In theory, fiscal decentralization can be beneficial to the effect that local governments can tailor their social schemes and other public expenditure programs according to the preferences of the population. However, in practice, barring a few countries, we have rather centralized revenue collection in most developed countries. The United States is very distinct in that respect, providing significant fiscal autonomy for sub-national governments going down to the level of municipalities. The variety largely stems from the ability of state and local governments to levy taxes.

In their BSE Working Paper (No. 1001), “Strength in Diversity? Fiscal Federalism among the Fifty US States,” Teresa Garcia-Milà, Therese J. McGuire, and Wallace E. Oates discuss many facets of the US fiscal federal governance structure vis-à-vis other developed countries and the role this governance structure has played in the development of the country.

Fiscal Federalism in the United States

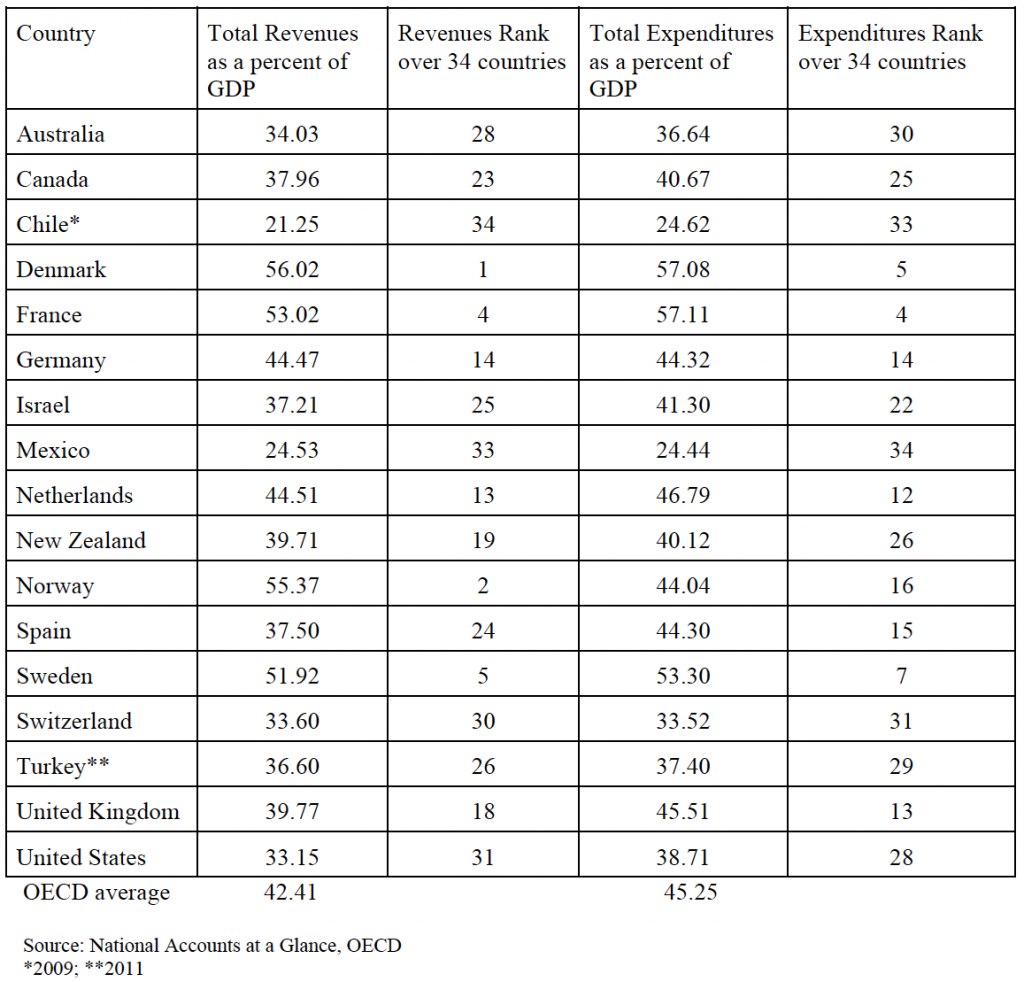

Fiscal federalism in the United States has a distinctive structure that contrasts sharply with that of most other industrialized nations. Table 1 below displays the share of total revenues and the share of total expenditures that are attributable to sub-national units of government for several countries. Depending on the measure and the source, the degree of decentralization in the US sits in a tight range from 43 percent to 47 percent, a relatively large degree of decentralization, and expenditures are only slightly more decentralized than revenues, with that difference being the smallest of all countries displayed.

The sizeable degree of decentralization in the US reflects in large measure the relatively limited range of functions performed at the central level in the US In the budget of the central government, two items, military spending and the social security program, account for more than half of central expenditures. The primary responsibility for most other functions rests with the state and local sector. And not only are direct expenditures on goods and services at the central level relatively small in the US, but transfers of revenues from the center to the state and local sector are also relatively modest. In the fiscal year 2011, central-government grants to state and local governments accounted for only 17 percent of central expenditures and funded about a quarter of spending by state and local governments. About half of these transfers support public-health programs, most notably the Medicaid program, which provides health care for low-income households. There are also transfers to the states to assist with various infrastructure programs such as highway construction. Relative to outer countries, this degree of decentralization of revenue-raising authority and expenditure responsibility is large.

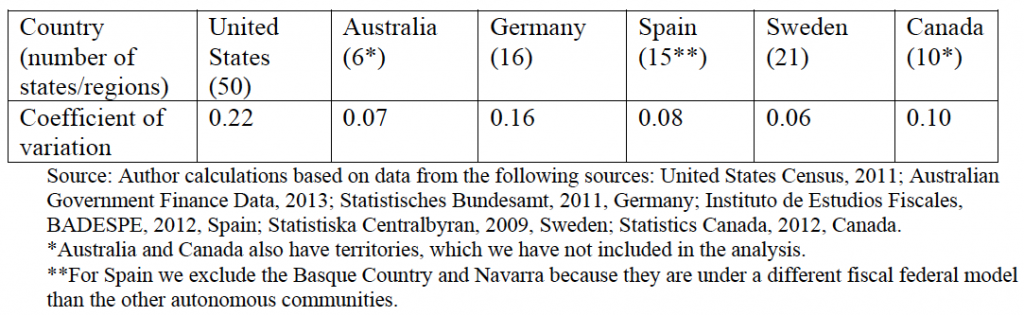

To understand to what degree diversity among subnational governments is a distinct feauture of the US system, Table 2 below shows the degree of diversity across states within a country in total subnational expenditures per capita for some countries. The United States is the country that displays the greatest diversity. All the other countries displayed exhibit significantly less diversity, a fact that fits well with the casual observation that these countries, for the sake of preserving equity, tend to devolve less fiscal autonomy to subnational governments or to have more significant equalizing grants—or both— than does the United States.

Fifty distinct K-12 education systems

In particular, to further emphasize the diversity across states, the authors describe the fifty K-12 education systems in the United States. In 2011, the state share of total K-12 education spending ranged from a high of 89 percent in Hawaii to a low of 29 percent in South Dakota. On average, states fund about 45 percent of the total, with the vast majority of the remainder attributable to local taxes (the federal government is responsible on average for around 10 percent of total K-12 education spending).

Additionally, states differ substantially in their treatment of charter schools. As of 2012, 15 states either actively encouraged or were accepting of charter schools. Nineteen states had charter laws, but the laws neither encouraged nor placed strict limits on the expansion of charter schools. In eight states, there were laws enabling charter schools, however, expansion of the system of charter schools was restricted. Nine states had no active charter law in place.

Fifty distinct fiscal systems

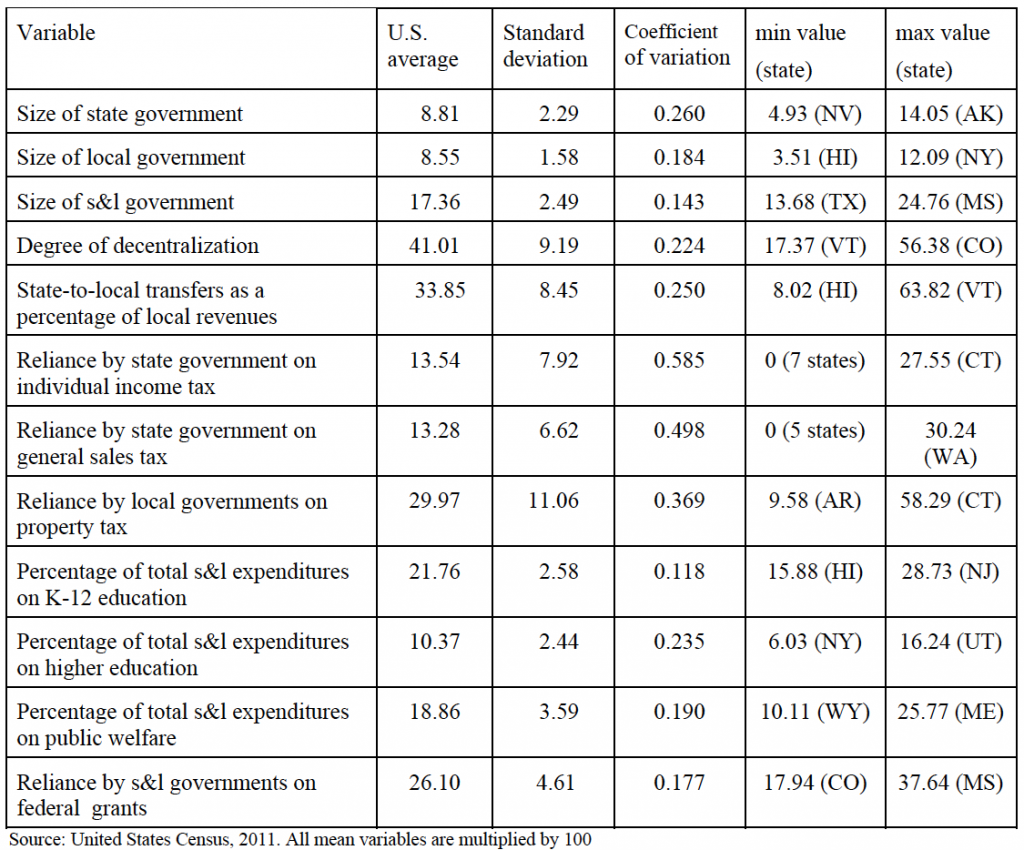

In essence, what the authors show is that in fact there are 50 different fiscal systems, one for each state, in the United States. Table 3 below presents descriptive statistics on 11 variables that capture the main features of the state and local public sector. There is great variety across each of the measures. For example, the average degree of decentralization is 41 percent as measured by the proportion of total state and local government own-source revenues raised by local governments, but the range across the states is from 17 percent to 56 percent. The authors establish that this diversity has stood the test of time. In all the variables displayed in Table 3, there has been very little if any change in the diversity across the states if one examines the evolution of the coefficients of variation over time.

Is all this diversity a good thing?

Ultimately, what it boils down to is whether all this diversity as seen in the US is a good thing. This is important especially if one is to contrast the more centralized fiscal systems in Europe. To this effect, the authors point to the proposition that in the absence of economies of scale of providing public services decentralization is Pareto efficient, as local governments can do at least as well as the federal government by tailoring public goods provision to the preferences of its citizens. However, the authors are quick to note that the need for equity especially in more fundamental forms of human capital such as education and health acts as a limit on decentralization. Another advantage of the federal structure in the US is that states have acted as a laboratory of sorts for experiments on public policies. Many states have in the past provided examples of successful new policies which ended up being part of the national framework, for example, the emission standards before being adopted nationally were introduced initially in the state of California.

All in all, fiscal decentralization and diversity have thus made a variety of contributions to social well-being. The evidence presented in the paper suggests that diversity across sub-national fiscal systems has thrived in the US. Economic theory indicates that when sub-national governments have the ability to act on the preferences of resident-voters in setting important dimensions of their fiscal systems, as they do in the US, the result is likely higher social welfare than would ensue without this autonomy, even in societies where solidarity preferences — a sense that equality in publicly provided goods is desirable — are strong.

Dedication

We dedicate this paper to the memory of our dear friend, mentor and coauthor, Wally Oates, who passed away before we could complete the paper. Wally’s contributions to the paper – and to our understanding of fiscal federalism in general – were immense.