Public purchases constitute an important part of any government’s transactions. In Barcelona Working Paper 1232, “Rules Versus Discretion in Public Procurement,” Rodrigo Carril uses the United States federal procurement system to show empirically how changes in the contracting policy affected incentives and contract outcomes. The paper also provides a structural model that sheds light on the mechanisms behind the regularities observed in the data and allows for optimal policy analysis.

The US federal procurement system

In 2018, US federal procurement contract awards amounted to $835 billion. These contracts take place between private firms and specialized government officials and are subject to a degree of regulatory scrutiny and complexity that changes discontinuously with respect to a regulatory threshold. On the one hand, US public contracts that amount to more than a certain level must obey the so-called negotiated acquisition procedure, including more complex and lengthy formalities. On the other hand, the simplified acquisition allows government officials to enjoy discretion for those transactions below the said limit, and the regulatory burden is significantly reduced for both parties. How do these discontinuous rules affect contracting outcomes?

Empirical evidence

Using data for definitive (one time, one vendor) contracts for the fiscal years 2006-2016, the author disentangles the behavioral effects that took place once the aforementioned threshold was changed from $100,000 to $150,000 in 2011.

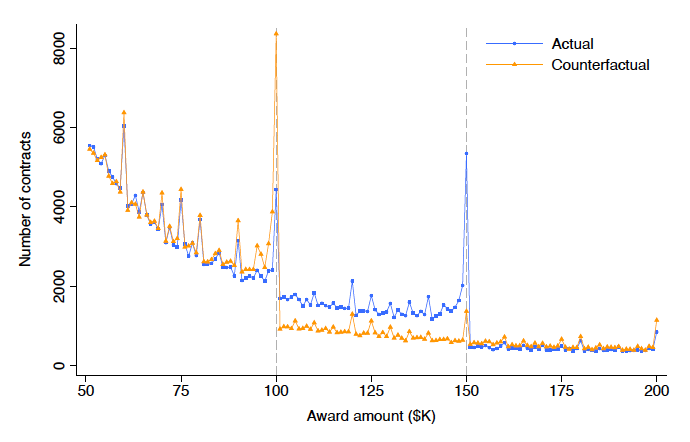

Figure 1 provides an illustration. The blue line represents the distribution of contracts with the new regulation. The orange line constitutes the counterfactual case and represents the distribution of contracts that we would observe had the regulation remained unchanged. This case was estimated by means of non-parametric techniques, using the pre-2011 distribution as reference.

First, the bunching of contracts that occurs around the threshold levels and the shift to the right of the distribution points out the behavioral response of contracting under more lax regulation (recall an increase in the threshold means fewer contracts affected by regulatory costs).

There are two underlying effects behind these changes. The intensive margin effect indicates that some contracts’ award would be inflated now that there is a more lenient (i.e., larger) threshold. The extensive margin effect occurs because new contracts become profitable with the new regulation. Raising the threshold is found to have awarded 4000 additional contracts that amounted to an extra $546 million in annual spending, and this effect is robust to a variety of tests.

Another interesting consequence studied in the paper is the change in the quality of contracts. There appears to be a causal relation between highly regulated and lower quality contracts as measured by different proxies such as completion delays, cost overruns or contractor defaults.

A model for public procurement

Finally, the author proposes a bargaining model of public procurement that rationalizes the empirical evidence found so far and allows for policy analysis by means of simulation.

The set up consists of two agents, government and contractor, that bargain over the purchase of a particular good or service. The key formulation comes from the introduction of a nested principal-agent structure on the government side. Bureaucrats (agents) enjoy private information about the project’s cost and are divided into those aligned with the government’s (principal) interests and those with different personal benefits. An agent’s private information is made public for those contracts above a threshold and enables the government to control misaligned agents’ behavior (that, for instance, can be thought of as inefficiently priced contracts due to laziness or corruption). However, this control comes at a cost to transacting parties in the form of costly red tape.

To offer a quantitative view of the equilibrium results, the model is adjusted and estimated via Simulated Method of Moments on the available data and closely replicates the empirical findings.

Optimal regulation

The optimal regulation balances the regulatory costs of tighter controls with the prevention in wasteful spending by misaligned agents. Estimating model counterfactuals reveals that the forthcoming change in the threshold to $250.000 is close to the optimum that results from the model ($295.000). This result is in part driven by the high fraction of aligned agents found in the estimation. To see the importance of that parameter, optimal thresholds are derived, letting this fraction vary and telling us that more discretion would be optimal under the presence of more aligned bureaucrats, avoiding the extra costs that are needed to control non-optimal agreements.

In conclusion, the paper suggests that transactions in the US procurement system are dependent on the level of regulation. The empirical evidence points out the preference for low procurement levels as contracts are bunched around the threshold that determines the change of contract governance.

This behavior is rationalized by a bargaining model of public procurement and later used to make counterfactual analysis, which illustrates that the incoming changes to the threshold will increase the net benefit obtained by the government from its procurement contracts.