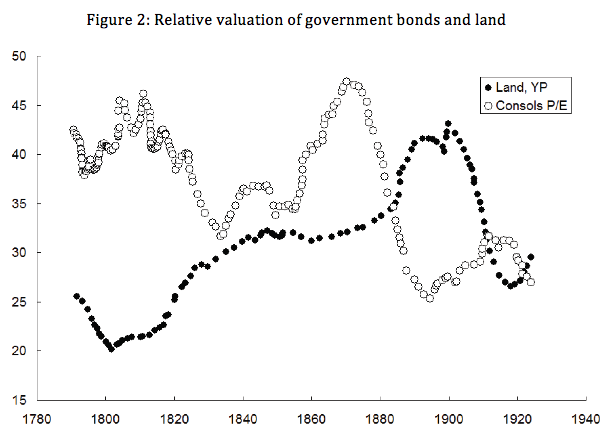

Ventura and Voth cite a number of historical economic studies showing that by the early 19th century many nobles were not merely slowing their agricultural investments, but were selling large tracts of their land in order to buy bonds. They also bring together statistics from the latest archival studies which show that the average return on land investments stayed well below the return on government debt until late in the 19th century–explaining the eagerness of many nobles for this new investment vehicle. This data is plotted in Figure 2.

The story that Ventura and Voth tell based on this evidence is as follows. Lower investment in agricultural improvements leads to less labor being hired to work the farms, increasing the supply of workers available to industrialists. Furthermore, the selling of agricultural land directly increases the supply of land available for purchase by industrialists. The law of supply and demand then dictates that the industrialists are able to hire labor and buy land more cheaply, make larger profits, invest more, and grow faster.

In other words, government debt does have a crowding-out effect on investment–specifically, on the less profitable investments in agriculture. This frees up resources to be used in more profitable investments, facilitating an effective transfer of capital in the absence of efficient capital markets.

The same story in modern China?

It often happens that lessons we learn from economic history have some parallels in the modern day, and so allow us to learn something about our current economic situation, too. In this case, the authors cite the recent rapid modernization of China’s economy. Other economic research has argued that the Chinese growth “miracle” which has taken place since the late 1970’s has been driven by a transfer of resources from inefficient state-owned firms to highly productive private firms. Ventura and Voth suggest that the growth of the Chinese government’s foreign currency holdings during this time may have played a role similar to that of the growth of government debt in industrializing Britain, reducing investment in state-owned firms and thus freeing resources for private entrepreneurs to use.

It’s all about storing value

The larger point made by the paper is that sometimes even wasteful investments can have a positive effect on the economy if they correct some other imbalance. In Britain’s case, the government borrowed money to invest in foreign wars with no clear economic benefit, but by providing an alternative store of value to the nobles, was able to mitigate an important imbalance. In a similar way, some economists (including Ventura) have argued that asset bubbles can mitigate different kinds of financial frictions in the modern economy, also by providing an alternative store of value that replaces unproductive investments. In a world with “perfect” markets, the authors are quick to note, the economy would not “need” asset bubbles or foreign wars. But as it seems that financial frictions are here with us to stay, we would do well to keep looking for the silver lining in “bad” investments.