The great recession and the euro crisis put a lot of pressure on government budgets leading to austerity measures. At the same time, numerous tax fraud scandals, as the Panama files and corruption cases at the country level, were brought to the public attention. The social cost of fraud was more visible and the national authorities more in need to eradicate it. However, understanding and observing fraud remains a particularly difficult task.

In BSE Working Paper (No. 1080), “Transaction-tax Evasion in the Housing Market,” José G. Montalvo, Amedeo Piolatto and Josep Raya develop a fraud decision theory and test its implications with a unique Spanish dataset.

Spain is amongst the European Union countries with the highest levels of tax evasion. In the Mediterranean area, several corruption cases related to the construction sector have been investigated and prosecuted in recent years. Fraud has been closely related to the housing market, particularly during the boom years. Perhaps the most common form of tax evasion in the housing market in Spain is under-declaring the purchase price to the tax authority. Therefore, the authors focus on homebuyers’ strategic behavior to study the fraud decision.

Tax evasion and the housing market

Tax evasion theory relies on models where evasion is a decision under risk where individuals weight evasion gains and losses by the probability of being audited or not. This is the standard way economists think of behavior under risk: individuals weight future gains with its associated probabilities to maximize expected happiness.

The authors go beyond standard economic modelling by including behavioral components, like shame and stigma, to get closer to reality. Stigma reflects the unease that a person may feel when other people become aware of a fraudulent behavior. In contrast, shame corresponds to the feeling of guilt that a person may suffer regardless of whether their fraudulent behavior is discovered.

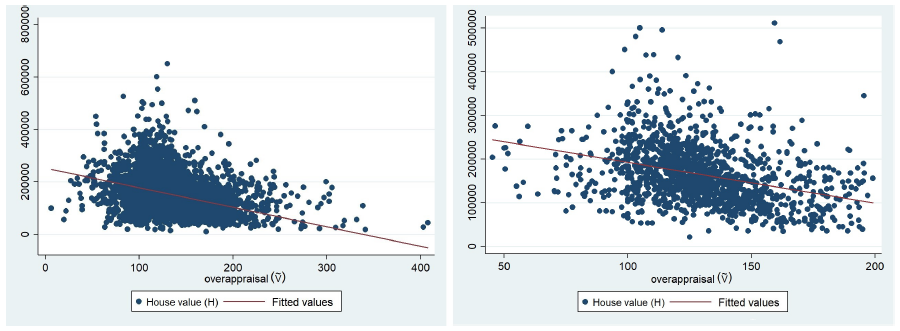

A key component of the model is the appraisal value: the estimation of the value of the property realized by a financial institution. The solution of the model provides testable predictions on declaring housing purchase price and evasion. First, an increase on personal liquid savings leads to an increase in the amount of undeclared housing and a decrease on the over-appraisal. The reason is the following: an individual with access to liquid savings can afford to evade and does not need to push for over-appraisal while a liquidity-constrained individual is unable to evade and must ask for an over-appraisal. It follows that the level of evasion and over-appraisal are negatively correlated. Second, in the model stigma plays a role on the amount evaded only if the probability of being caught depends on the amount evaded. Third, the housing value that is hidden from the tax authority may vary locally depending on the level of law enforcement and through shame.

Empirical results and policy implications

To test these predictions, the authors use a novel Spanish dataset. The dataset includes second-hand private housing transactions that occurred in Spain between 2005 and 2011. The data is unique since it includes both the real transaction price and that declared to the tax authority. For a subset of them, socioeconomic characteristics of the buyer and information about the mortgage are also observed. With this data, the authors can observe tax evasion and identify some strong patterns. More precisely, they detect a very robust negative effect of over-appraisal on tax evasion as predicted by the model (see Figure 1).

The authors are also able to identify sources of heterogeneity in tax evasion both at the individual and at the geographical level. They show that tax evasion decreases as the buyer’s level of education rises while it is affected negatively by the local level of law compliance and trust.

Policy implications

This study generates two important policy implications. First, tax authorities should focus their efforts on preventing evasion by auditing transactions that show low levels of over-appraisal. This approach is also advantageous in that appraisals are much easier to observe than other elements such as access to cash or fraudulent behavior itself. Second, the guilty feeling and the loss of reputation of a defrauder decreases when corruption is widespread. Therefore, governments should promote anti-corruption policies but also educate their citizens. Well-educated citizens who observe responsible governments are less prone to engage in tax-evasion.